Proprietary trading firms demand rigorous skill, capital commitment, and strict performance metrics, making them challenging for many traders to enter. Copy trading offers a lower barrier by allowing investors to mirror experienced traders' strategies without extensive market knowledge. Discover how these trading pathways compare and which suits your financial goals best.

Why it is important

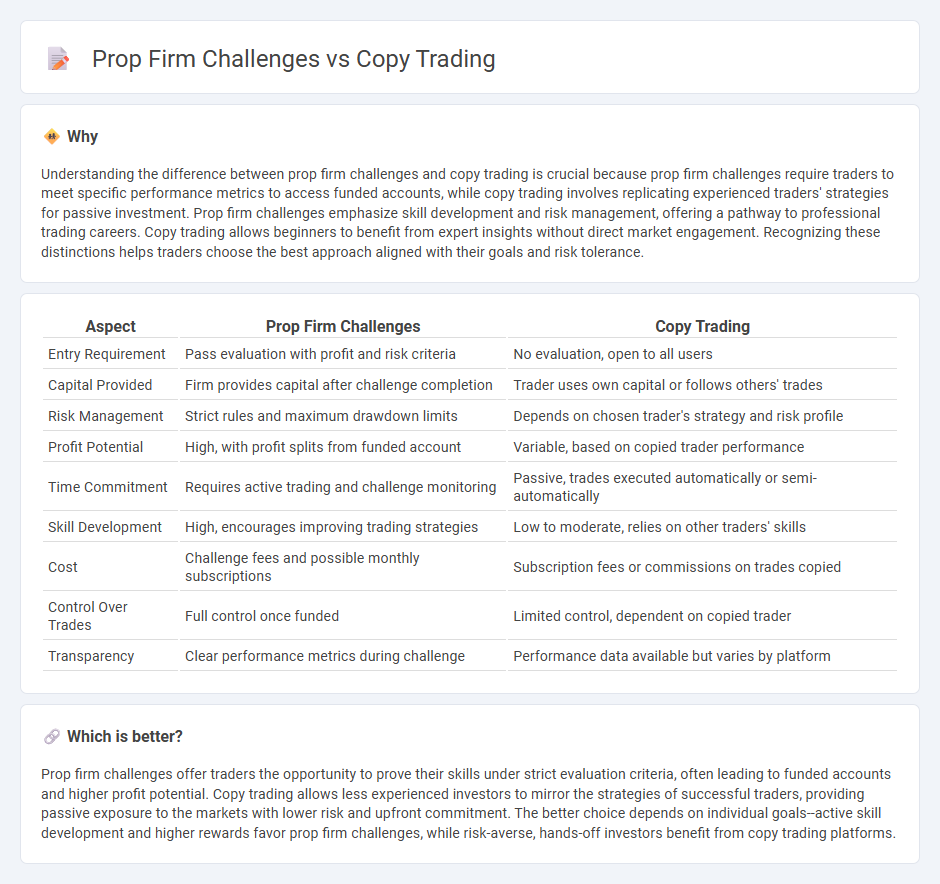

Understanding the difference between prop firm challenges and copy trading is crucial because prop firm challenges require traders to meet specific performance metrics to access funded accounts, while copy trading involves replicating experienced traders' strategies for passive investment. Prop firm challenges emphasize skill development and risk management, offering a pathway to professional trading careers. Copy trading allows beginners to benefit from expert insights without direct market engagement. Recognizing these distinctions helps traders choose the best approach aligned with their goals and risk tolerance.

Comparison Table

| Aspect | Prop Firm Challenges | Copy Trading |

|---|---|---|

| Entry Requirement | Pass evaluation with profit and risk criteria | No evaluation, open to all users |

| Capital Provided | Firm provides capital after challenge completion | Trader uses own capital or follows others' trades |

| Risk Management | Strict rules and maximum drawdown limits | Depends on chosen trader's strategy and risk profile |

| Profit Potential | High, with profit splits from funded account | Variable, based on copied trader performance |

| Time Commitment | Requires active trading and challenge monitoring | Passive, trades executed automatically or semi-automatically |

| Skill Development | High, encourages improving trading strategies | Low to moderate, relies on other traders' skills |

| Cost | Challenge fees and possible monthly subscriptions | Subscription fees or commissions on trades copied |

| Control Over Trades | Full control once funded | Limited control, dependent on copied trader |

| Transparency | Clear performance metrics during challenge | Performance data available but varies by platform |

Which is better?

Prop firm challenges offer traders the opportunity to prove their skills under strict evaluation criteria, often leading to funded accounts and higher profit potential. Copy trading allows less experienced investors to mirror the strategies of successful traders, providing passive exposure to the markets with lower risk and upfront commitment. The better choice depends on individual goals--active skill development and higher rewards favor prop firm challenges, while risk-averse, hands-off investors benefit from copy trading platforms.

Connection

Proprietary firm challenges serve as a gateway for traders to demonstrate their skills and secure capital, directly influencing copy trading platforms by providing vetted, high-performing traders to follow. Copy trading relies on these verified traders from prop firms to offer reliable strategies, enhancing investor confidence and optimizing risk management. This connection fosters a symbiotic ecosystem where prop firm challenges validate trader expertise, which in turn fuels the growth and accuracy of copy trading networks.

Key Terms

**Copy Trading:**

Copy trading offers retail investors direct access to professional trading strategies by mirroring experts' trades, enabling portfolio diversification without deep market knowledge. However, challenges include dependency on the lead trader's performance, potential delays in trade execution, and limited control over risk management settings. Discover how overcoming these hurdles can optimize your copy trading experience.

Signal Provider

Signal providers in copy trading face challenges such as maintaining consistent performance and managing risk across various market conditions, directly impacting followers' returns. Proprietary firms demand rigorous compliance, capital allocation, and performance metrics to validate the trader's strategies before offering funding. Explore detailed comparisons to understand how these factors influence profitability and trader accountability.

Social Trading Platform

Social trading platforms face significant challenges when balancing the transparency required for effective copy trading against the proprietary strategies guarded by prop firms. Copy trading demands real-time data sharing and user trust, which can conflict with prop firms' need to protect their intellectual property and trading algorithms. Explore how social trading platforms navigate these complexities to foster successful environments for both individual traders and professional firms.

Source and External Links

Copy trading - Wikipedia - Copy trading allows individuals to automatically replicate the trades of selected investors, linking a portion of their funds to the chosen trader's account so that all trades and risk management actions are copied in real time, while still allowing the copier to manage or disconnect trades manually.

Copy Trading | Copy the Best Traders in 2025 - Copy trading lets less experienced traders automatically replicate trades of seasoned traders, offering a hands-off, time-saving approach distinct from social trading (manual copying) and mirror trading (systematic strategy replication).

What is Copy Trading, How Does it Work ... - Copy trading enables traders to automatically mimic the trading decisions of expert traders, with customizable capital allocation and risk controls, making it useful for novices and busy traders alike to capitalize on market opportunities without personal market analysis.

dowidth.com

dowidth.com