Liquidity sweeps involve aggressively targeting and executing large orders to quickly consume available liquidity across multiple price levels, often impacting market depth by removing significant volumes from order books. Market depth displays the cumulative quantity of buy and sell orders at various price points, reflecting the supply and demand balance that traders use to gauge potential price movements. Explore more to understand how liquidity sweeps influence market depth and trading strategies.

Why it is important

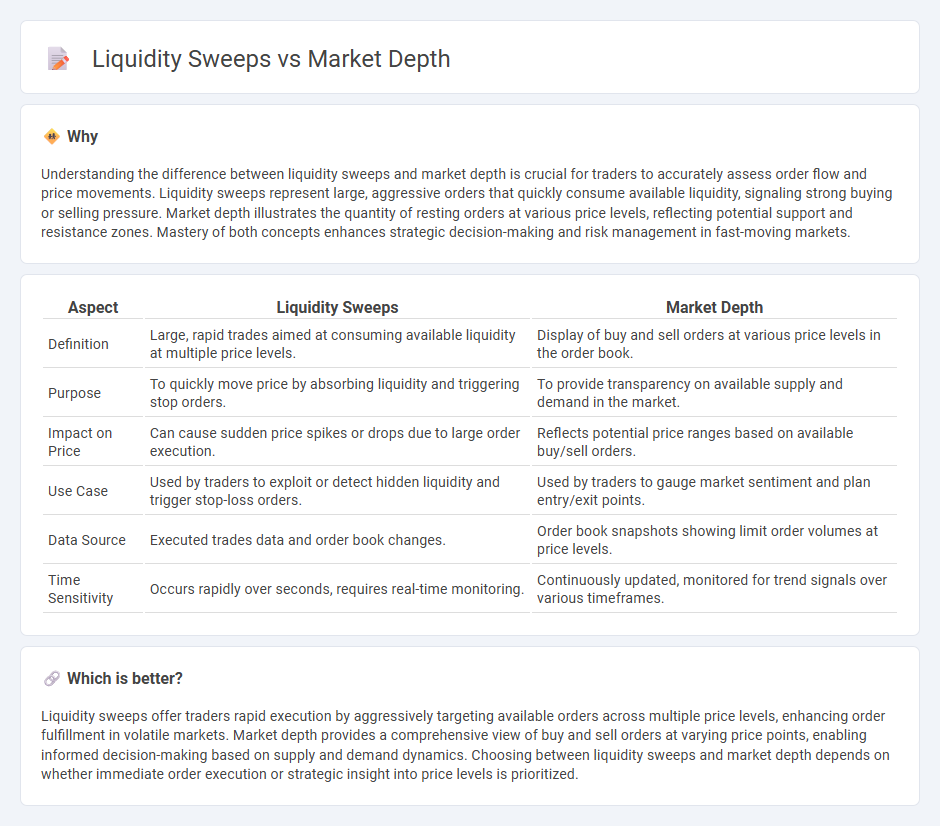

Understanding the difference between liquidity sweeps and market depth is crucial for traders to accurately assess order flow and price movements. Liquidity sweeps represent large, aggressive orders that quickly consume available liquidity, signaling strong buying or selling pressure. Market depth illustrates the quantity of resting orders at various price levels, reflecting potential support and resistance zones. Mastery of both concepts enhances strategic decision-making and risk management in fast-moving markets.

Comparison Table

| Aspect | Liquidity Sweeps | Market Depth |

|---|---|---|

| Definition | Large, rapid trades aimed at consuming available liquidity at multiple price levels. | Display of buy and sell orders at various price levels in the order book. |

| Purpose | To quickly move price by absorbing liquidity and triggering stop orders. | To provide transparency on available supply and demand in the market. |

| Impact on Price | Can cause sudden price spikes or drops due to large order execution. | Reflects potential price ranges based on available buy/sell orders. |

| Use Case | Used by traders to exploit or detect hidden liquidity and trigger stop-loss orders. | Used by traders to gauge market sentiment and plan entry/exit points. |

| Data Source | Executed trades data and order book changes. | Order book snapshots showing limit order volumes at price levels. |

| Time Sensitivity | Occurs rapidly over seconds, requires real-time monitoring. | Continuously updated, monitored for trend signals over various timeframes. |

Which is better?

Liquidity sweeps offer traders rapid execution by aggressively targeting available orders across multiple price levels, enhancing order fulfillment in volatile markets. Market depth provides a comprehensive view of buy and sell orders at varying price points, enabling informed decision-making based on supply and demand dynamics. Choosing between liquidity sweeps and market depth depends on whether immediate order execution or strategic insight into price levels is prioritized.

Connection

Liquidity sweeps occur when large orders consume available liquidity across multiple price levels, directly impacting market depth by reducing the quantity of buy and sell orders at each level. Market depth reflects the supply and demand at various prices, influencing how quickly liquidity sweeps can move prices and trigger stop-loss orders. Understanding the dynamic between liquidity sweeps and market depth is crucial for traders aiming to anticipate price volatility and optimize order execution.

Key Terms

Order Book

Market depth shows the volume of buy and sell orders across different price levels in the order book, reflecting the market's capacity to absorb large trades without significant price changes. Liquidity sweeps occur when aggressive orders rapidly consume these resting limit orders, causing immediate price shifts and testing hidden liquidity. Explore how analyzing order book dynamics between market depth and liquidity sweeps can enhance trading strategies.

Bid-Ask Spread

Market depth reveals the volume of buy and sell orders at various price levels, indicating liquidity availability and the tightness of the bid-ask spread. Liquidity sweeps occur when large market orders consume these depths, causing rapid price changes and temporary bid-ask spread widening. Explore deeper insights on how bid-ask spread dynamics influence trading strategies and market behavior.

Slippage

Market depth reflects the volume of buy and sell orders at various price levels, directly influencing liquidity and price stability during trades. Liquidity sweeps occur when large market orders absorb liquidity across multiple price points, often causing significant slippage--the difference between expected and executed trade prices. Explore how understanding market depth and liquidity sweeps can minimize slippage and improve trade execution efficiency.

Source and External Links

Market Depth - Definition, How It's Used, Examples - Market depth is the ability of a market to sustain large orders without significantly affecting the security's price, reflecting the number of shares available at various price levels in the limit order book and indicating market liquidity.

Depth of market (DOM): what it is and how traders can use it - Depth of market is a tool showing the number of buy and sell orders at different prices, helping traders understand supply and demand and assess market liquidity through the order book.

Market Depth | IBKR Glossary - Market depth describes a market's capacity to absorb large securities orders without noticeably impacting price, and trading platforms often display this via tools showing bids and offers beyond the top quote to gauge liquidity.

dowidth.com

dowidth.com