Bid-ask spread capture involves executing trades to profit from the difference between the buying price and selling price in the market, focusing on market efficiency and liquidity creation. Quote stuffing, conversely, floods the market with excessive order placements and cancellations to confuse competitors and manipulate prices, often leading to decreased market transparency. Explore more to understand how these strategies impact trading dynamics and market fairness.

Why it is important

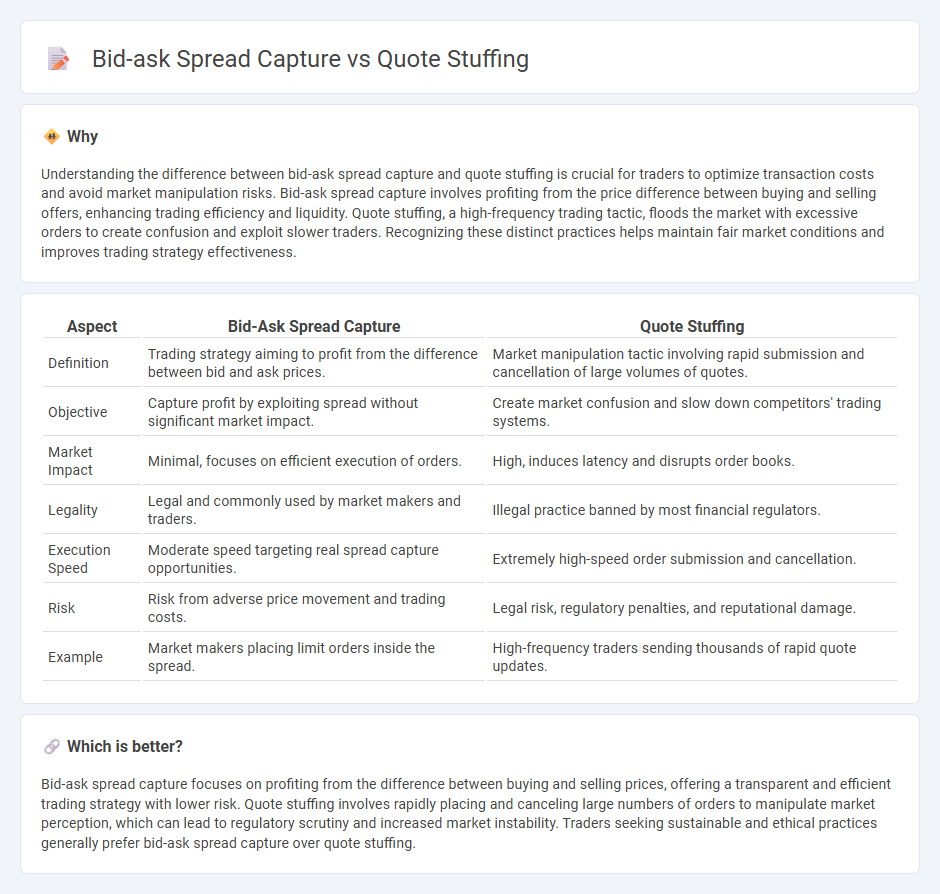

Understanding the difference between bid-ask spread capture and quote stuffing is crucial for traders to optimize transaction costs and avoid market manipulation risks. Bid-ask spread capture involves profiting from the price difference between buying and selling offers, enhancing trading efficiency and liquidity. Quote stuffing, a high-frequency trading tactic, floods the market with excessive orders to create confusion and exploit slower traders. Recognizing these distinct practices helps maintain fair market conditions and improves trading strategy effectiveness.

Comparison Table

| Aspect | Bid-Ask Spread Capture | Quote Stuffing |

|---|---|---|

| Definition | Trading strategy aiming to profit from the difference between bid and ask prices. | Market manipulation tactic involving rapid submission and cancellation of large volumes of quotes. |

| Objective | Capture profit by exploiting spread without significant market impact. | Create market confusion and slow down competitors' trading systems. |

| Market Impact | Minimal, focuses on efficient execution of orders. | High, induces latency and disrupts order books. |

| Legality | Legal and commonly used by market makers and traders. | Illegal practice banned by most financial regulators. |

| Execution Speed | Moderate speed targeting real spread capture opportunities. | Extremely high-speed order submission and cancellation. |

| Risk | Risk from adverse price movement and trading costs. | Legal risk, regulatory penalties, and reputational damage. |

| Example | Market makers placing limit orders inside the spread. | High-frequency traders sending thousands of rapid quote updates. |

Which is better?

Bid-ask spread capture focuses on profiting from the difference between buying and selling prices, offering a transparent and efficient trading strategy with lower risk. Quote stuffing involves rapidly placing and canceling large numbers of orders to manipulate market perception, which can lead to regulatory scrutiny and increased market instability. Traders seeking sustainable and ethical practices generally prefer bid-ask spread capture over quote stuffing.

Connection

Bid-ask spread capture strategy exploits temporary price differences between buy and sell orders, often influenced by high-frequency trading algorithms that generate rapid trade signals. Quote stuffing floods the market with excessive orders to create false impressions of supply and demand, increasing bid-ask spreads and market volatility. This manipulation distorts price discovery, enabling traders to profit from artificially widened spreads during rapid order book fluctuations.

Key Terms

Latency

Quote stuffing exploits ultra-low latency trading systems by rapidly submitting and canceling large volumes of quotes, causing market participants to experience delayed data and reduced price transparency. Bid-ask spread capture leverages minimal latency to detect and act on price discrepancies between bids and asks, securing profits through swift trade execution before others can react. Explore further how latency influences these high-frequency trading strategies and market efficiency.

Liquidity

Quote stuffing disrupts market liquidity by flooding order books with excessive, rapidly canceling quotes, creating an illusion of depth that hinders genuine market transparency. Bid-ask spread capture exploits this artificial volatility by executing trades within the manipulated spread, profiting from momentary price inefficiencies in highly liquid environments. Explore how these practices impact liquidity dynamics and market efficiency in greater detail.

Order book

Quote stuffing floods the order book with a rapid influx of orders and cancellations to create market confusion and exploit latency advantages, distorting the true supply and demand dynamics. Bid-ask spread capture involves strategically placing and adjusting orders within the order book to profit from the difference between bid and ask prices without overwhelming the market with excessive quote traffic. Explore detailed mechanisms and impacts of these strategies on order book integrity and market efficiency.

Source and External Links

Quote Stuffing - Overview, How It Works, Example - Quote stuffing is a market manipulation strategy where traders place many buy or sell orders rapidly but cancel them immediately to create artificial demand or supply, impacting stock prices to profit from the resulting price movements.

How Larger Players Use Quote Stuffing to Gain an Edge in Trading - This strategy involves flooding the market with an excessive amount of orders that are swiftly canceled to disrupt market activity, confuse other traders, and manipulate bid-ask spreads using high-speed automated trading algorithms.

Quote Stuffing - What Is It, Vs Spoofing Vs Layering - WallStreetMojo - Quote stuffing is a form of market manipulation characterized by placing and quickly canceling numerous orders to create false market hype, mainly practiced by high-frequency traders to gain a pricing advantage over competitors.

dowidth.com

dowidth.com