On-chain analytics provide transparent insights into blockchain transaction flows, wallet activity, and network metrics, enabling traders to assess liquidity and investor behavior in real-time. Market microstructure analysis focuses on order book dynamics, trade executions, and price formation processes within exchanges to understand supply-demand imbalances and market depth. Explore deeper analysis techniques to enhance your trading strategy and decision-making.

Why it is important

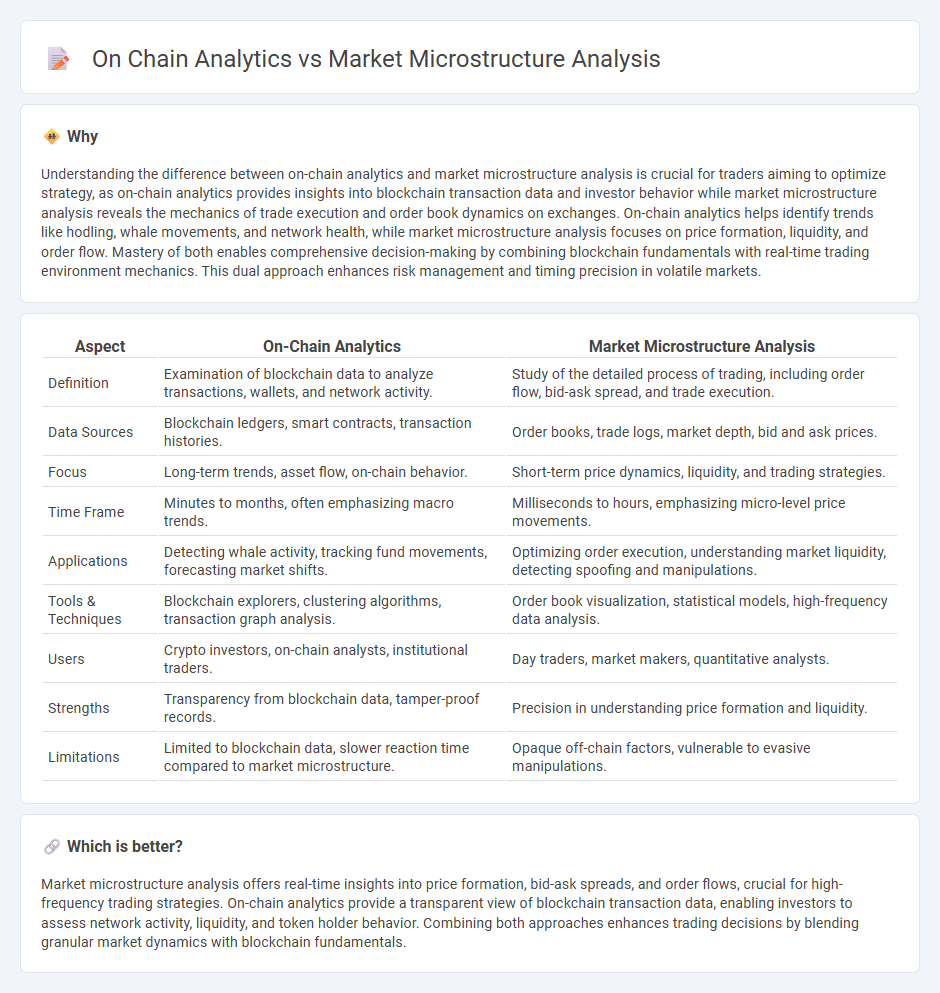

Understanding the difference between on-chain analytics and market microstructure analysis is crucial for traders aiming to optimize strategy, as on-chain analytics provides insights into blockchain transaction data and investor behavior while market microstructure analysis reveals the mechanics of trade execution and order book dynamics on exchanges. On-chain analytics helps identify trends like hodling, whale movements, and network health, while market microstructure analysis focuses on price formation, liquidity, and order flow. Mastery of both enables comprehensive decision-making by combining blockchain fundamentals with real-time trading environment mechanics. This dual approach enhances risk management and timing precision in volatile markets.

Comparison Table

| Aspect | On-Chain Analytics | Market Microstructure Analysis |

|---|---|---|

| Definition | Examination of blockchain data to analyze transactions, wallets, and network activity. | Study of the detailed process of trading, including order flow, bid-ask spread, and trade execution. |

| Data Sources | Blockchain ledgers, smart contracts, transaction histories. | Order books, trade logs, market depth, bid and ask prices. |

| Focus | Long-term trends, asset flow, on-chain behavior. | Short-term price dynamics, liquidity, and trading strategies. |

| Time Frame | Minutes to months, often emphasizing macro trends. | Milliseconds to hours, emphasizing micro-level price movements. |

| Applications | Detecting whale activity, tracking fund movements, forecasting market shifts. | Optimizing order execution, understanding market liquidity, detecting spoofing and manipulations. |

| Tools & Techniques | Blockchain explorers, clustering algorithms, transaction graph analysis. | Order book visualization, statistical models, high-frequency data analysis. |

| Users | Crypto investors, on-chain analysts, institutional traders. | Day traders, market makers, quantitative analysts. |

| Strengths | Transparency from blockchain data, tamper-proof records. | Precision in understanding price formation and liquidity. |

| Limitations | Limited to blockchain data, slower reaction time compared to market microstructure. | Opaque off-chain factors, vulnerable to evasive manipulations. |

Which is better?

Market microstructure analysis offers real-time insights into price formation, bid-ask spreads, and order flows, crucial for high-frequency trading strategies. On-chain analytics provide a transparent view of blockchain transaction data, enabling investors to assess network activity, liquidity, and token holder behavior. Combining both approaches enhances trading decisions by blending granular market dynamics with blockchain fundamentals.

Connection

On-chain analytics provide real-time blockchain data such as transaction volumes and wallet activities, which reveal trader behavior and liquidity patterns essential for market microstructure analysis. Market microstructure examines order flow, bid-ask spreads, and price formation mechanisms that are directly influenced by the underlying on-chain transaction dynamics. Integrating both methods enhances predictive accuracy of price movements and improves trading strategies by capturing granular market signals.

Key Terms

**Market Microstructure Analysis:**

Market microstructure analysis examines the processes, mechanisms, and dynamics behind trade execution, order flow, and price formation in financial markets, using high-frequency data to understand bid-ask spreads, liquidity, and order book dynamics. This approach provides insights into market behavior, impacts of market participants, and trading strategies by analyzing transaction costs, order types, and market impact. Discover how market microstructure analysis can improve trading decisions, risk management, and market efficiency by exploring its advanced methodologies.

Order Book

Market microstructure analysis examines the order book's bid-ask dynamics, trade execution, and liquidity patterns to understand price formation in traditional financial markets. On-chain analytics focus on blockchain-based order books, tracking real-time transaction flows, decentralized exchange orders, and on-chain liquidity to gauge market sentiment and transparency. Explore deeper insights into how order book structures influence trading strategies and market efficiency in both contexts.

Bid-Ask Spread

Market microstructure analysis examines the bid-ask spread by evaluating order flow, liquidity, and trader behavior in traditional financial markets, revealing insights into price formation and market efficiency. On-chain analytics assess bid-ask spreads in decentralized finance (DeFi) by analyzing transaction data, smart contract interactions, and liquidity pool dynamics on blockchain networks like Ethereum. Explore the nuances of bid-ask spread measurement across these frameworks to enhance trading strategies and market understanding.

Source and External Links

Market microstructure - Wikipedia - Market microstructure is the branch of finance studying how exchanges occur in markets, focusing on the role of trading mechanisms in price formation, transaction costs, liquidity, and regulatory implications like insider trading and market manipulation.

What is Financial Market Microstructure? - Bookmap - This explains how financial markets operate at a fundamental level, including trading exchanges, price discovery, bid-ask spreads, participant behavior, and how technological advances like algorithms impact market volume and order flow.

What is Market Microstructure? - Quantitative Brokers - Market microstructure studies how financial markets work to capture optimal prices and improve portfolio returns, focusing on how information, liquidity, and transaction costs are reflected in price movements and how this guides algorithmic trading strategies.

dowidth.com

dowidth.com