Liquidity sweeps involve large orders executed to quickly absorb available liquidity at multiple price levels, often signaling informed trading activity. Fat finger trades result from human errors, such as incorrect order sizes or prices, causing unexpected market disruptions and price volatility. Explore further to understand how these distinct trading phenomena impact market behavior and risk management.

Why it is important

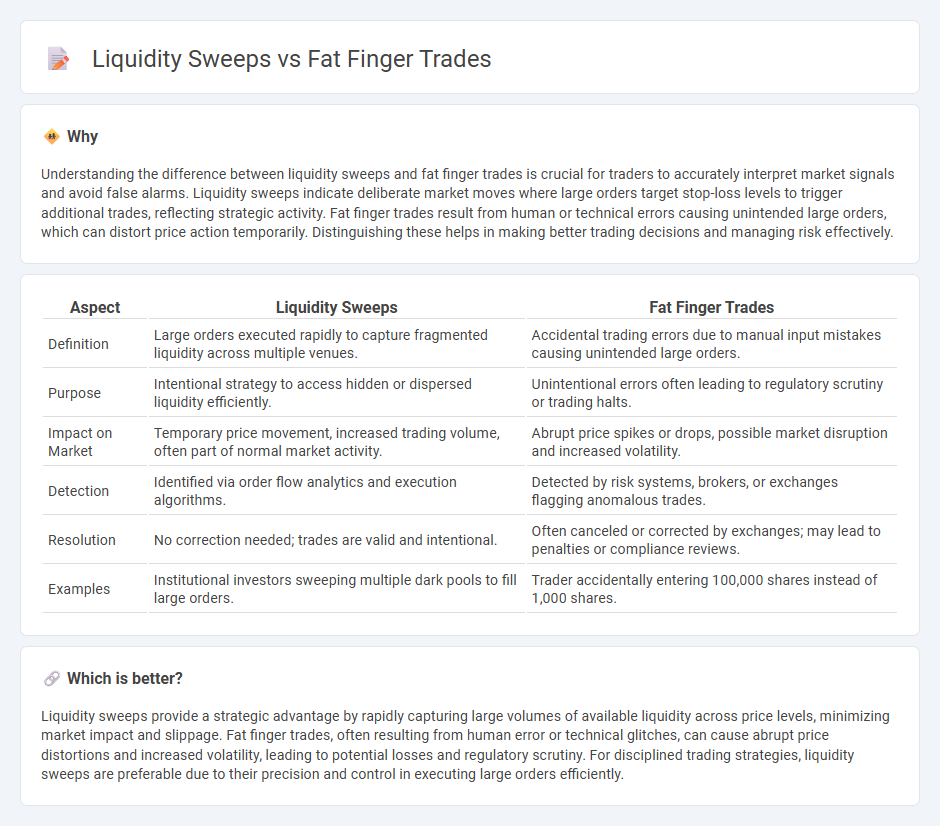

Understanding the difference between liquidity sweeps and fat finger trades is crucial for traders to accurately interpret market signals and avoid false alarms. Liquidity sweeps indicate deliberate market moves where large orders target stop-loss levels to trigger additional trades, reflecting strategic activity. Fat finger trades result from human or technical errors causing unintended large orders, which can distort price action temporarily. Distinguishing these helps in making better trading decisions and managing risk effectively.

Comparison Table

| Aspect | Liquidity Sweeps | Fat Finger Trades |

|---|---|---|

| Definition | Large orders executed rapidly to capture fragmented liquidity across multiple venues. | Accidental trading errors due to manual input mistakes causing unintended large orders. |

| Purpose | Intentional strategy to access hidden or dispersed liquidity efficiently. | Unintentional errors often leading to regulatory scrutiny or trading halts. |

| Impact on Market | Temporary price movement, increased trading volume, often part of normal market activity. | Abrupt price spikes or drops, possible market disruption and increased volatility. |

| Detection | Identified via order flow analytics and execution algorithms. | Detected by risk systems, brokers, or exchanges flagging anomalous trades. |

| Resolution | No correction needed; trades are valid and intentional. | Often canceled or corrected by exchanges; may lead to penalties or compliance reviews. |

| Examples | Institutional investors sweeping multiple dark pools to fill large orders. | Trader accidentally entering 100,000 shares instead of 1,000 shares. |

Which is better?

Liquidity sweeps provide a strategic advantage by rapidly capturing large volumes of available liquidity across price levels, minimizing market impact and slippage. Fat finger trades, often resulting from human error or technical glitches, can cause abrupt price distortions and increased volatility, leading to potential losses and regulatory scrutiny. For disciplined trading strategies, liquidity sweeps are preferable due to their precision and control in executing large orders efficiently.

Connection

Liquidity sweeps occur when large market orders rapidly consume resting limit orders across multiple price levels, often triggering significant price movements. Fat finger trades, caused by accidental input errors such as incorrect order size or price, can initiate unexpected liquidity sweeps by suddenly absorbing available liquidity. The interaction between fat finger trades and liquidity sweeps can lead to increased volatility, triggering stop-loss orders and algorithmic reactions in high-frequency trading environments.

Key Terms

Order Entry Error

Fat finger trades result from inadvertent input errors during order entry, often causing unusually large or mispriced orders that impact market dynamics unexpectedly. Liquidity sweeps involve strategically executing multiple orders to capture available liquidity across price levels, designed to optimize execution without unintended input mistakes. Explore the mechanisms differentiating order entry errors and tactical liquidity sweeps to deepen your understanding of market microstructure nuances.

Market Depth

Fat finger trades occur when an erroneous order significantly disturbs market depth by causing sudden and irregular price movements. Liquidity sweeps aggressively remove resting orders across multiple price levels, rapidly depleting market depth to execute large volume trades. Explore in-depth analysis to understand their distinct impacts on order book dynamics and trading strategies.

Slippage

Fat finger trades often cause unexpected large market orders leading to significant slippage due to sudden price impact and reduced price stability. Liquidity sweeps systematically consume order book depth, resulting in slippage as the market adjusts to absorb large trade volumes. Explore the dynamics between fat finger trades and liquidity sweeps to better understand their effects on slippage in trading environments.

Source and External Links

Fat Finger Trade Meaning: What Is It and How Does It Work? - Fat finger trades are accidental orders placed by traders due to input errors, such as entering the wrong price or quantity, often leading to unintended financial losses and market disruptions.

Fat-finger error - Wikipedia - A fat-finger error is a financial market trading mistake caused by keyboard or mouse input errors, resulting in unintended buy or sell orders with potentially significant consequences.

Fat-finger error: Explained | TIOmarkets - Fat-finger errors can trigger sudden market volatility and financial loss for both the trader and the broader market, as erroneous large orders may cause sharp price swings and even reputational damage.

dowidth.com

dowidth.com