High frequency trading (HFT) leverages advanced algorithms and ultra-low latency systems to execute thousands of trades within milliseconds, focusing on exploiting small price inefficiencies in highly liquid markets. Quantitative trading utilizes mathematical models and statistical analysis to identify trading opportunities across various asset classes, often holding positions longer than HFT strategies. Discover how these distinct trading methodologies impact market dynamics and investment performance.

Why it is important

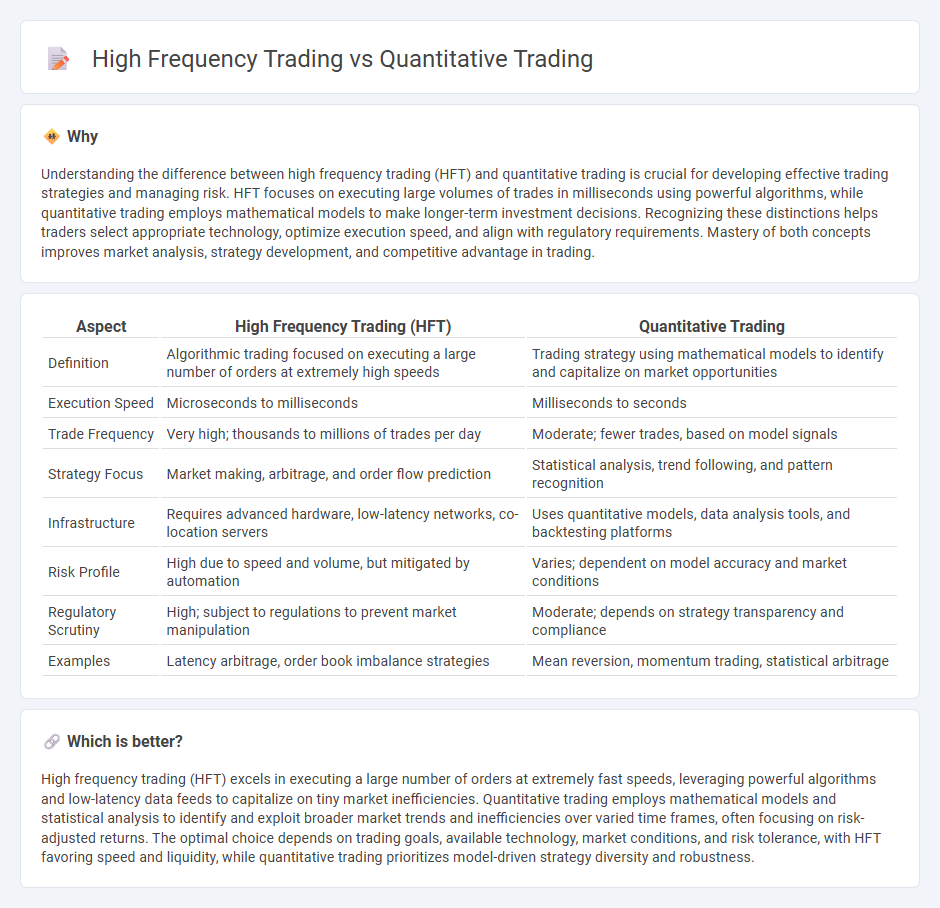

Understanding the difference between high frequency trading (HFT) and quantitative trading is crucial for developing effective trading strategies and managing risk. HFT focuses on executing large volumes of trades in milliseconds using powerful algorithms, while quantitative trading employs mathematical models to make longer-term investment decisions. Recognizing these distinctions helps traders select appropriate technology, optimize execution speed, and align with regulatory requirements. Mastery of both concepts improves market analysis, strategy development, and competitive advantage in trading.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Quantitative Trading |

|---|---|---|

| Definition | Algorithmic trading focused on executing a large number of orders at extremely high speeds | Trading strategy using mathematical models to identify and capitalize on market opportunities |

| Execution Speed | Microseconds to milliseconds | Milliseconds to seconds |

| Trade Frequency | Very high; thousands to millions of trades per day | Moderate; fewer trades, based on model signals |

| Strategy Focus | Market making, arbitrage, and order flow prediction | Statistical analysis, trend following, and pattern recognition |

| Infrastructure | Requires advanced hardware, low-latency networks, co-location servers | Uses quantitative models, data analysis tools, and backtesting platforms |

| Risk Profile | High due to speed and volume, but mitigated by automation | Varies; dependent on model accuracy and market conditions |

| Regulatory Scrutiny | High; subject to regulations to prevent market manipulation | Moderate; depends on strategy transparency and compliance |

| Examples | Latency arbitrage, order book imbalance strategies | Mean reversion, momentum trading, statistical arbitrage |

Which is better?

High frequency trading (HFT) excels in executing a large number of orders at extremely fast speeds, leveraging powerful algorithms and low-latency data feeds to capitalize on tiny market inefficiencies. Quantitative trading employs mathematical models and statistical analysis to identify and exploit broader market trends and inefficiencies over varied time frames, often focusing on risk-adjusted returns. The optimal choice depends on trading goals, available technology, market conditions, and risk tolerance, with HFT favoring speed and liquidity, while quantitative trading prioritizes model-driven strategy diversity and robustness.

Connection

High frequency trading (HFT) utilizes advanced algorithms and high-speed data processing to execute large volumes of trades within milliseconds, relying heavily on quantitative models to identify and exploit market inefficiencies. Quantitative trading involves using mathematical models and statistical techniques to analyze historical data and predict price movements, forming the foundational strategies that drive HFT systems. The connection between HFT and quantitative trading lies in their mutual dependence on algorithmic decision-making and data-driven insights to maximize trading efficiency and profitability.

Key Terms

Algorithmic Models

Quantitative trading employs complex algorithmic models to analyze vast datasets and identify market inefficiencies over various time frames, typically ranging from minutes to days. High-frequency trading (HFT), a subset of quantitative trading, uses ultra-low latency algorithms and high-speed data feeds to execute thousands of trades per second, capitalizing on microscopic price discrepancies. Explore the key algorithmic strategies and technological innovations that differentiate quantitative trading from high-frequency trading to understand their market impacts.

Latency

Quantitative trading employs algorithmic models based on historical data to execute trades, with latency playing a significant but variable role depending on strategy complexity. High-frequency trading (HFT) prioritizes ultra-low latency systems to capitalize on minute market inefficiencies through rapid order execution, often measured in microseconds. Explore advanced technologies and strategies that distinguish latency optimization in these trading approaches for deeper insights.

Trade Volume

Quantitative trading uses algorithmic models to analyze extensive historical data and execute trades based on statistical patterns, often involving moderate to high trade volumes spread over longer periods. High-frequency trading (HFT) relies on ultra-fast execution speeds and advanced technology to conduct thousands or millions of trades per second, focusing on extremely high trade volumes within milliseconds to capitalize on minute market inefficiencies. Explore how trade volume dynamics influence the performance and risk profiles of quantitative trading and HFT strategies to enhance your trading insights.

Source and External Links

Quantitative analysis (finance) - Wikipedia - Quantitative trading uses mathematical and statistical methods to develop trading strategies, including areas like algorithmic and statistical arbitrage, with professionals known as quants working on trading, risk management, portfolio optimization, and derivatives pricing.

8-Course Guide to Quantitative Trading for Beginners - A beginner's guide to quant trading covers strategies, machine learning applications, coding and backtesting of trading algorithms, and risk management, with live trading implementation using platforms like Blueshift.

Beginner's guide to the world of quant trading w/ @GoodWorkMB - Quant trading involves roles such as researchers, traders, and developers who create option pricing models and execute algorithmic strategies to generate profits on Wall Street.

dowidth.com

dowidth.com