Risk reversal and reverse iron condor are advanced trading strategies used to hedge or speculate on market movements. Risk reversal involves buying a call and selling a put to capitalize on directional price changes, while reverse iron condor combines multiple options to profit from volatility in a defined range. Explore the nuances and applications of these strategies to enhance your trading acumen.

Why it is important

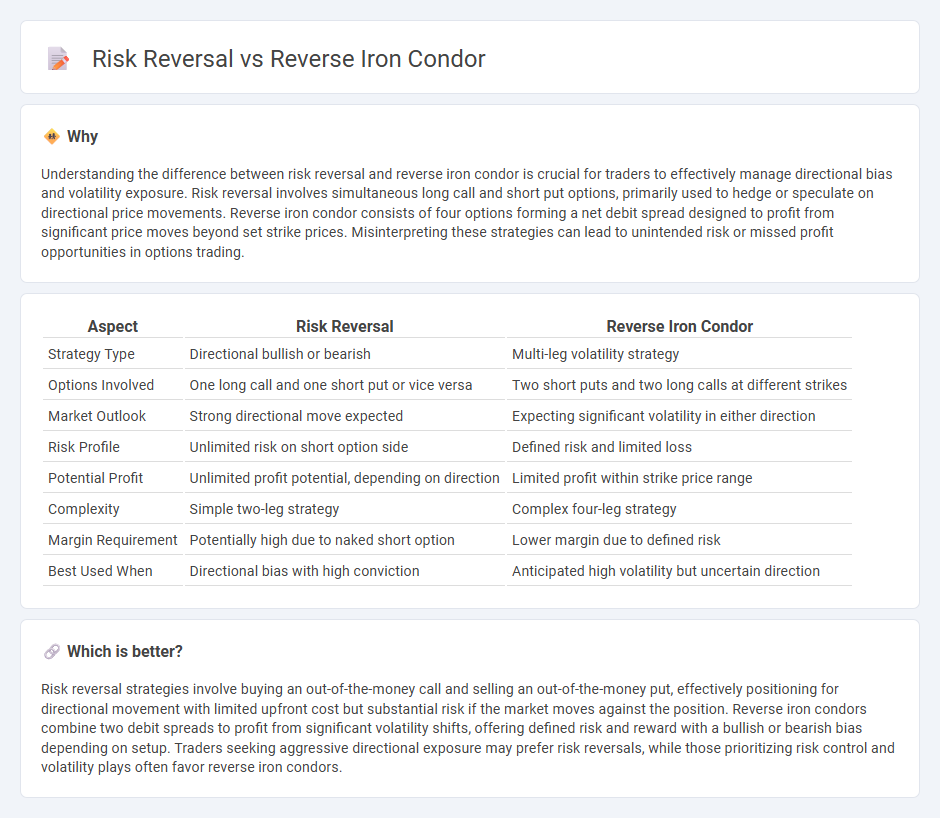

Understanding the difference between risk reversal and reverse iron condor is crucial for traders to effectively manage directional bias and volatility exposure. Risk reversal involves simultaneous long call and short put options, primarily used to hedge or speculate on directional price movements. Reverse iron condor consists of four options forming a net debit spread designed to profit from significant price moves beyond set strike prices. Misinterpreting these strategies can lead to unintended risk or missed profit opportunities in options trading.

Comparison Table

| Aspect | Risk Reversal | Reverse Iron Condor |

|---|---|---|

| Strategy Type | Directional bullish or bearish | Multi-leg volatility strategy |

| Options Involved | One long call and one short put or vice versa | Two short puts and two long calls at different strikes |

| Market Outlook | Strong directional move expected | Expecting significant volatility in either direction |

| Risk Profile | Unlimited risk on short option side | Defined risk and limited loss |

| Potential Profit | Unlimited profit potential, depending on direction | Limited profit within strike price range |

| Complexity | Simple two-leg strategy | Complex four-leg strategy |

| Margin Requirement | Potentially high due to naked short option | Lower margin due to defined risk |

| Best Used When | Directional bias with high conviction | Anticipated high volatility but uncertain direction |

Which is better?

Risk reversal strategies involve buying an out-of-the-money call and selling an out-of-the-money put, effectively positioning for directional movement with limited upfront cost but substantial risk if the market moves against the position. Reverse iron condors combine two debit spreads to profit from significant volatility shifts, offering defined risk and reward with a bullish or bearish bias depending on setup. Traders seeking aggressive directional exposure may prefer risk reversals, while those prioritizing risk control and volatility plays often favor reverse iron condors.

Connection

Risk reversal and reverse iron condor are connected through their use in options trading strategies designed to capitalize on market volatility and directional moves. Risk reversal involves simultaneously buying an out-of-the-money call option and selling an out-of-the-money put option to create a bullish or bearish position, while the reverse iron condor combines a long call spread and a long put spread to profit from significant price movement in either direction. Both strategies manage risk and reward by leveraging option premiums and strike prices to optimize potential gains within defined or undefined risk parameters.

Key Terms

Strike Prices

A reverse iron condor involves buying and selling out-of-the-money call and put options with strike prices spaced to create a net credit, whereas a risk reversal typically consists of selling a put and buying a call option to hedge directional risk. The strike prices in a reverse iron condor are set to capitalize on low volatility and limited price movement, while risk reversal strike prices align with expected directional moves in the underlying asset. Explore more about how strike price selection impacts your options strategies.

Volatility

A reverse iron condor involves selling an out-of-the-money put spread and an out-of-the-money call spread, profiting from increased volatility and large price moves in either direction. In contrast, a risk reversal combines a long call and short put, primarily targeting directional bullish volatility with asymmetric risk exposure. Explore detailed volatility impacts on these strategies to enhance your options trading decisions.

Unlimited Risk/Reward

Reverse iron condor and risk reversal strategies both offer unique risk/reward profiles with unlimited upside potential, but differ significantly in structure and risk exposure. A reverse iron condor involves selling a bull put spread and a bear call spread, creating a position with limited risk and potentially unlimited reward on volatility expansion. Explore deeper insights on optimizing your options strategies by understanding these nuances in risk and reward dynamics.

Source and External Links

Reverse Iron Condor Strategy: Best Tips and Techniques - XS - The reverse iron condor is an advanced options strategy involving buying a lower strike call and put and selling higher strike call and put options, designed to profit from large, unexpected price moves regardless of direction, thriving in volatile markets.

The Reverse Iron Condor Strategy - This strategy is for volatile markets and involves buying out-of-the-money call and put spreads, aiming to profit from significant price moves with limited risk, featuring a risk-reward profile opposite to a traditional iron condor.

Reverse Iron Condor Options Strategy - The reverse iron condor combines a bull call spread and a bear put spread, offering high profit potential and limited risk from a net debit, and is directionally neutral as profits rely on significant price movement in either direction.

dowidth.com

dowidth.com