On-chain analytics provides real-time insight into blockchain transactions, wallet activity, and network health, offering a data-driven edge for traders. Sentiment analysis extracts market sentiment from social media, news, and forums to gauge investor mood and potential market movements. Explore how combining on-chain analytics with sentiment analysis can enhance your trading strategy.

Why it is important

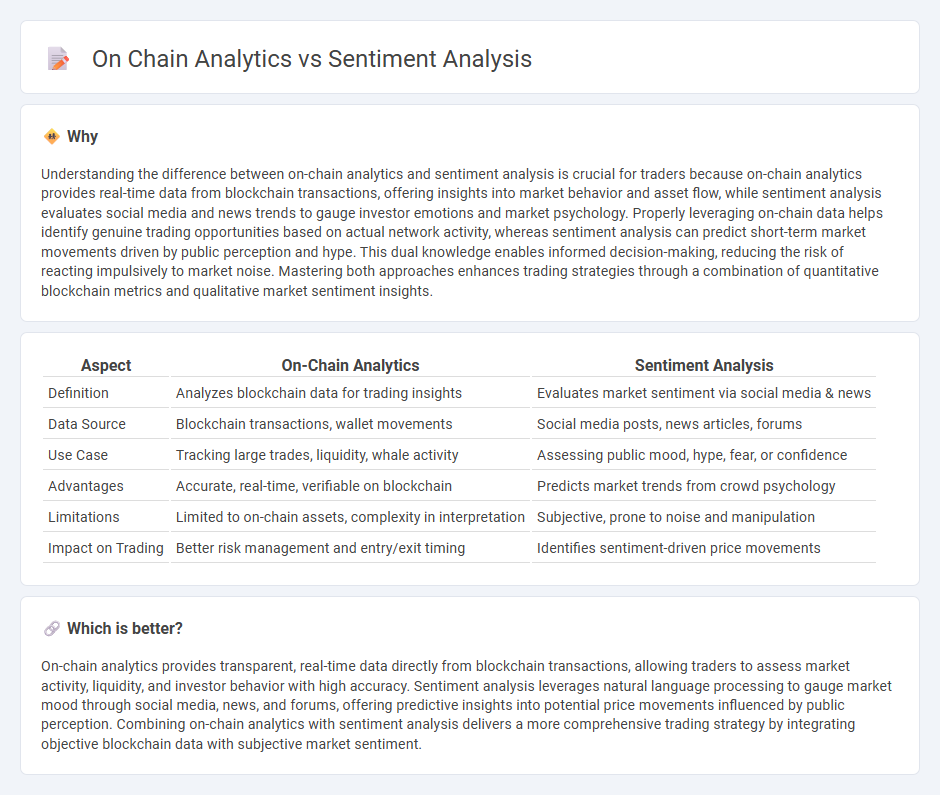

Understanding the difference between on-chain analytics and sentiment analysis is crucial for traders because on-chain analytics provides real-time data from blockchain transactions, offering insights into market behavior and asset flow, while sentiment analysis evaluates social media and news trends to gauge investor emotions and market psychology. Properly leveraging on-chain data helps identify genuine trading opportunities based on actual network activity, whereas sentiment analysis can predict short-term market movements driven by public perception and hype. This dual knowledge enables informed decision-making, reducing the risk of reacting impulsively to market noise. Mastering both approaches enhances trading strategies through a combination of quantitative blockchain metrics and qualitative market sentiment insights.

Comparison Table

| Aspect | On-Chain Analytics | Sentiment Analysis |

|---|---|---|

| Definition | Analyzes blockchain data for trading insights | Evaluates market sentiment via social media & news |

| Data Source | Blockchain transactions, wallet movements | Social media posts, news articles, forums |

| Use Case | Tracking large trades, liquidity, whale activity | Assessing public mood, hype, fear, or confidence |

| Advantages | Accurate, real-time, verifiable on blockchain | Predicts market trends from crowd psychology |

| Limitations | Limited to on-chain assets, complexity in interpretation | Subjective, prone to noise and manipulation |

| Impact on Trading | Better risk management and entry/exit timing | Identifies sentiment-driven price movements |

Which is better?

On-chain analytics provides transparent, real-time data directly from blockchain transactions, allowing traders to assess market activity, liquidity, and investor behavior with high accuracy. Sentiment analysis leverages natural language processing to gauge market mood through social media, news, and forums, offering predictive insights into potential price movements influenced by public perception. Combining on-chain analytics with sentiment analysis delivers a more comprehensive trading strategy by integrating objective blockchain data with subjective market sentiment.

Connection

On-chain analytics provide real-time data on blockchain transactions, enabling traders to track asset flows, wallet activities, and network health. Sentiment analysis processes social media posts and news to gauge market mood, which often influences trader behavior and price movements. Combining on-chain analytics with sentiment analysis offers a comprehensive view of market dynamics, improving trading strategy accuracy and risk management.

Key Terms

**Sentiment Analysis:**

Sentiment analysis leverages natural language processing algorithms to gauge public opinion and emotions across social media, news articles, and forums, offering real-time insights into market trends and investor behavior. This method enhances decision-making by quantifying bullish or bearish sentiment, predicting price movements based on collective investor psychology. Explore how integrating sentiment analysis can optimize your trading strategies and risk management.

Social Media Mentions

Sentiment analysis measures public opinion by evaluating emotions and attitudes expressed in social media mentions, providing real-time insights into market mood and investor psychology. On-chain analytics tracks blockchain transaction data and wallet activity to identify trends and investor behavior without relying on textual sentiment. Explore the differences and applications of these methods to enhance your cryptocurrency investment strategy.

Market Sentiment Scores

Market Sentiment Scores derived from sentiment analysis measure investor emotions using social media, news, and forums, providing real-time insights into market psychology. On-chain analytics utilize blockchain data such as transaction volume, wallet activity, and token flows to assess the actual behavior and trends within cryptocurrency ecosystems. Explore the detailed methodologies and advantages of Market Sentiment Scores in relation to on-chain analytics for a comprehensive understanding.

Source and External Links

What is Sentiment Analysis? | Definition from TechTarget - Sentiment analysis, or opinion mining, is a natural language processing method that detects emotional tone in text, categorizing it as positive, negative, or neutral, often using AI and machine learning to analyze customer opinions and brand sentiment from diverse text sources.

Sentiment Analysis and How to Leverage It - Sentiment analysis can be fine-grained, aspect-based, or intent-based, allowing businesses to measure sentiment intensity, evaluate sentiment on specific product features, or understand the reasons behind customer feedback.

What Is Sentiment Analysis? - Sentiment analysis helps companies process vast textual data from emails, tweets, surveys, and reviews to extract meaningful customer insights, improving experience and brand reputation with AI-powered tools that allow near-real-time monitoring and objective classification of mixed sentiments.

dowidth.com

dowidth.com