High-frequency scalp bots execute numerous rapid trades to capitalize on small price fluctuations, leveraging advanced algorithms and real-time data for instant decision-making. Swing trading algorithms focus on capturing larger, short- to medium-term price movements by analyzing trends and market momentum over hours or days. Explore the intricacies of these trading strategies to optimize your investment approach.

Why it is important

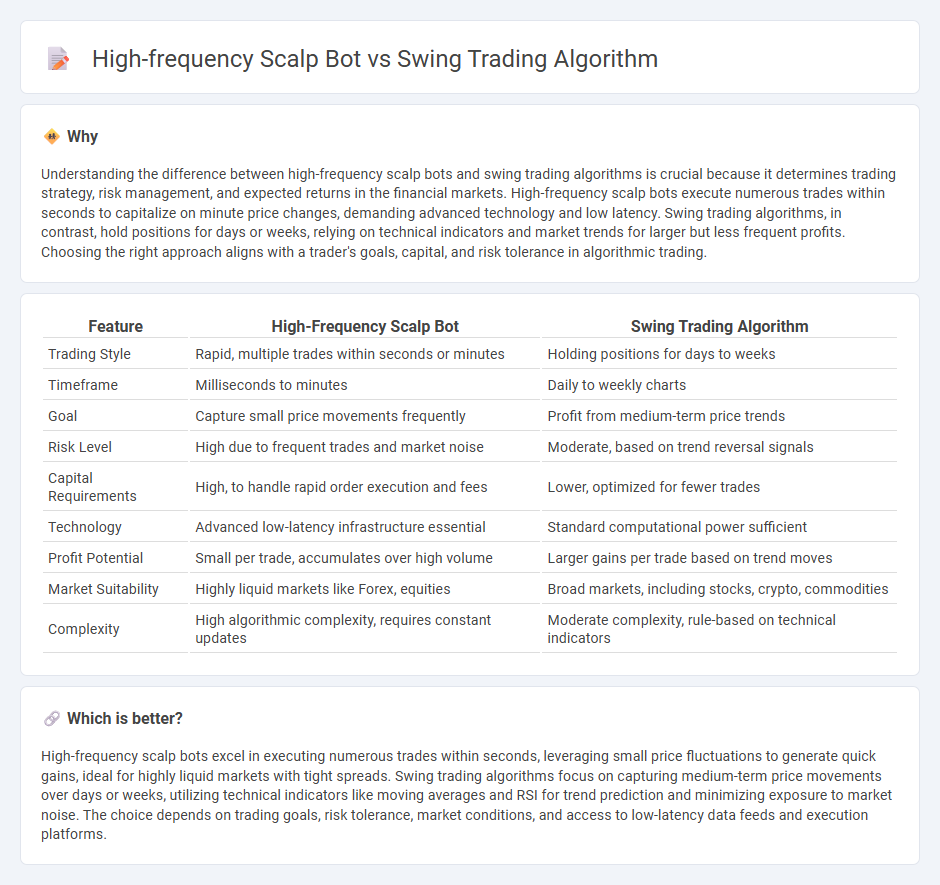

Understanding the difference between high-frequency scalp bots and swing trading algorithms is crucial because it determines trading strategy, risk management, and expected returns in the financial markets. High-frequency scalp bots execute numerous trades within seconds to capitalize on minute price changes, demanding advanced technology and low latency. Swing trading algorithms, in contrast, hold positions for days or weeks, relying on technical indicators and market trends for larger but less frequent profits. Choosing the right approach aligns with a trader's goals, capital, and risk tolerance in algorithmic trading.

Comparison Table

| Feature | High-Frequency Scalp Bot | Swing Trading Algorithm |

|---|---|---|

| Trading Style | Rapid, multiple trades within seconds or minutes | Holding positions for days to weeks |

| Timeframe | Milliseconds to minutes | Daily to weekly charts |

| Goal | Capture small price movements frequently | Profit from medium-term price trends |

| Risk Level | High due to frequent trades and market noise | Moderate, based on trend reversal signals |

| Capital Requirements | High, to handle rapid order execution and fees | Lower, optimized for fewer trades |

| Technology | Advanced low-latency infrastructure essential | Standard computational power sufficient |

| Profit Potential | Small per trade, accumulates over high volume | Larger gains per trade based on trend moves |

| Market Suitability | Highly liquid markets like Forex, equities | Broad markets, including stocks, crypto, commodities |

| Complexity | High algorithmic complexity, requires constant updates | Moderate complexity, rule-based on technical indicators |

Which is better?

High-frequency scalp bots excel in executing numerous trades within seconds, leveraging small price fluctuations to generate quick gains, ideal for highly liquid markets with tight spreads. Swing trading algorithms focus on capturing medium-term price movements over days or weeks, utilizing technical indicators like moving averages and RSI for trend prediction and minimizing exposure to market noise. The choice depends on trading goals, risk tolerance, market conditions, and access to low-latency data feeds and execution platforms.

Connection

High-frequency scalp bots and swing trading algorithms both utilize automated strategies to exploit market inefficiencies but operate on different time horizons; scalp bots execute numerous rapid trades within seconds or minutes, while swing algorithms target price movements over days or weeks. Both rely on advanced quantitative models and real-time data analysis to optimize entry and exit points, enhancing trade precision and profitability. Integration of scalp bot signals can inform swing algorithms about short-term momentum shifts, creating synergy between ultra-short-term and medium-term trading strategies.

Key Terms

Timeframe

Swing trading algorithms operate on longer timeframes, typically holding positions for days or weeks to capture medium-term market trends. High-frequency scalp bots execute trades within seconds or milliseconds, capitalizing on small price fluctuations in ultra-short timeframes. Explore in-depth comparisons to understand which strategy aligns best with your trading goals and risk tolerance.

Trade Frequency

Swing trading algorithms typically execute trades over multiple days or weeks, aiming to capture medium-term market trends with lower trade frequency and reduced transaction costs. High-frequency scalp bots operate on ultra-short timeframes, executing dozens to hundreds of trades per minute to exploit minimal price fluctuations and capitalize on market microstructure inefficiencies. Discover the advantages and trade frequency dynamics of both strategies to enhance your trading approach.

Order Execution Speed

Swing trading algorithms prioritize capturing price trends over several days, relying on moderate order execution speed to enter and exit trades effectively, while high-frequency scalp bots demand ultra-low latency systems to execute thousands of trades per second and capitalize on minute price discrepancies. Execution speed in high-frequency scalp bots directly impacts profitability and risk management, requiring cutting-edge technology such as FPGA-based co-processors or colocated servers in exchange data centers. Explore detailed performance comparisons and technology benchmarks to understand the critical role of order execution speed in these trading strategies.

Source and External Links

Swing Trading - MATLAB & Simulink - MathWorks - Swing trading is a rule-based strategy to capture short-term trends over 2 to 5 days, often implemented algorithmically using technical or fundamental indicators like MACD, RSI, or moving averages to generate signals and orders.

Building a Simple Swing Trading Strategy in Python Step ... - YouTube - Demonstrates a step-by-step Python implementation of a swing trading algorithm using Exponential Moving Average (EMA) crossover for buy/sell signals based on Nifty50 data, converting signals into buy (1) and sell (0) integer values for automation.

Simple SWING trading strategy using EMAs in Python ... - YouTube - Walks through a Python swing trading strategy using three EMAs (period 21, 50, 100) to identify trend direction and generate long/short signals, including logic for dynamic stop-loss and trailing stops to maximize trend capture.

dowidth.com

dowidth.com