High frequency trading bots execute thousands of orders per second using advanced algorithms to capitalize on minute market fluctuations, maximizing short-term profits with minimal human intervention. Copy trading allows investors to replicate the trades of experienced traders in real time, providing a more accessible and hands-off approach to market participation. Explore the distinct advantages and risks of these strategies to enhance your trading decisions.

Why it is important

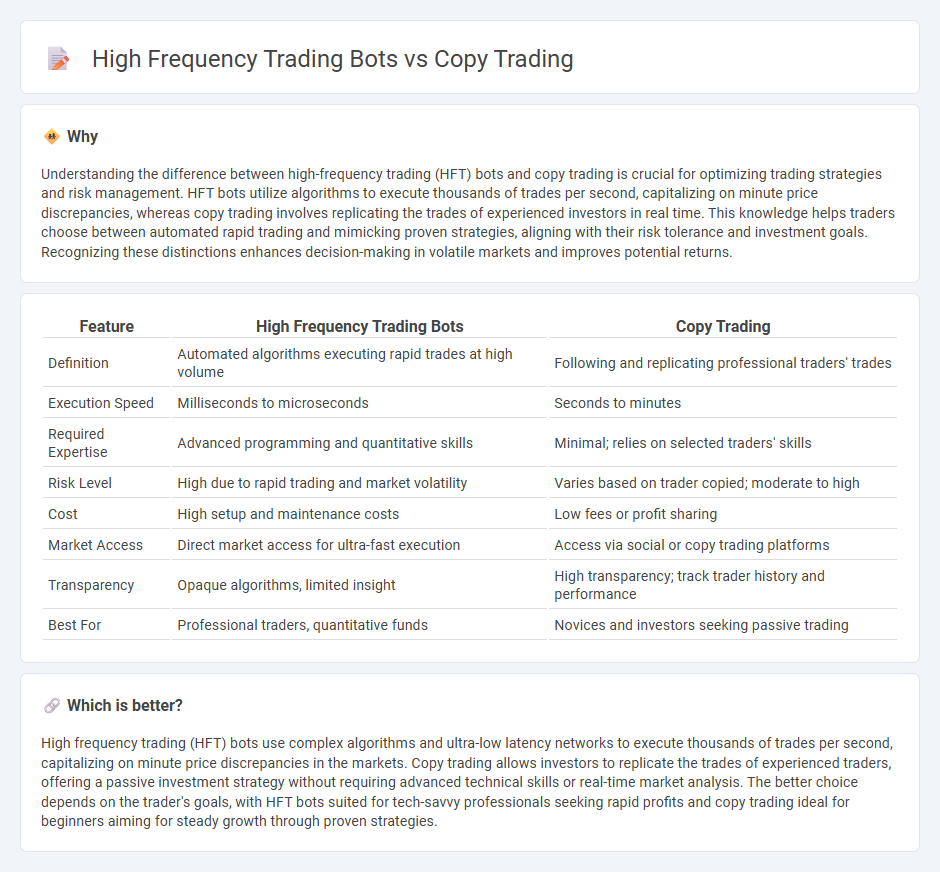

Understanding the difference between high-frequency trading (HFT) bots and copy trading is crucial for optimizing trading strategies and risk management. HFT bots utilize algorithms to execute thousands of trades per second, capitalizing on minute price discrepancies, whereas copy trading involves replicating the trades of experienced investors in real time. This knowledge helps traders choose between automated rapid trading and mimicking proven strategies, aligning with their risk tolerance and investment goals. Recognizing these distinctions enhances decision-making in volatile markets and improves potential returns.

Comparison Table

| Feature | High Frequency Trading Bots | Copy Trading |

|---|---|---|

| Definition | Automated algorithms executing rapid trades at high volume | Following and replicating professional traders' trades |

| Execution Speed | Milliseconds to microseconds | Seconds to minutes |

| Required Expertise | Advanced programming and quantitative skills | Minimal; relies on selected traders' skills |

| Risk Level | High due to rapid trading and market volatility | Varies based on trader copied; moderate to high |

| Cost | High setup and maintenance costs | Low fees or profit sharing |

| Market Access | Direct market access for ultra-fast execution | Access via social or copy trading platforms |

| Transparency | Opaque algorithms, limited insight | High transparency; track trader history and performance |

| Best For | Professional traders, quantitative funds | Novices and investors seeking passive trading |

Which is better?

High frequency trading (HFT) bots use complex algorithms and ultra-low latency networks to execute thousands of trades per second, capitalizing on minute price discrepancies in the markets. Copy trading allows investors to replicate the trades of experienced traders, offering a passive investment strategy without requiring advanced technical skills or real-time market analysis. The better choice depends on the trader's goals, with HFT bots suited for tech-savvy professionals seeking rapid profits and copy trading ideal for beginners aiming for steady growth through proven strategies.

Connection

High frequency trading bots execute rapid, algorithm-driven trades using advanced technology to exploit market inefficiencies, while copy trading allows investors to replicate the strategies of successful traders, often including those utilizing high frequency techniques. Both methods rely on automation and data analysis to maximize trading efficiency and returns. The integration of these strategies enables users to leverage sophisticated algorithms without developing their own systems.

Key Terms

Signal provider

Signal providers in copy trading deliver curated trade ideas based on market analysis, enabling followers to replicate strategies with minimal effort. High-frequency trading bots employ sophisticated algorithms to execute numerous trades at lightning speed, prioritizing volume and execution efficiency over individual signal clarity. Discover the distinct advantages of signal providers and their impact on trading success.

Latency

Latency critically impacts high frequency trading (HFT) bots by determining the speed at which they execute trades, often measured in microseconds to maximize profit margins from minute price fluctuations. Copy trading, however, operates on longer latencies as it replicates trades from selected experts, emphasizing strategy over raw speed and benefiting from social trading networks and user trust. Discover how latency influences performance and decision-making in these trading methods to optimize your investment approach.

Automation

Copy trading leverages automation by replicating the trades of experienced investors in real-time, allowing users to benefit from proven strategies without constant monitoring. High frequency trading (HFT) bots utilize advanced algorithms and ultra-low latency systems to execute thousands of trades per second, capitalizing on minute market inefficiencies. Explore deeper insights into how automated trading systems reshape modern financial markets.

Source and External Links

Copy trading - Wikipedia - Copy trading enables individuals to automatically duplicate the trades of selected investors, linking a portion of their funds to the copied trader's account so that all subsequent trading actions are simultaneously executed proportionally in their own account, offering a form of delegated portfolio management known as People-Based Portfolios.

Copy Trading | Copy the Best Traders in 2025 | AvaTrade - Copy trading allows less experienced traders to automatically replicate the trades of skilled traders, providing a hands-off way to participate in markets by choosing leads based on performance, risk, and trading style, and is distinct from mirror trading and social trading because it copies individual trader behaviors with some customization.

What is Copy Trading, How Does it Work and How to ... - PrimeXBT - Copy trading is an automated investment method where you follow and replicate the trades of experienced traders by allocating capital to them, enabling novices and busy traders to engage in markets without deep analysis, with platforms allowing filtering of traders and risk customization per trade.

dowidth.com

dowidth.com