Delta neutral strategy involves balancing positive and negative delta positions to hedge against price movements, reducing market risk while maintaining exposure to other factors like volatility. Mean reversion relies on the assumption that asset prices will revert to their historical average, enabling traders to capitalize on temporary price deviations. Explore the key differences and applications of these strategies to enhance your trading approach.

Why it is important

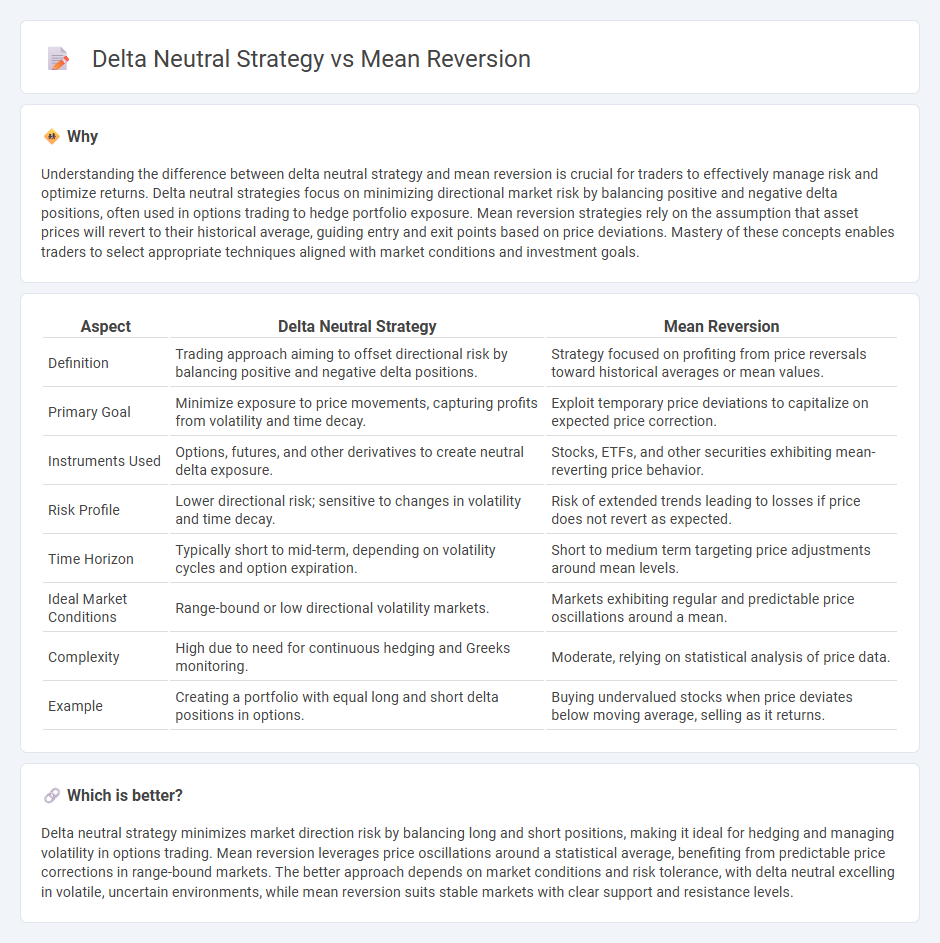

Understanding the difference between delta neutral strategy and mean reversion is crucial for traders to effectively manage risk and optimize returns. Delta neutral strategies focus on minimizing directional market risk by balancing positive and negative delta positions, often used in options trading to hedge portfolio exposure. Mean reversion strategies rely on the assumption that asset prices will revert to their historical average, guiding entry and exit points based on price deviations. Mastery of these concepts enables traders to select appropriate techniques aligned with market conditions and investment goals.

Comparison Table

| Aspect | Delta Neutral Strategy | Mean Reversion |

|---|---|---|

| Definition | Trading approach aiming to offset directional risk by balancing positive and negative delta positions. | Strategy focused on profiting from price reversals toward historical averages or mean values. |

| Primary Goal | Minimize exposure to price movements, capturing profits from volatility and time decay. | Exploit temporary price deviations to capitalize on expected price correction. |

| Instruments Used | Options, futures, and other derivatives to create neutral delta exposure. | Stocks, ETFs, and other securities exhibiting mean-reverting price behavior. |

| Risk Profile | Lower directional risk; sensitive to changes in volatility and time decay. | Risk of extended trends leading to losses if price does not revert as expected. |

| Time Horizon | Typically short to mid-term, depending on volatility cycles and option expiration. | Short to medium term targeting price adjustments around mean levels. |

| Ideal Market Conditions | Range-bound or low directional volatility markets. | Markets exhibiting regular and predictable price oscillations around a mean. |

| Complexity | High due to need for continuous hedging and Greeks monitoring. | Moderate, relying on statistical analysis of price data. |

| Example | Creating a portfolio with equal long and short delta positions in options. | Buying undervalued stocks when price deviates below moving average, selling as it returns. |

Which is better?

Delta neutral strategy minimizes market direction risk by balancing long and short positions, making it ideal for hedging and managing volatility in options trading. Mean reversion leverages price oscillations around a statistical average, benefiting from predictable price corrections in range-bound markets. The better approach depends on market conditions and risk tolerance, with delta neutral excelling in volatile, uncertain environments, while mean reversion suits stable markets with clear support and resistance levels.

Connection

Delta neutral strategies involve balancing a portfolio so that its overall delta is zero, minimizing exposure to directional price movements in underlying assets. Mean reversion trading capitalizes on the tendency of asset prices to revert to their historical averages, providing signals for entry and exit points. Combining these approaches allows traders to hedge directional risk while exploiting price deviations from mean values, enhancing risk-adjusted returns.

Key Terms

**Mean Reversion:**

Mean reversion strategy capitalizes on the tendency of asset prices to revert to their historical average or mean, making it effective in markets with cyclical price fluctuations. Traders identify overbought or oversold conditions using technical indicators such as Bollinger Bands, RSI, or moving averages, allowing for timely entry and exit points. Discover how mean reversion strategies can optimize your trading portfolio by exploring key examples and performance metrics.

Statistical Arbitrage

Mean reversion strategies exploit the tendency of asset prices to revert to their historical averages, making profits by identifying and trading deviations from the mean. Delta neutral strategies, on the other hand, aim to hedge directional risk by balancing positions so that overall delta--the sensitivity to price changes--is zero, allowing traders to capitalize on volatility and time decay. Explore more about how combining mean reversion and delta neutral principles can enhance statistical arbitrage performance.

Z-score

Mean reversion strategies rely on the Z-score to identify when an asset's price deviates significantly from its historical average, signaling a potential return to the mean. Delta neutral strategies, often used in options trading, involve balancing positive and negative deltas to create a portfolio insensitive to small price movements while leveraging the Z-score to adjust hedge ratios or entry points. Explore detailed insights on how integrating Z-score enhances both mean reversion and delta neutral approaches for optimized trading performance.

Source and External Links

Mean Reversion Strategies: Introduction, Trading, Strategies and More - Mean reversion is a financial theory stating that asset prices and returns tend to revert to their historical average, with trading strategies focused on identifying when prices deviate significantly from this mean to generate buy or sell signals.

Mean reversion (finance) - Wikipedia - Mean reversion assumes that asset prices converge to their average over time, and this principle underpins trading strategies that buy when prices fall below the average and sell when prices rise above it.

Mean Reversion - Overview, Trading, Impact of Catalysts - Mean reversion implies asset prices and returns move toward their long-term mean, and traders use this theory to exploit deviations through statistical analysis and trading strategies involving buying below and selling above the mean.

dowidth.com

dowidth.com