Tokenized assets represent ownership of real-world assets through blockchain technology, enabling fractional ownership, increased liquidity, and enhanced transparency compared to traditional assets held in physical or centralized forms. Traditional assets, such as stocks, bonds, and real estate, often involve intermediaries and slower transaction processes, limiting accessibility and flexibility. Discover how tokenized assets are revolutionizing investment strategies and market participation.

Why it is important

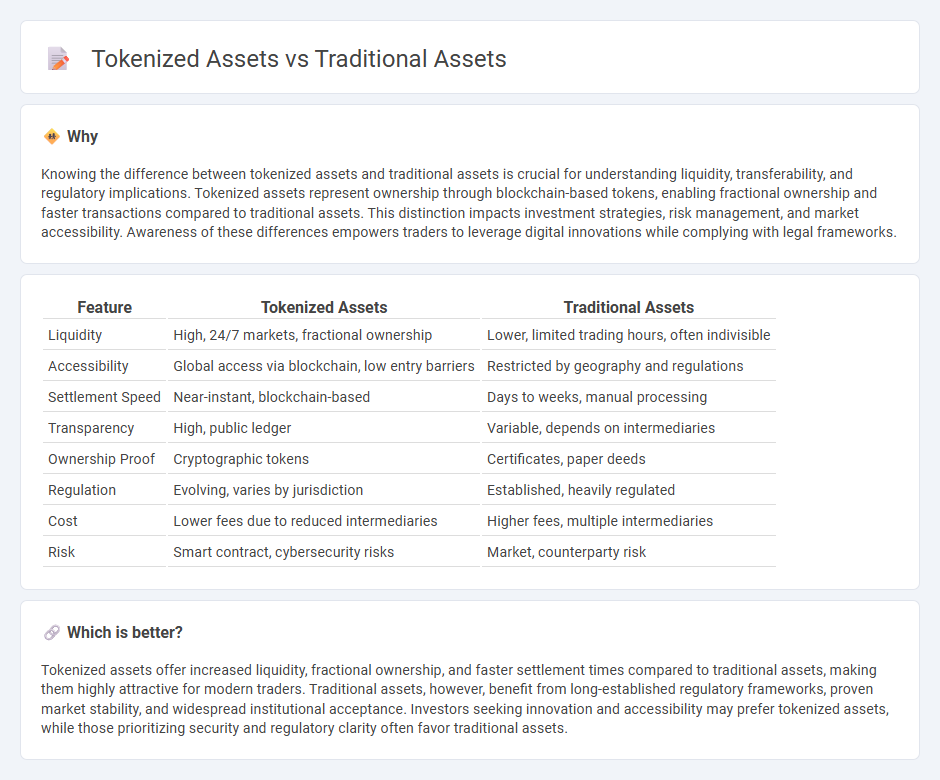

Knowing the difference between tokenized assets and traditional assets is crucial for understanding liquidity, transferability, and regulatory implications. Tokenized assets represent ownership through blockchain-based tokens, enabling fractional ownership and faster transactions compared to traditional assets. This distinction impacts investment strategies, risk management, and market accessibility. Awareness of these differences empowers traders to leverage digital innovations while complying with legal frameworks.

Comparison Table

| Feature | Tokenized Assets | Traditional Assets |

|---|---|---|

| Liquidity | High, 24/7 markets, fractional ownership | Lower, limited trading hours, often indivisible |

| Accessibility | Global access via blockchain, low entry barriers | Restricted by geography and regulations |

| Settlement Speed | Near-instant, blockchain-based | Days to weeks, manual processing |

| Transparency | High, public ledger | Variable, depends on intermediaries |

| Ownership Proof | Cryptographic tokens | Certificates, paper deeds |

| Regulation | Evolving, varies by jurisdiction | Established, heavily regulated |

| Cost | Lower fees due to reduced intermediaries | Higher fees, multiple intermediaries |

| Risk | Smart contract, cybersecurity risks | Market, counterparty risk |

Which is better?

Tokenized assets offer increased liquidity, fractional ownership, and faster settlement times compared to traditional assets, making them highly attractive for modern traders. Traditional assets, however, benefit from long-established regulatory frameworks, proven market stability, and widespread institutional acceptance. Investors seeking innovation and accessibility may prefer tokenized assets, while those prioritizing security and regulatory clarity often favor traditional assets.

Connection

Tokenized assets bridge traditional assets and blockchain technology by converting real-world holdings such as stocks, real estate, or commodities into digital tokens on a distributed ledger. This connection enhances liquidity, transparency, and accessibility in trading by enabling fractional ownership, faster settlement times, and global market participation. Market participants can seamlessly trade tokenized versions of traditional assets, integrating conventional finance with decentralized finance (DeFi) ecosystems.

Key Terms

Ownership Structure

Traditional assets often involve centralized ownership structures managed by intermediaries, limiting direct control and transferability for investors. Tokenized assets use blockchain technology to enable decentralized ownership, granting investors fractionalized and transparent rights through smart contracts. Explore how this shift redefines asset management and investor empowerment.

Liquidity

Traditional assets often face limited liquidity due to longer settlement times and reliance on intermediaries, restricting rapid buying and selling. Tokenized assets leverage blockchain technology to enable fractional ownership and 24/7 trading, significantly enhancing market liquidity. Explore how tokenization is reshaping liquidity dynamics and investment opportunities in modern finance.

Settlement Mechanism

Traditional assets settle through centralized clearinghouses using manual processes that can take several days, increasing counterparty risk. Tokenized assets leverage blockchain technology for near-instantaneous, transparent settlement, significantly reducing settlement time and operational costs. Explore how the settlement mechanism revolutionizes asset management with tokenized solutions.

Source and External Links

Traditional investments - Traditional assets include well-known classes like bonds, cash, real estate, and equity shares, typically aimed at capital appreciation, dividends, and interest income.

Alternative Investments and Traditional ones - Traditional investments mainly encompass stocks, bonds, and mutual funds known for their liquidity, transparency, regulation, and accessibility to a broad range of investors.

Alternative Investments vs. Traditional Investments - Traditional investments include stocks, bonds, mutual funds, ETFs, and cash equivalents, favored for their suitability to risk-averse investors and liquidity needs.

dowidth.com

dowidth.com