Liquidity mining and market making are pivotal strategies in decentralized finance (DeFi) that enhance market efficiency and trading volume by providing liquidity to crypto assets. Liquidity mining incentivizes participants with rewards for locking tokens in liquidity pools, while market making involves continuously buying and selling assets to maintain market stability and tight spreads. Explore the distinct benefits and mechanisms of each approach to optimize your trading strategy.

Why it is important

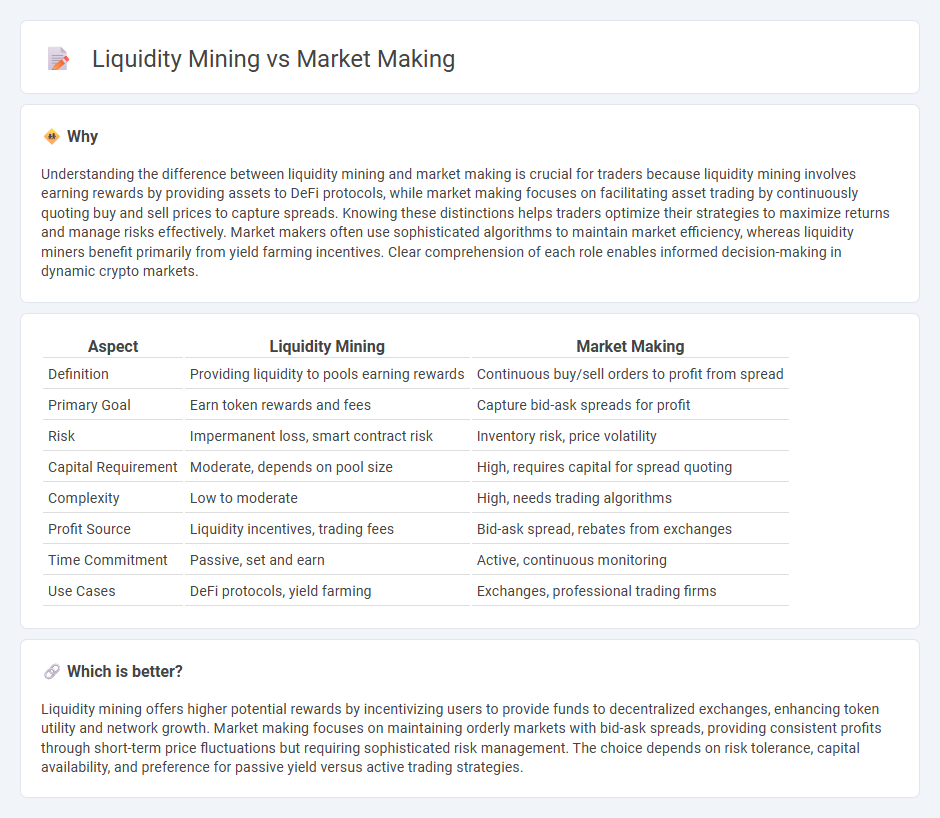

Understanding the difference between liquidity mining and market making is crucial for traders because liquidity mining involves earning rewards by providing assets to DeFi protocols, while market making focuses on facilitating asset trading by continuously quoting buy and sell prices to capture spreads. Knowing these distinctions helps traders optimize their strategies to maximize returns and manage risks effectively. Market makers often use sophisticated algorithms to maintain market efficiency, whereas liquidity miners benefit primarily from yield farming incentives. Clear comprehension of each role enables informed decision-making in dynamic crypto markets.

Comparison Table

| Aspect | Liquidity Mining | Market Making |

|---|---|---|

| Definition | Providing liquidity to pools earning rewards | Continuous buy/sell orders to profit from spread |

| Primary Goal | Earn token rewards and fees | Capture bid-ask spreads for profit |

| Risk | Impermanent loss, smart contract risk | Inventory risk, price volatility |

| Capital Requirement | Moderate, depends on pool size | High, requires capital for spread quoting |

| Complexity | Low to moderate | High, needs trading algorithms |

| Profit Source | Liquidity incentives, trading fees | Bid-ask spread, rebates from exchanges |

| Time Commitment | Passive, set and earn | Active, continuous monitoring |

| Use Cases | DeFi protocols, yield farming | Exchanges, professional trading firms |

Which is better?

Liquidity mining offers higher potential rewards by incentivizing users to provide funds to decentralized exchanges, enhancing token utility and network growth. Market making focuses on maintaining orderly markets with bid-ask spreads, providing consistent profits through short-term price fluctuations but requiring sophisticated risk management. The choice depends on risk tolerance, capital availability, and preference for passive yield versus active trading strategies.

Connection

Liquidity mining incentivizes participants to provide liquidity by rewarding them with tokens, directly enhancing market depth and reducing spreads. Market making involves placing buy and sell orders to facilitate smoother trading and increase order book activity. Both strategies work synergistically to improve overall market efficiency and attract more traders through increased liquidity and tighter bid-ask spreads.

Key Terms

Bid-Ask Spread

Market making involves continuously placing buy and sell orders to profit from the bid-ask spread, ensuring tighter spreads and improved market efficiency. Liquidity mining incentivizes users to provide liquidity by rewarding token holders, often leading to increased volume but variable spread widths. Explore deeper insights into how bid-ask dynamics shape trading strategies and liquidity provision.

Automated Market Maker (AMM)

Market making in Automated Market Makers (AMMs) involves algorithms that continuously provide buy and sell orders, ensuring constant liquidity by automatically adjusting prices based on supply and demand dynamics. Liquidity mining rewards users who supply assets to AMM pools with incentives like tokens, promoting deeper liquidity and network growth. Explore more about how AMM protocols optimize trading efficiency and liquidity incentives.

Incentive Rewards

Market making incentivizes traders with spreads and rebates to ensure continuous bid-ask availability, fostering efficient price discovery and minimizing spreads. Liquidity mining offers token-based rewards to participants who provide capital to decentralized pools, promoting volume and user engagement while often involving higher risk exposure. Explore detailed comparisons on how these incentive rewards shape trading ecosystems and participant behavior.

Source and External Links

Mastering the Market Maker Trading Strategy | EPAM SolutionsHub - Market makers earn profits by capitalizing on the bid-ask spread, managing inventory, and analyzing order flow to provide liquidity while balancing regulatory requirements.

Market maker: What it is, importance, benefits & examples - StoneX - A market maker continuously quotes buy and sell prices, profits from the bid-ask spread, and manages risk while ensuring liquidity in markets.

Market Maker - Definition, Role, How They Work - Market makers provide two-sided quotes, facilitate trade execution for others and themselves, and make profits from the bid-ask spread while compensating for holding inventory risk.

dowidth.com

dowidth.com