Dark pool activity involves private trading venues where large institutional investors execute block trades anonymously, minimizing market impact and price fluctuations. Alternative Trading Systems (ATS) operate as regulated platforms providing diverse order types and liquidity pools, enhancing transparency and access beyond traditional exchanges. Explore comprehensive insights to understand how dark pools and ATS reshape modern trading dynamics.

Why it is important

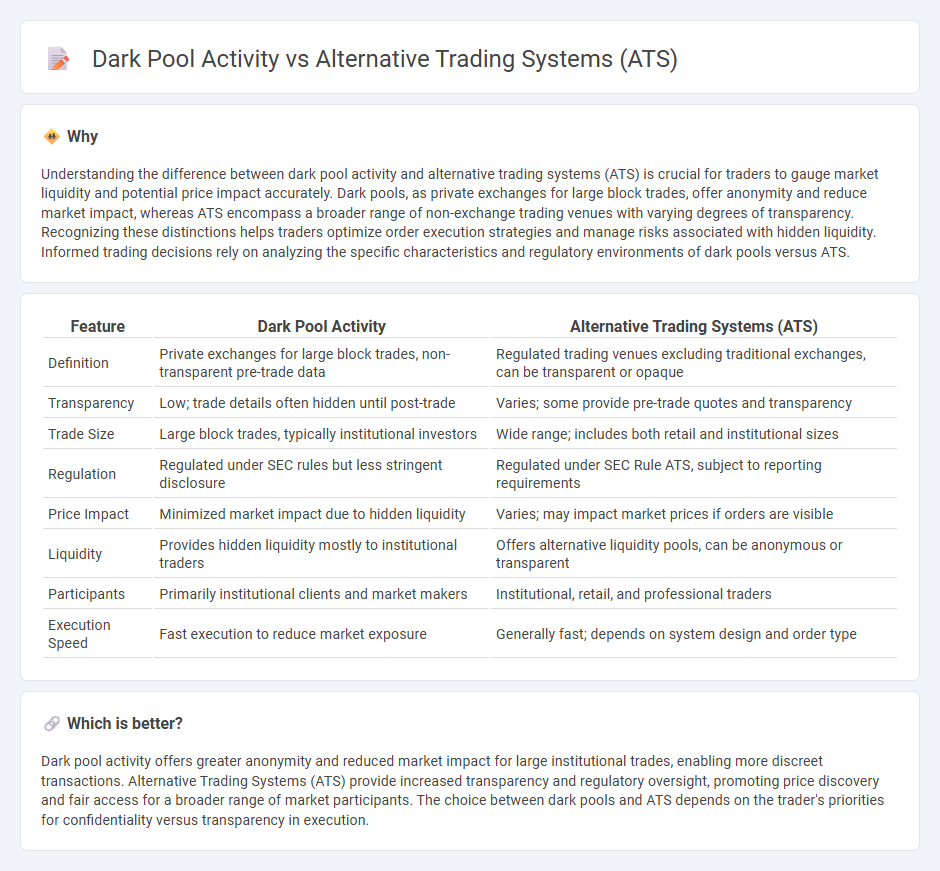

Understanding the difference between dark pool activity and alternative trading systems (ATS) is crucial for traders to gauge market liquidity and potential price impact accurately. Dark pools, as private exchanges for large block trades, offer anonymity and reduce market impact, whereas ATS encompass a broader range of non-exchange trading venues with varying degrees of transparency. Recognizing these distinctions helps traders optimize order execution strategies and manage risks associated with hidden liquidity. Informed trading decisions rely on analyzing the specific characteristics and regulatory environments of dark pools versus ATS.

Comparison Table

| Feature | Dark Pool Activity | Alternative Trading Systems (ATS) |

|---|---|---|

| Definition | Private exchanges for large block trades, non-transparent pre-trade data | Regulated trading venues excluding traditional exchanges, can be transparent or opaque |

| Transparency | Low; trade details often hidden until post-trade | Varies; some provide pre-trade quotes and transparency |

| Trade Size | Large block trades, typically institutional investors | Wide range; includes both retail and institutional sizes |

| Regulation | Regulated under SEC rules but less stringent disclosure | Regulated under SEC Rule ATS, subject to reporting requirements |

| Price Impact | Minimized market impact due to hidden liquidity | Varies; may impact market prices if orders are visible |

| Liquidity | Provides hidden liquidity mostly to institutional traders | Offers alternative liquidity pools, can be anonymous or transparent |

| Participants | Primarily institutional clients and market makers | Institutional, retail, and professional traders |

| Execution Speed | Fast execution to reduce market exposure | Generally fast; depends on system design and order type |

Which is better?

Dark pool activity offers greater anonymity and reduced market impact for large institutional trades, enabling more discreet transactions. Alternative Trading Systems (ATS) provide increased transparency and regulatory oversight, promoting price discovery and fair access for a broader range of market participants. The choice between dark pools and ATS depends on the trader's priorities for confidentiality versus transparency in execution.

Connection

Dark pool activity is predominantly executed through Alternative Trading Systems (ATS), providing a private venue where large institutional investors trade significant blocks of securities away from public exchanges. These ATS facilitate reduced market impact and enhanced anonymity by matching buy and sell orders internally, thereby minimizing information leakage. The connection between dark pools and ATS is critical for understanding the evolving landscape of liquidity fragmentation and off-exchange trading volumes in modern financial markets.

Key Terms

Transparency

Alternative trading systems (ATS) offer a regulated marketplace with varying degrees of transparency compared to traditional exchanges, while dark pools operate with limited pre-trade transparency to facilitate large block trades without impacting market prices. ATS platforms disclose trade data post-execution, enabling market participants to assess liquidity and price discovery, whereas dark pools often delay or withhold trade information, increasing opacity. Explore more about how transparency differences between ATS and dark pools affect trading strategies and market integrity.

Order Execution

Alternative Trading Systems (ATS) provide a regulated platform for executing large block trades with more transparency than traditional dark pools, which operate privately to minimize market impact. ATS facilitate order execution by matching buyers and sellers efficiently while maintaining regulatory oversight, whereas dark pools prioritize anonymity and often lack the same level of pre-trade transparency. Explore detailed insights into how ATS and dark pools differ in order execution strategies and their impact on market quality.

Regulation

Alternative Trading Systems (ATS) and dark pools operate as private trading venues outside traditional exchanges, offering limited transparency and reduced market impact for large orders. Regulatory frameworks such as Regulation ATS in the U.S. enforce registration, disclosure, and operational requirements to enhance market integrity and investor protection. Explore more to understand how evolving regulations shape ATS and dark pool activities and their impact on market transparency.

Source and External Links

Alternative trading system - An Alternative Trading System (ATS) is a US and Canadian regulated non-exchange trading venue that matches buyers and sellers, typically regulated as broker-dealers rather than exchanges, and provides an alternative to traditional stock exchanges for accessing liquidity, including large block trades away from the public market.

Alternative Trading System (ATS) - Definition, Examples - An ATS is a North American trading venue matching buyers and sellers without exchange regulation, often used for large trades to avoid market impact, with common forms including electronic communication networks (ECNs), dark pools, crossing networks, and call markets.

Alternative Trading System (ATS) Regulation and ... - ATSs include various types such as dark pools, ECNs, crossing networks, broker-dealers' internal systems, and call markets, each offering distinct trading advantages like anonymity, fast execution, or reduced market impact, thereby complementing traditional exchanges and enhancing market diversity.

dowidth.com

dowidth.com