Quantitative signals use mathematical models and historical data patterns to predict market movements and generate trading decisions. Statistical arbitrage exploits price inefficiencies between related securities through systematic, algorithm-driven trading strategies. Discover more about how these approaches enhance trading performance and risk management.

Why it is important

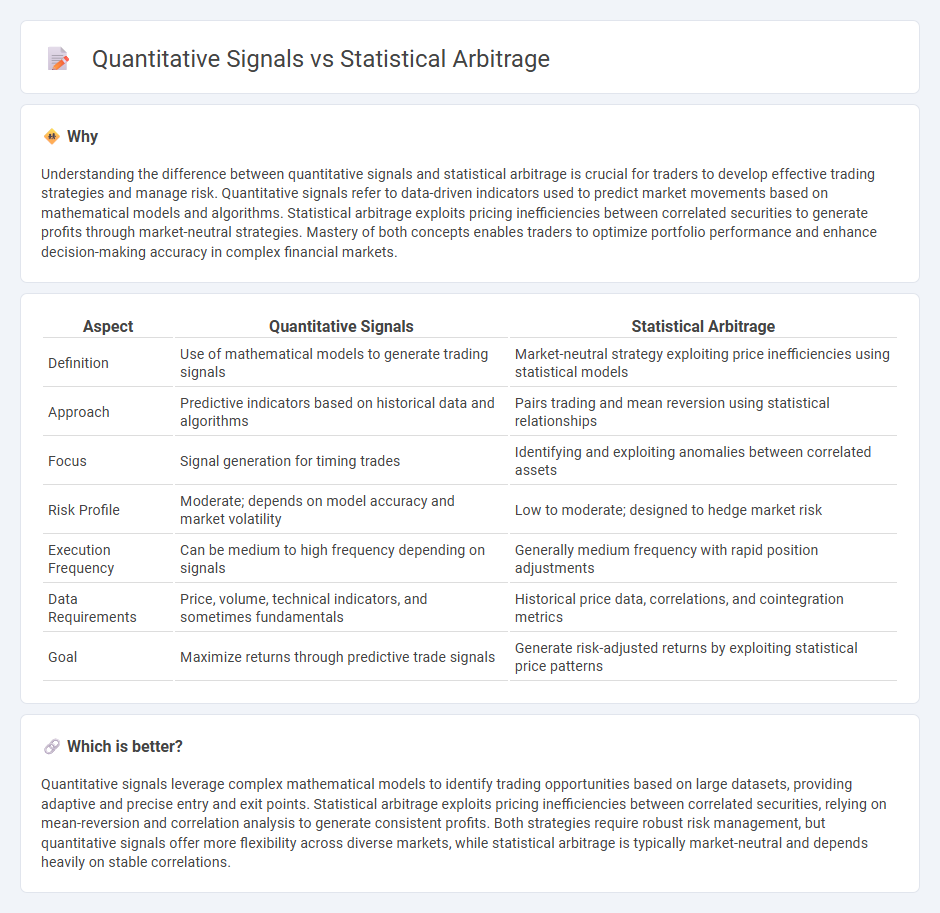

Understanding the difference between quantitative signals and statistical arbitrage is crucial for traders to develop effective trading strategies and manage risk. Quantitative signals refer to data-driven indicators used to predict market movements based on mathematical models and algorithms. Statistical arbitrage exploits pricing inefficiencies between correlated securities to generate profits through market-neutral strategies. Mastery of both concepts enables traders to optimize portfolio performance and enhance decision-making accuracy in complex financial markets.

Comparison Table

| Aspect | Quantitative Signals | Statistical Arbitrage |

|---|---|---|

| Definition | Use of mathematical models to generate trading signals | Market-neutral strategy exploiting price inefficiencies using statistical models |

| Approach | Predictive indicators based on historical data and algorithms | Pairs trading and mean reversion using statistical relationships |

| Focus | Signal generation for timing trades | Identifying and exploiting anomalies between correlated assets |

| Risk Profile | Moderate; depends on model accuracy and market volatility | Low to moderate; designed to hedge market risk |

| Execution Frequency | Can be medium to high frequency depending on signals | Generally medium frequency with rapid position adjustments |

| Data Requirements | Price, volume, technical indicators, and sometimes fundamentals | Historical price data, correlations, and cointegration metrics |

| Goal | Maximize returns through predictive trade signals | Generate risk-adjusted returns by exploiting statistical price patterns |

Which is better?

Quantitative signals leverage complex mathematical models to identify trading opportunities based on large datasets, providing adaptive and precise entry and exit points. Statistical arbitrage exploits pricing inefficiencies between correlated securities, relying on mean-reversion and correlation analysis to generate consistent profits. Both strategies require robust risk management, but quantitative signals offer more flexibility across diverse markets, while statistical arbitrage is typically market-neutral and depends heavily on stable correlations.

Connection

Quantitative signals in trading utilize mathematical models and algorithms to identify patterns and predict market movements, forming the foundation of statistical arbitrage strategies. Statistical arbitrage exploits pricing inefficiencies between related securities by executing numerous trades based on quantitative signals derived from historical price data and statistical relationships. This connection enables traders to systematically capitalize on short-term market anomalies with reduced risk and increased precision.

Key Terms

**Statistical Arbitrage:**

Statistical arbitrage leverages mean reversion and price inefficiencies across large portfolios of securities, employing advanced statistical models and high-frequency data to exploit short-term market anomalies. This strategy relies on rigorous risk management, including diversification and correlation modeling, to optimize returns while minimizing exposure to systemic risks. Explore the mechanics and applications of statistical arbitrage to enhance your quantitative trading strategies.

Mean Reversion

Statistical arbitrage employs mean reversion by identifying pricing inefficiencies where asset prices tend to revert to their historical averages, exploiting temporary deviations in markets. Quantitative signals in mean reversion strategies harness statistical models and historical data to generate precise entry and exit points based on deviations from mean price levels. Explore detailed methodologies and real-world applications of mean reversion in trading to enhance your investment approach.

Cointegration

Statistical arbitrage often leverages cointegration to identify pairs of assets whose price movements are statistically linked, enabling traders to exploit mean-reverting spreads for profit. Quantitative signals incorporate cointegration tests to enhance trading strategies by confirming long-term equilibrium relationships between asset pairs, improving trade entry and exit points. Explore detailed methodologies and case studies on how cointegration drives success in statistical arbitrage and quantitative signal strategies.

Source and External Links

Top Statistical Arbitrage Strategies and Their Risks - WunderTrading - Statistical arbitrage is a market-neutral, quantitative trading strategy exploiting price discrepancies between related securities using complex algorithms and data analysis, focusing on mean reversion and often involving simultaneous long and short positions to hedge market risk and aim for consistent returns.

Statistical arbitrage - Wikipedia - Statistical arbitrage (Stat Arb) involves short-term, beta-neutral financial trading strategies relying on mean reversion and multi-factor statistical methods within broadly diversified portfolios, typically automated to manage high turnover and capture small price inefficiencies.

Statistical Arbitrage in High Frequency Trading Based on Limit Order ... - Stanford - Statistical arbitrage is defined academically as spreading risk across thousands to millions of very short-term trades, leveraging statistical models to gain from tiny, frequent pricing inefficiencies typically in high-frequency trading contexts.

dowidth.com

dowidth.com