Social copy trading enables investors to replicate experienced traders' strategies automatically, reducing the time and knowledge needed for market analysis. Manual trading requires direct decision-making and hands-on management of trades, offering greater control but demanding more expertise and time commitment. Explore these methods to determine the best approach for your trading goals.

Why it is important

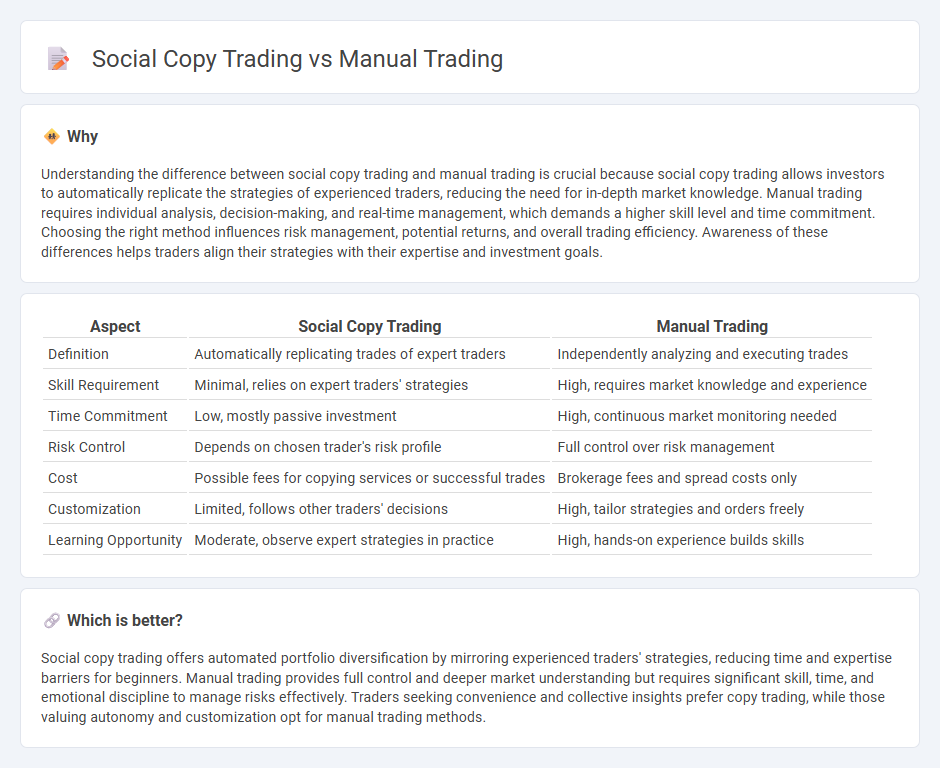

Understanding the difference between social copy trading and manual trading is crucial because social copy trading allows investors to automatically replicate the strategies of experienced traders, reducing the need for in-depth market knowledge. Manual trading requires individual analysis, decision-making, and real-time management, which demands a higher skill level and time commitment. Choosing the right method influences risk management, potential returns, and overall trading efficiency. Awareness of these differences helps traders align their strategies with their expertise and investment goals.

Comparison Table

| Aspect | Social Copy Trading | Manual Trading |

|---|---|---|

| Definition | Automatically replicating trades of expert traders | Independently analyzing and executing trades |

| Skill Requirement | Minimal, relies on expert traders' strategies | High, requires market knowledge and experience |

| Time Commitment | Low, mostly passive investment | High, continuous market monitoring needed |

| Risk Control | Depends on chosen trader's risk profile | Full control over risk management |

| Cost | Possible fees for copying services or successful trades | Brokerage fees and spread costs only |

| Customization | Limited, follows other traders' decisions | High, tailor strategies and orders freely |

| Learning Opportunity | Moderate, observe expert strategies in practice | High, hands-on experience builds skills |

Which is better?

Social copy trading offers automated portfolio diversification by mirroring experienced traders' strategies, reducing time and expertise barriers for beginners. Manual trading provides full control and deeper market understanding but requires significant skill, time, and emotional discipline to manage risks effectively. Traders seeking convenience and collective insights prefer copy trading, while those valuing autonomy and customization opt for manual trading methods.

Connection

Social copy trading enables traders to replicate the strategies of experienced manual traders directly, bridging the gap between automated signals and hands-on decision-making. Manual trading insights fuel social platforms where followers can analyze and select top-performing traders to emulate, creating a symbiotic relationship. This connection enhances market transparency and offers diverse strategies, benefiting both novice and expert traders.

Key Terms

Decision Autonomy

Manual trading offers traders full decision autonomy, allowing personalized strategy execution based on individual analysis and market conditions. Social copy trading limits autonomy by replicating trades from experienced investors, benefiting those with less expertise but also depending heavily on the chosen strategy's success. Explore the advantages and risks of each approach to determine which fits your trading goals best.

Signal Providers

Manual trading demands individual expertise, continuous market analysis, and timely decision-making to capitalize on price movements. Social copy trading leverages the insights of experienced signal providers, allowing users to automatically replicate their trades and potentially benefit from proven strategies. Explore how choosing the right signal providers can enhance your trading performance and reduce risks.

Trade Execution

Manual trading demands active decision-making and precise timing to execute trades based on individual analysis of market trends and indicators. Social copy trading automates trade execution by replicating strategies of expert traders in real-time, reducing the need for personal intervention. Explore more about how execution methods impact trading efficacy and risk management.

Source and External Links

What is Manual Trading? Characteristics of Manual Traders - Manual trading is the process of buying and selling assets based on a trader's own analysis and judgment, requiring emotional control and allowing strategies like day trading and swing trading.

Auto-Trading vs. Manual Trading: Which Is Best? - Manual trading involves active, real-time decisions by traders who rely on their knowledge and emotions, contrasting with automated trading's speed and efficiency but limited by traders' available time.

Manual vs. Automated Trading in Forex: Which Strategy Suits You Best? - Manual trading offers complete control and adaptability, helping traders learn market dynamics, but requires time and is vulnerable to emotional influences and inconsistency.

dowidth.com

dowidth.com