Order flow analysis offers real-time insights into market liquidity and participant behavior by examining the actual transactions and order book dynamics, providing traders with precise entry and exit timing. The Wyckoff method, developed by Richard D. Wyckoff, focuses on understanding market cycles and supply-demand imbalances through price action, volume patterns, and phases of accumulation and distribution. Explore in-depth comparisons to determine which strategy aligns best with your trading objectives and style.

Why it is important

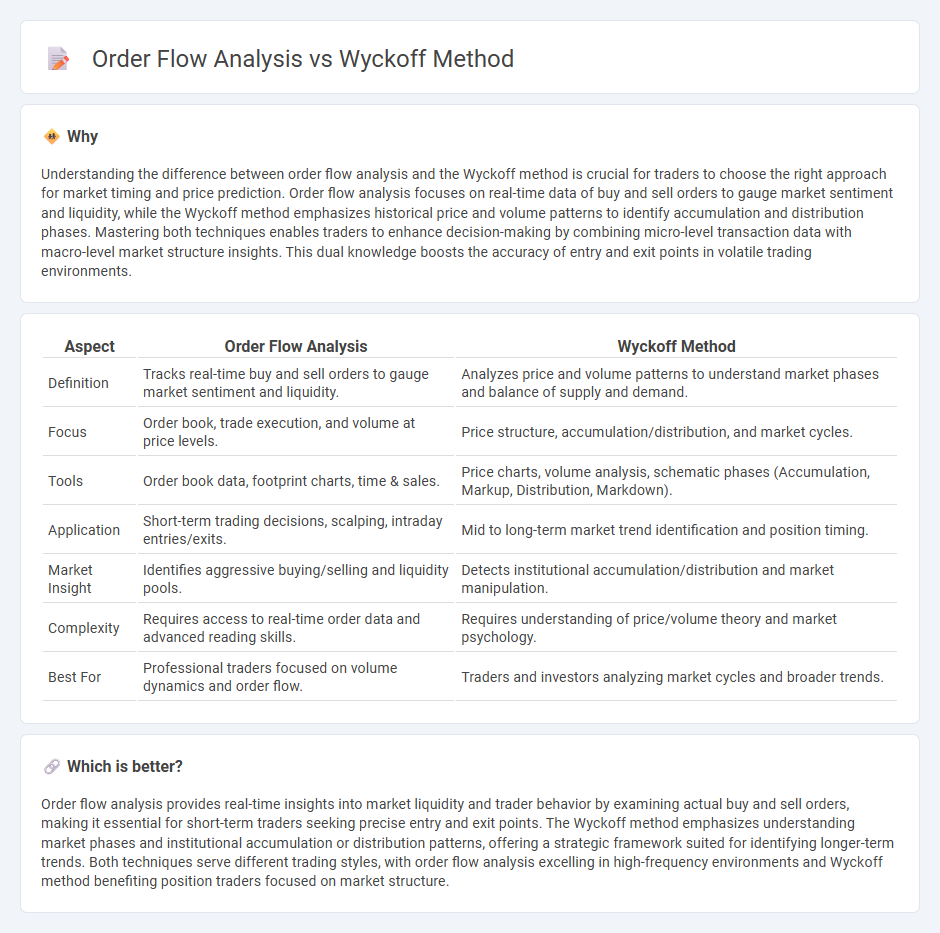

Understanding the difference between order flow analysis and the Wyckoff method is crucial for traders to choose the right approach for market timing and price prediction. Order flow analysis focuses on real-time data of buy and sell orders to gauge market sentiment and liquidity, while the Wyckoff method emphasizes historical price and volume patterns to identify accumulation and distribution phases. Mastering both techniques enables traders to enhance decision-making by combining micro-level transaction data with macro-level market structure insights. This dual knowledge boosts the accuracy of entry and exit points in volatile trading environments.

Comparison Table

| Aspect | Order Flow Analysis | Wyckoff Method |

|---|---|---|

| Definition | Tracks real-time buy and sell orders to gauge market sentiment and liquidity. | Analyzes price and volume patterns to understand market phases and balance of supply and demand. |

| Focus | Order book, trade execution, and volume at price levels. | Price structure, accumulation/distribution, and market cycles. |

| Tools | Order book data, footprint charts, time & sales. | Price charts, volume analysis, schematic phases (Accumulation, Markup, Distribution, Markdown). |

| Application | Short-term trading decisions, scalping, intraday entries/exits. | Mid to long-term market trend identification and position timing. |

| Market Insight | Identifies aggressive buying/selling and liquidity pools. | Detects institutional accumulation/distribution and market manipulation. |

| Complexity | Requires access to real-time order data and advanced reading skills. | Requires understanding of price/volume theory and market psychology. |

| Best For | Professional traders focused on volume dynamics and order flow. | Traders and investors analyzing market cycles and broader trends. |

Which is better?

Order flow analysis provides real-time insights into market liquidity and trader behavior by examining actual buy and sell orders, making it essential for short-term traders seeking precise entry and exit points. The Wyckoff method emphasizes understanding market phases and institutional accumulation or distribution patterns, offering a strategic framework suited for identifying longer-term trends. Both techniques serve different trading styles, with order flow analysis excelling in high-frequency environments and Wyckoff method benefiting position traders focused on market structure.

Connection

Order flow analysis and the Wyckoff method are interconnected through their shared emphasis on understanding market supply and demand dynamics. Order flow analysis provides real-time data on buy and sell orders, which complements Wyckoff's principles of market phases and price manipulation by large operators. Traders integrating both techniques can enhance their insight into price action, improving entry and exit timing in trading strategies.

Key Terms

Wyckoff Method:

The Wyckoff Method centers on understanding market structure through supply and demand dynamics, focusing on price and volume patterns to identify accumulation and distribution phases. It emphasizes key concepts like the Composite Man, trading ranges, and price cycles to anticipate market turning points. Explore deeper insights into how the Wyckoff Method can enhance your trading strategy.

Accumulation/Distribution

The Wyckoff Method emphasizes price patterns and volume to identify accumulation and distribution phases, highlighting the intentions of large market participants through price and volume analysis. Order flow analysis concentrates on real-time market orders, tracking liquidity and buying or selling pressure to reveal the precise timing of accumulation and distribution events. Explore deeper insights into how these methods complement each other in trading strategies.

Price Cycle Phases

The Wyckoff method emphasizes understanding the Price Cycle Phases--Accumulation, Markup, Distribution, and Markdown--to identify market trends and potential reversal points based on supply and demand dynamics. Order flow analysis concentrates on real-time transaction data, such as volume and bid-ask imbalances, providing granular insight into market participant behavior within those phases. Explore deeper comparisons between Wyckoff Price Cycle Phases and order flow metrics to enhance trading precision and timing strategies.

Source and External Links

The Wyckoff Method: What It Is and How You Can Trade It - The Wyckoff Method is a classic technical analysis system developed by Richard D. Wyckoff that uses price and volume to understand market behavior, identify trends, and find optimal trading entry and exit points based on supply and demand forces and smart money liquidity strategies.

Wyckoff Theory For Beginners (The Definitive Guide) - This method explains market movements by three laws--Supply and Demand, Cause and Effect, and Effort versus Result--and uses cycles to help traders predict price direction by analyzing price changes, volume, and market trend patterns.

The Simplified Guide To Trading With The Wyckoff Method - Wyckoff identified four main market cycle stages--accumulation, markup, distribution, and markdown--describing how "smart money" accumulates positions after downtrends and the price behavior in each phase, providing insight into trend developments through Wyckoff's framework.

dowidth.com

dowidth.com