Smart Money Concepts focus on identifying the actions of institutional investors and understanding their market influence through tracking large volume trades and liquidity zones. Market Structure Analysis examines price patterns, support and resistance levels, and trend formations to gauge overall market direction and momentum. Explore deeper insights into how these approaches enhance trading strategies and improve decision-making.

Why it is important

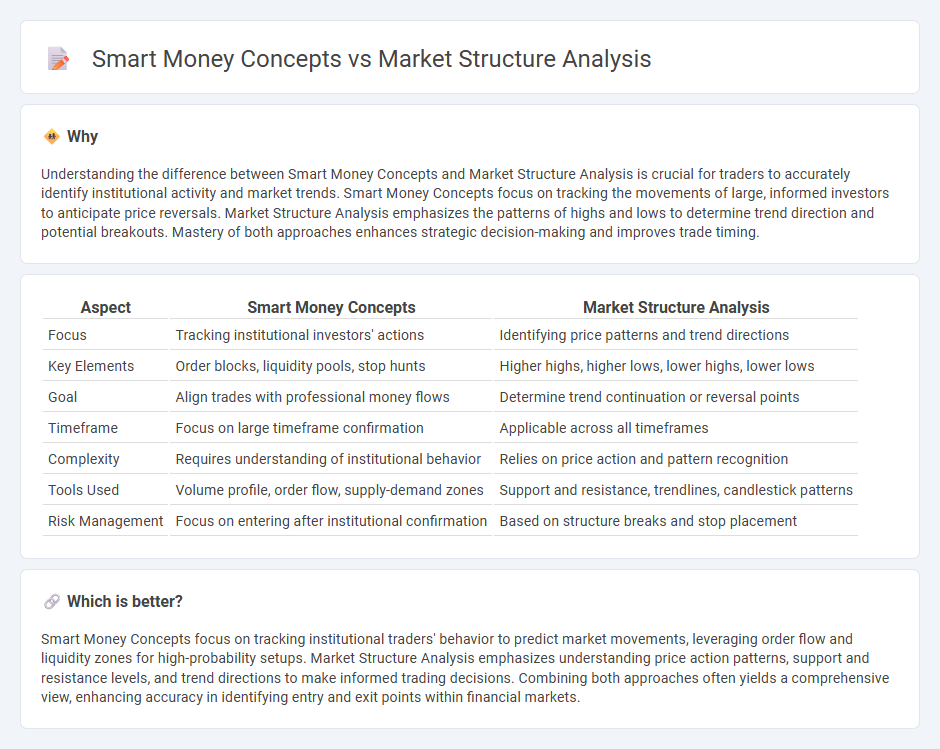

Understanding the difference between Smart Money Concepts and Market Structure Analysis is crucial for traders to accurately identify institutional activity and market trends. Smart Money Concepts focus on tracking the movements of large, informed investors to anticipate price reversals. Market Structure Analysis emphasizes the patterns of highs and lows to determine trend direction and potential breakouts. Mastery of both approaches enhances strategic decision-making and improves trade timing.

Comparison Table

| Aspect | Smart Money Concepts | Market Structure Analysis |

|---|---|---|

| Focus | Tracking institutional investors' actions | Identifying price patterns and trend directions |

| Key Elements | Order blocks, liquidity pools, stop hunts | Higher highs, higher lows, lower highs, lower lows |

| Goal | Align trades with professional money flows | Determine trend continuation or reversal points |

| Timeframe | Focus on large timeframe confirmation | Applicable across all timeframes |

| Complexity | Requires understanding of institutional behavior | Relies on price action and pattern recognition |

| Tools Used | Volume profile, order flow, supply-demand zones | Support and resistance, trendlines, candlestick patterns |

| Risk Management | Focus on entering after institutional confirmation | Based on structure breaks and stop placement |

Which is better?

Smart Money Concepts focus on tracking institutional traders' behavior to predict market movements, leveraging order flow and liquidity zones for high-probability setups. Market Structure Analysis emphasizes understanding price action patterns, support and resistance levels, and trend directions to make informed trading decisions. Combining both approaches often yields a comprehensive view, enhancing accuracy in identifying entry and exit points within financial markets.

Connection

Smart Money Concepts identify institutional trading patterns by analyzing order flow and liquidity, which directly influence Market Structure Analysis by highlighting key support and resistance levels formed by these large players. Market Structure Analysis interprets price action trends and swing points shaped by smart money activity, enabling traders to anticipate potential market reversals or continuations. Integrating both approaches enhances trade decision-making through a deeper understanding of supply-demand dynamics and market sentiment.

Key Terms

Market Structure Analysis:

Market Structure Analysis examines price patterns, support and resistance levels, and trend formations to identify potential market turning points and trends, providing traders with a systematic approach to understanding market dynamics. It relies on analyzing swing highs, swing lows, and consolidation zones to determine the prevailing market bias and key breakout or breakdown areas. Explore more to understand how Market Structure Analysis can enhance your trading strategy and decision-making process.

Swing High/Low

Market structure analysis identifies key Swing Highs and Swing Lows to determine trend direction and potential reversal points, emphasizing price action and volume changes. Smart Money Concepts use Swing Highs and Lows to pinpoint institutional order blocks, liquidity pools, and manipulation zones where large traders accumulate or distribute positions. Explore how integrating both approaches enhances precision in forecasting market movements and optimizing trade entries.

Support and Resistance

Market structure analysis identifies key support and resistance levels by examining price patterns, trends, and swing highs and lows to determine potential reversal or breakout zones. Smart money concepts enhance this approach by focusing on institutional activity, liquidity pools, and order blocks to predict where significant buying or selling pressure may occur around these levels. Explore how combining these strategies can improve your trading edge and precision in market entries.

Source and External Links

Understanding Market Structure: Types, Characteristics - Market structure refers to the organization and behavior of firms and buyers in a market, determining the degree of competition and pricing strategies, with four main types: perfect competition, monopolistic competition, oligopoly, and monopoly.

Market Structure - Overview, Definition, Features, and Types - Market structure classifies industries by the degree and nature of competition, based on factors like number of buyers and sellers, product differentiation, and barriers to entry, leading to four primary market types: perfect competition, monopolistic competition, oligopoly, and monopoly.

Market structure - In economics, market structure describes how firms are categorized by product type and competition levels, including perfect competition, monopolistic competition, oligopoly, and monopoly, influencing price control and market entry barriers.

dowidth.com

dowidth.com