Tape reading involves analyzing real-time stock price and volume data to predict short-term market movements, providing traders with a direct insight into supply and demand dynamics. Arbitrage exploits price discrepancies of the same asset across different markets to generate risk-free profits through simultaneous buying and selling. Discover how mastering tape reading and arbitrage strategies can enhance your trading performance.

Why it is important

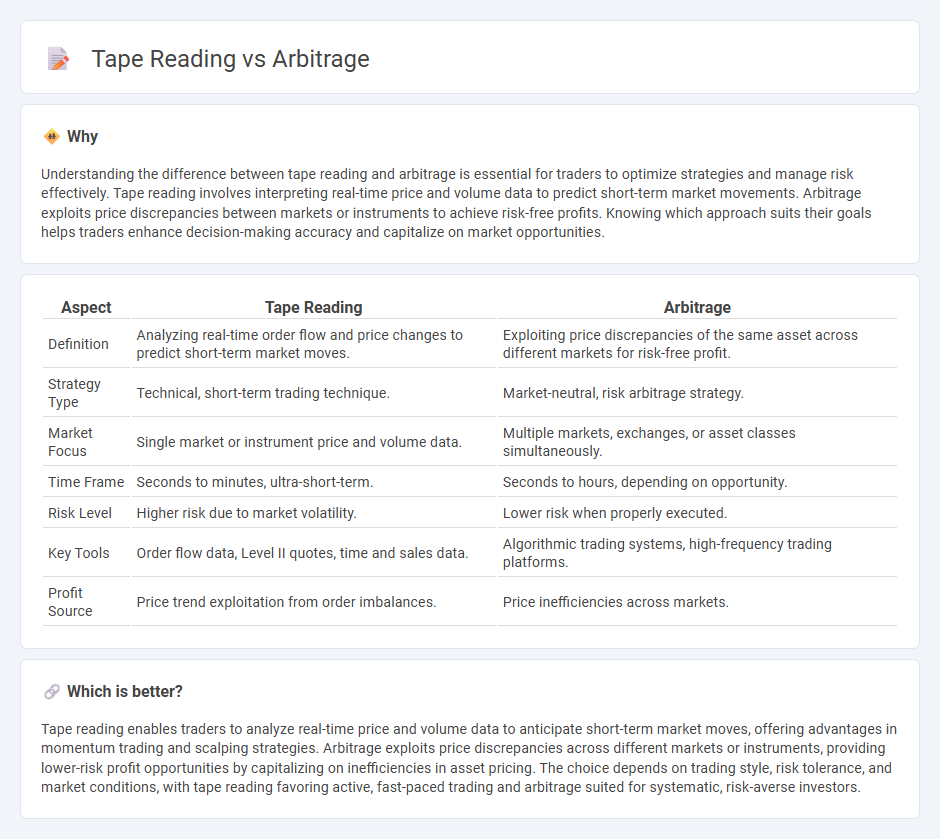

Understanding the difference between tape reading and arbitrage is essential for traders to optimize strategies and manage risk effectively. Tape reading involves interpreting real-time price and volume data to predict short-term market movements. Arbitrage exploits price discrepancies between markets or instruments to achieve risk-free profits. Knowing which approach suits their goals helps traders enhance decision-making accuracy and capitalize on market opportunities.

Comparison Table

| Aspect | Tape Reading | Arbitrage |

|---|---|---|

| Definition | Analyzing real-time order flow and price changes to predict short-term market moves. | Exploiting price discrepancies of the same asset across different markets for risk-free profit. |

| Strategy Type | Technical, short-term trading technique. | Market-neutral, risk arbitrage strategy. |

| Market Focus | Single market or instrument price and volume data. | Multiple markets, exchanges, or asset classes simultaneously. |

| Time Frame | Seconds to minutes, ultra-short-term. | Seconds to hours, depending on opportunity. |

| Risk Level | Higher risk due to market volatility. | Lower risk when properly executed. |

| Key Tools | Order flow data, Level II quotes, time and sales data. | Algorithmic trading systems, high-frequency trading platforms. |

| Profit Source | Price trend exploitation from order imbalances. | Price inefficiencies across markets. |

Which is better?

Tape reading enables traders to analyze real-time price and volume data to anticipate short-term market moves, offering advantages in momentum trading and scalping strategies. Arbitrage exploits price discrepancies across different markets or instruments, providing lower-risk profit opportunities by capitalizing on inefficiencies in asset pricing. The choice depends on trading style, risk tolerance, and market conditions, with tape reading favoring active, fast-paced trading and arbitrage suited for systematic, risk-averse investors.

Connection

Tape reading involves analyzing real-time price and volume data from the stock ticker tape to detect market trends and trading opportunities. Arbitrage exploits price discrepancies across different markets or instruments, relying heavily on rapid, accurate information from tape reading to identify and execute profitable trades quickly. Efficient tape reading enhances arbitrage strategies by providing critical insights into supply-demand imbalances and price movements in milliseconds.

Key Terms

**Arbitrage:**

Arbitrage exploits price discrepancies across different markets or exchanges to secure risk-free profits, commonly utilized in forex, stocks, and cryptocurrency trading. It involves simultaneous buying and selling of assets to capitalize on varying prices, ensuring gains without market exposure. Explore more insights on how arbitrage strategies optimize financial opportunities.

Price discrepancy

Arbitrage capitalizes on price discrepancies between different markets or exchanges by simultaneously buying low and selling high to secure risk-free profits. Tape reading involves analyzing real-time price and volume data to predict short-term price movements, focusing on market sentiment rather than direct price differences. Explore these strategies in detail to understand how mastering price discrepancy can enhance trading success.

Simultaneous buy/sell

Arbitrage involves simultaneous buying and selling of assets across different markets to exploit price discrepancies, ensuring risk-free profits. Tape reading analyzes real-time ticker data and order flow to predict short-term price movements, often informing rapid buy or sell decisions but not necessarily simultaneously. Explore the nuances of arbitrage versus tape reading to optimize your trading strategies further.

Source and External Links

Arbitrage - Wikipedia - Arbitrage is the practice of capitalizing on the price difference of the same or very similar assets in two or more markets by simultaneously buying low in one and selling high in another, often considered risk-free in academic terms but carrying some risks in practice.

Arbitrage Definition and Meaning - Arbitrage involves buying a product or asset in one market at a lower price and simultaneously selling it in another market at a higher price to profit from market inefficiencies, commonly used in finance, retail, and logistics.

What Is Arbitrage? 3 Strategies to Know - Arbitrage is an investment strategy where investors simultaneously buy and sell the same asset in different markets to exploit price differences, with common types including pure arbitrage, merger arbitrage, and convertible arbitrage.

dowidth.com

dowidth.com