High-frequency trading (HFT) leverages sophisticated algorithms and ultra-low latency networks to execute thousands of orders within milliseconds, capitalizing on minuscule price discrepancies. Momentum trading, by contrast, relies on identifying and following established price trends over longer periods, using technical analysis to predict future market movements. Explore the deeper mechanics and strategies behind these distinct trading styles to enhance your market approach.

Why it is important

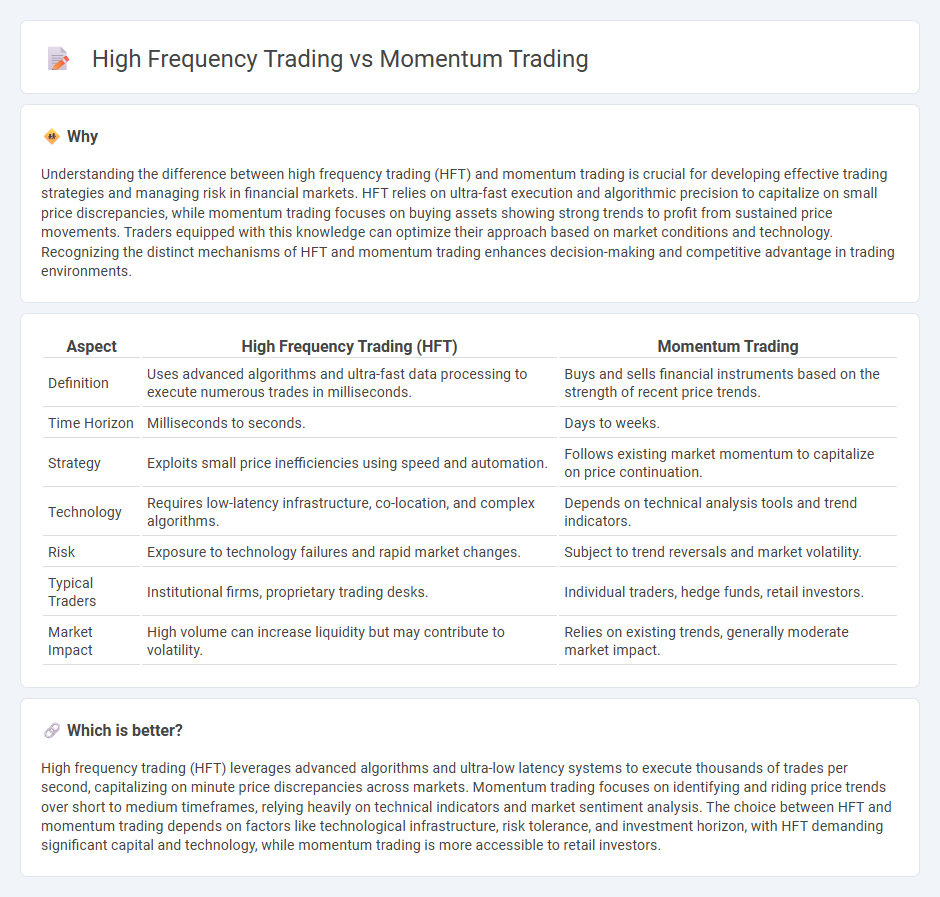

Understanding the difference between high frequency trading (HFT) and momentum trading is crucial for developing effective trading strategies and managing risk in financial markets. HFT relies on ultra-fast execution and algorithmic precision to capitalize on small price discrepancies, while momentum trading focuses on buying assets showing strong trends to profit from sustained price movements. Traders equipped with this knowledge can optimize their approach based on market conditions and technology. Recognizing the distinct mechanisms of HFT and momentum trading enhances decision-making and competitive advantage in trading environments.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Momentum Trading |

|---|---|---|

| Definition | Uses advanced algorithms and ultra-fast data processing to execute numerous trades in milliseconds. | Buys and sells financial instruments based on the strength of recent price trends. |

| Time Horizon | Milliseconds to seconds. | Days to weeks. |

| Strategy | Exploits small price inefficiencies using speed and automation. | Follows existing market momentum to capitalize on price continuation. |

| Technology | Requires low-latency infrastructure, co-location, and complex algorithms. | Depends on technical analysis tools and trend indicators. |

| Risk | Exposure to technology failures and rapid market changes. | Subject to trend reversals and market volatility. |

| Typical Traders | Institutional firms, proprietary trading desks. | Individual traders, hedge funds, retail investors. |

| Market Impact | High volume can increase liquidity but may contribute to volatility. | Relies on existing trends, generally moderate market impact. |

Which is better?

High frequency trading (HFT) leverages advanced algorithms and ultra-low latency systems to execute thousands of trades per second, capitalizing on minute price discrepancies across markets. Momentum trading focuses on identifying and riding price trends over short to medium timeframes, relying heavily on technical indicators and market sentiment analysis. The choice between HFT and momentum trading depends on factors like technological infrastructure, risk tolerance, and investment horizon, with HFT demanding significant capital and technology, while momentum trading is more accessible to retail investors.

Connection

High frequency trading (HFT) and momentum trading are interconnected through their reliance on rapid data analysis and market trends to capitalize on short-term price movements. HFT algorithms exploit momentum by executing large volumes of trades within milliseconds, identifying and amplifying price trends before they dissipate. This synergy accelerates market liquidity and volatility, influencing price discovery and trading efficiency.

Key Terms

**Momentum Trading:**

Momentum trading capitalizes on market trends by buying assets showing upward price movement and selling those demonstrating downward momentum, relying heavily on technical indicators like moving averages and relative strength index (RSI). Traders exploit sustained price trends to generate profits, typically holding positions from days to weeks rather than executing rapid trades. Explore deeper insights into momentum trading strategies and risk management techniques to enhance your trading proficiency.

Trend

Momentum trading capitalizes on sustained price trends by identifying stocks exhibiting strong upward or downward movement, relying on technical indicators like moving averages and volume trends to time entry and exit points. High-frequency trading (HFT) exploits minute, short-term price discrepancies through rapid executions powered by advanced algorithms and low-latency systems, often focusing on small, fleeting trends across numerous assets. Explore comprehensive strategies and technological differences between momentum trading and high-frequency trading for deeper insights.

Relative Strength

Momentum trading relies on identifying securities with strong recent performance using Relative Strength (RS) indicators to predict continued price trends. High Frequency Trading (HFT) exploits minute price discrepancies through algorithmic models, often incorporating real-time RS data for rapid decision-making. Explore detailed strategies and comparative advantages by delving deeper into their application of Relative Strength in modern markets.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends, with two main types: time-series momentum, which focuses on an asset's own historical performance, and cross-sectional momentum, which compares assets relative to each other.

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - Momentum trading strategies capitalize on trends by buying assets with strong recent upward momentum and selling those with downward momentum, using either time-series (individual asset) or cross-sectional (relative asset ranking) approaches.

Momentum Trading for Beginners (What They Don't Teach You) - This video explains momentum trading as a strategy to ride strong price moves in various markets, highlighting key tools like RSI and MACD, the importance of volume, volatility, and risk management, and practical ways to identify momentum-driven trades.

dowidth.com

dowidth.com