Liquidity mining incentivizes users to provide assets to decentralized finance (DeFi) protocols, earning trading fees and reward tokens by supplying liquidity to pools. Delegated staking allows token holders to delegate their stake to validators, enhancing network security while receiving staking rewards without actively managing nodes. Explore the benefits and differences between liquidity mining and delegated staking to optimize your trading strategy.

Why it is important

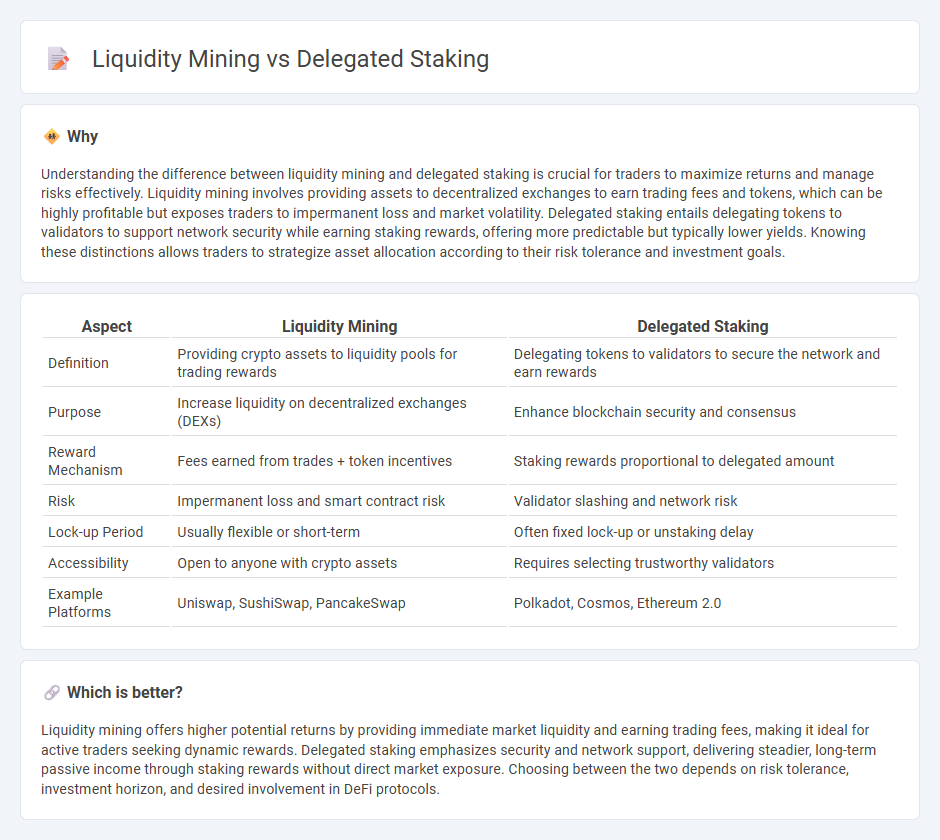

Understanding the difference between liquidity mining and delegated staking is crucial for traders to maximize returns and manage risks effectively. Liquidity mining involves providing assets to decentralized exchanges to earn trading fees and tokens, which can be highly profitable but exposes traders to impermanent loss and market volatility. Delegated staking entails delegating tokens to validators to support network security while earning staking rewards, offering more predictable but typically lower yields. Knowing these distinctions allows traders to strategize asset allocation according to their risk tolerance and investment goals.

Comparison Table

| Aspect | Liquidity Mining | Delegated Staking |

|---|---|---|

| Definition | Providing crypto assets to liquidity pools for trading rewards | Delegating tokens to validators to secure the network and earn rewards |

| Purpose | Increase liquidity on decentralized exchanges (DEXs) | Enhance blockchain security and consensus |

| Reward Mechanism | Fees earned from trades + token incentives | Staking rewards proportional to delegated amount |

| Risk | Impermanent loss and smart contract risk | Validator slashing and network risk |

| Lock-up Period | Usually flexible or short-term | Often fixed lock-up or unstaking delay |

| Accessibility | Open to anyone with crypto assets | Requires selecting trustworthy validators |

| Example Platforms | Uniswap, SushiSwap, PancakeSwap | Polkadot, Cosmos, Ethereum 2.0 |

Which is better?

Liquidity mining offers higher potential returns by providing immediate market liquidity and earning trading fees, making it ideal for active traders seeking dynamic rewards. Delegated staking emphasizes security and network support, delivering steadier, long-term passive income through staking rewards without direct market exposure. Choosing between the two depends on risk tolerance, investment horizon, and desired involvement in DeFi protocols.

Connection

Liquidity mining incentivizes participants to provide capital to decentralized exchanges, increasing market liquidity and earning rewards. Delegated staking allows token holders to delegate their staking power to validators, securing the network while earning staking rewards passively. Both mechanisms enhance decentralized finance ecosystems by promoting token utility, network security, and user engagement through reward-driven participation.

Key Terms

Validators

Delegated staking involves token holders assigning their assets to validators who secure the network and validate transactions, earning rewards on their behalf. Liquidity mining requires users to provide assets to decentralized finance (DeFi) pools, incentivizing liquidity with yield rewards but involving different risk profiles than staking. Explore deeper comparisons of validators' roles and reward mechanisms to understand which option aligns best with your investment strategy.

Liquidity Pools

Delegated staking involves users entrusting their tokens to validators to secure the network and earn rewards, while liquidity mining requires providing tokens to liquidity pools on decentralized exchanges to facilitate trading and earn incentives. Liquidity pools aggregate user funds to enable efficient token swaps, with participants earning fees and rewards proportional to their share, driving platform liquidity and DeFi growth. Explore deeper insights on how liquidity pools reshape decentralized finance and optimize your yield strategies.

Rewards

Delegated staking offers rewards through network inflation and transaction fees by entrusting tokens to validators, typically yielding stable returns with lower risk. Liquidity mining provides incentives in the form of native tokens and trading fees by supplying assets to decentralized pools, often resulting in higher but more volatile rewards. Explore detailed comparisons to optimize your crypto yield strategy.

Source and External Links

Delegated Staking - Forta Docs - Delegated staking allows token holders to delegate their tokens to a node pool to help secure the network and earn a share of rewards, with pools distributing rewards to delegators based on uptime and stake.

Delegated Staking: Your Guide to Earning Crypto Rewards - Delegated staking lowers the barrier to entry for earning crypto rewards by letting users delegate tokens to validators without running a node themselves, providing easier access and often more consistent rewards.

Understanding Delegated Staking - In delegated staking, node operators stake a required amount as collateral and receive 100% rewards from it, while delegators add additional stake to increase rewards, with operators taking a commission on delegated stake rewards.

dowidth.com

dowidth.com