High frequency trading bots execute thousands of trades within milliseconds by leveraging advanced algorithms and real-time data analysis, optimizing for speed and volume in liquid markets like equities and forex. Options trading bots focus on complex derivative strategies, analyzing volatility, time decay, and Greeks to manage risks and exploit market inefficiencies with precision. Explore more about how these automated systems transform trading strategies and market participation.

Why it is important

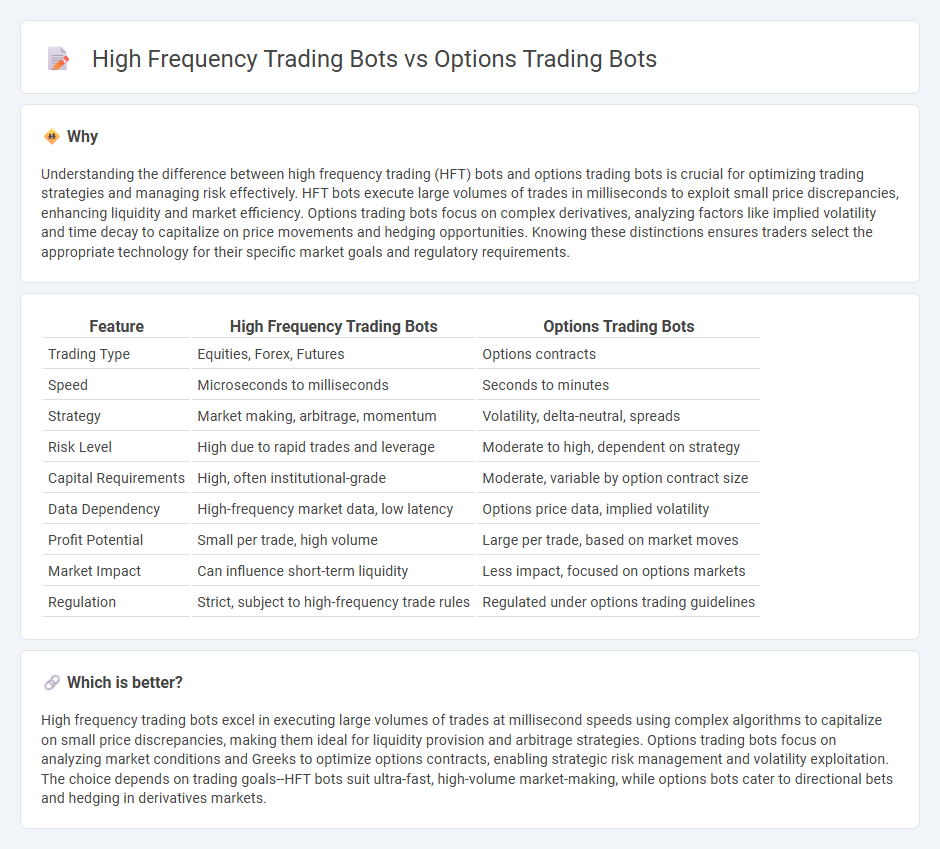

Understanding the difference between high frequency trading (HFT) bots and options trading bots is crucial for optimizing trading strategies and managing risk effectively. HFT bots execute large volumes of trades in milliseconds to exploit small price discrepancies, enhancing liquidity and market efficiency. Options trading bots focus on complex derivatives, analyzing factors like implied volatility and time decay to capitalize on price movements and hedging opportunities. Knowing these distinctions ensures traders select the appropriate technology for their specific market goals and regulatory requirements.

Comparison Table

| Feature | High Frequency Trading Bots | Options Trading Bots |

|---|---|---|

| Trading Type | Equities, Forex, Futures | Options contracts |

| Speed | Microseconds to milliseconds | Seconds to minutes |

| Strategy | Market making, arbitrage, momentum | Volatility, delta-neutral, spreads |

| Risk Level | High due to rapid trades and leverage | Moderate to high, dependent on strategy |

| Capital Requirements | High, often institutional-grade | Moderate, variable by option contract size |

| Data Dependency | High-frequency market data, low latency | Options price data, implied volatility |

| Profit Potential | Small per trade, high volume | Large per trade, based on market moves |

| Market Impact | Can influence short-term liquidity | Less impact, focused on options markets |

| Regulation | Strict, subject to high-frequency trade rules | Regulated under options trading guidelines |

Which is better?

High frequency trading bots excel in executing large volumes of trades at millisecond speeds using complex algorithms to capitalize on small price discrepancies, making them ideal for liquidity provision and arbitrage strategies. Options trading bots focus on analyzing market conditions and Greeks to optimize options contracts, enabling strategic risk management and volatility exploitation. The choice depends on trading goals--HFT bots suit ultra-fast, high-volume market-making, while options bots cater to directional bets and hedging in derivatives markets.

Connection

High frequency trading (HFT) bots and options trading bots both rely on advanced algorithms and real-time data analysis to execute trades at speeds far beyond human capabilities. HFT bots focus on executing a large number of trades within fractions of a second across various assets, while options trading bots specialize in complex strategies such as volatility arbitrage and delta-neutral positions to optimize options portfolios. Both types of bots leverage machine learning and quantitative models to exploit market inefficiencies and enhance trading precision.

Key Terms

Algorithmic Strategies

Algorithmic strategies for options trading bots often emphasize volatility modeling, Greeks calculation, and risk management tailored to options' unique payoff structures. High frequency trading bots rely on ultra-low latency execution, predictive analytics, and order book dynamics to capitalize on micro price discrepancies across markets. Explore detailed algorithmic techniques and comparative performance metrics to deepen your understanding of both trading bot paradigms.

Latency

Options trading bots prioritize strategic decision-making based on market conditions and implied volatility, often operating with moderate latency to optimize execution timing. High-frequency trading (HFT) bots exploit ultra-low latency environments, executing thousands of trades per second to capitalize on minute price discrepancies in options and other securities. Discover how latency impacts trading strategies and the competitive advantage each bot type offers by exploring this topic further.

Derivatives

Options trading bots analyze market conditions and execute trades based on predictive algorithms tailored to derivatives like options, aiming to maximize profit from volatility and time decay. High-frequency trading (HFT) bots leverage ultra-low latency infrastructure to execute large volumes of trades within milliseconds, capitalizing on minute price discrepancies in derivatives markets. Explore more details to understand how each bot type impacts derivatives trading strategies and market efficiency.

Source and External Links

Option Trading Bot: Automating Strategies for Smarter Options Trading - Itexus - These bots automate the buying and selling of options based on predefined rules and algorithms to execute trades instantly, apply risk management, and enable continuous market monitoring without emotional bias.

Leading Options Trading App | Options Trading Platform - SpeedBot - SpeedBot offers ultrafast options trading bots trained on years of market data that automate complex options strategies, predict market movements, and safeguard against heavy losses with minimal delay.

OPTIONS ROBOT - This platform provides easy-to-use automated bots to create trading plans without coding, connecting directly to brokers for live trading, incorporating discipline by managing option rolls and capital risk automatically.

dowidth.com

dowidth.com