Synthetic positions mimic the payoff of owning the underlying asset by combining options strategies, such as buying a call and selling a put with the same strike price and expiration date, providing traders flexibility with less capital. Covered calls involve holding the underlying asset while selling call options to generate income, balancing risk and reward with potential upside limitation. Discover how these strategies can be tailored to your trading goals for optimized portfolio management.

Why it is important

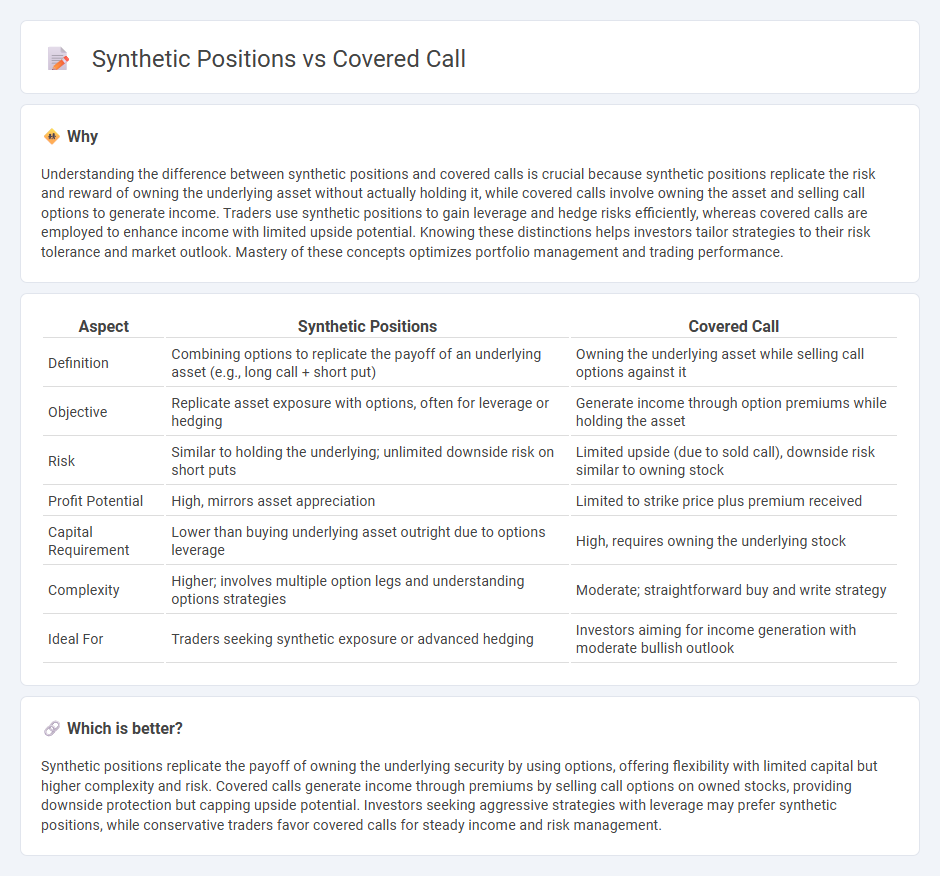

Understanding the difference between synthetic positions and covered calls is crucial because synthetic positions replicate the risk and reward of owning the underlying asset without actually holding it, while covered calls involve owning the asset and selling call options to generate income. Traders use synthetic positions to gain leverage and hedge risks efficiently, whereas covered calls are employed to enhance income with limited upside potential. Knowing these distinctions helps investors tailor strategies to their risk tolerance and market outlook. Mastery of these concepts optimizes portfolio management and trading performance.

Comparison Table

| Aspect | Synthetic Positions | Covered Call |

|---|---|---|

| Definition | Combining options to replicate the payoff of an underlying asset (e.g., long call + short put) | Owning the underlying asset while selling call options against it |

| Objective | Replicate asset exposure with options, often for leverage or hedging | Generate income through option premiums while holding the asset |

| Risk | Similar to holding the underlying; unlimited downside risk on short puts | Limited upside (due to sold call), downside risk similar to owning stock |

| Profit Potential | High, mirrors asset appreciation | Limited to strike price plus premium received |

| Capital Requirement | Lower than buying underlying asset outright due to options leverage | High, requires owning the underlying stock |

| Complexity | Higher; involves multiple option legs and understanding options strategies | Moderate; straightforward buy and write strategy |

| Ideal For | Traders seeking synthetic exposure or advanced hedging | Investors aiming for income generation with moderate bullish outlook |

Which is better?

Synthetic positions replicate the payoff of owning the underlying security by using options, offering flexibility with limited capital but higher complexity and risk. Covered calls generate income through premiums by selling call options on owned stocks, providing downside protection but capping upside potential. Investors seeking aggressive strategies with leverage may prefer synthetic positions, while conservative traders favor covered calls for steady income and risk management.

Connection

Synthetic positions and covered calls are connected through their use of options to replicate or enhance the payoff of owning the underlying asset. Both strategies involve combining options and the underlying asset: synthetic positions replicate long or short stock exposure using call and put options, while covered calls entail holding the underlying stock and selling call options. This strategic connection allows traders to manage risk, generate income, and tailor exposure to market movements effectively.

Key Terms

Option Premium

Covered calls generate option premium by selling call options against owned stock, providing income but capping upside gains. Synthetic positions, such as a long call combined with a short put, replicate stock ownership and option premium exposure with potentially higher leverage and risk. Explore deeper insights into option premium strategies and risk profiles for effective portfolio management.

Underlying Asset

Covered calls involve holding a long position in the underlying asset while selling call options to generate income, effectively capping upside potential but reducing risk. Synthetic positions replicate the payoff of an underlying asset using options strategies, such as combining calls and puts, enabling traders to gain exposure without owning the asset directly. Explore the nuances of how these approaches impact risk, reward, and asset management for deeper insights.

Risk-Reward Profile

Covered calls involve holding the underlying asset while selling call options, offering limited upside potential with moderate risk due to partial downside protection from the premium received. Synthetic positions, created by combining options like long calls and short puts, mimic the payoff of the underlying asset with potentially higher leverage and risk, exposing traders to greater losses if the market moves unfavorably. Explore more insights on how these strategies can align with your risk tolerance and investment goals.

Source and External Links

Covered Calls - A covered call strategy involves owning a futures contract and selling a call option on it to generate income and limit potential losses, capping the upside profit potential in exchange for premium income.

Covered option - A covered call is a financial strategy where the owner of stock sells a call option on it, receiving a premium that limits losses but also caps profits, making it a conservative, bullish strategy.

What Is A Covered Call Options Strategy? - A covered call involves owning stock and selling a call option at a chosen strike price to generate income while limiting risk, suitable even for beginners and often used to enhance returns on existing shares.

dowidth.com

dowidth.com