Funded account programs offer traders the opportunity to trade with capital provided by proprietary firms, allowing them to keep a percentage of the profits without risking their own money. Managed accounts involve professional portfolio managers making trading decisions on behalf of clients, typically with higher fees and less direct control for the investor. Explore the differences in fees, risk, and control to determine which trading structure aligns with your goals.

Why it is important

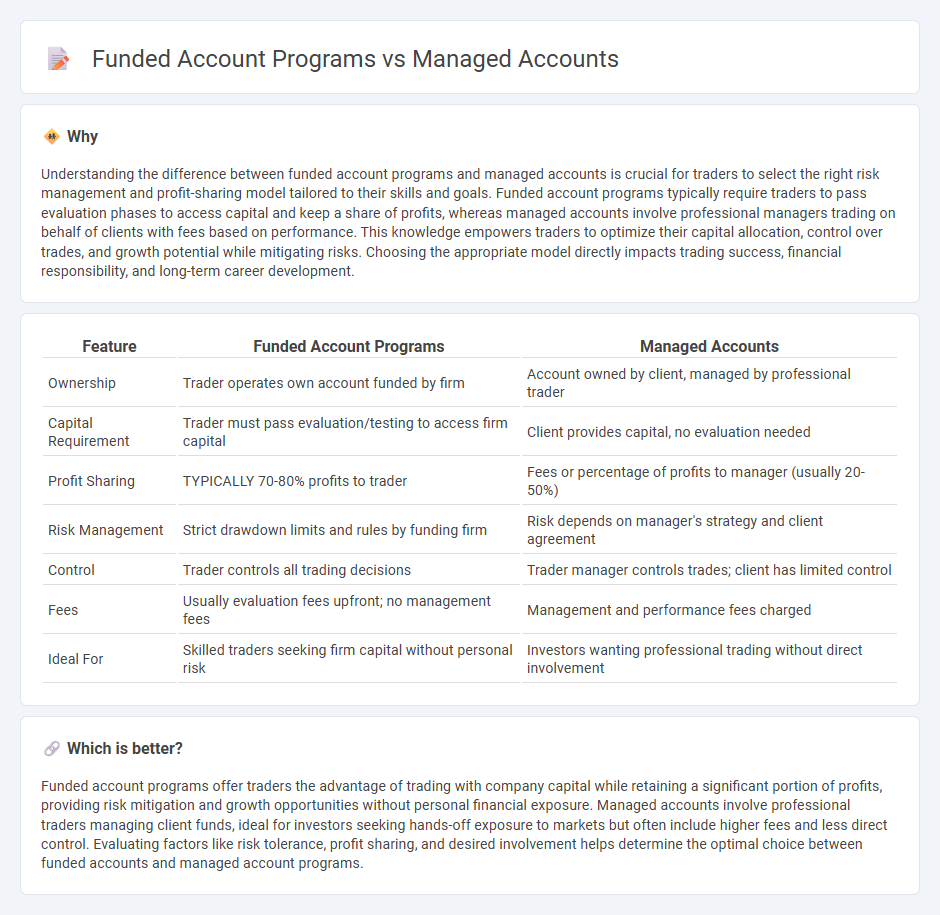

Understanding the difference between funded account programs and managed accounts is crucial for traders to select the right risk management and profit-sharing model tailored to their skills and goals. Funded account programs typically require traders to pass evaluation phases to access capital and keep a share of profits, whereas managed accounts involve professional managers trading on behalf of clients with fees based on performance. This knowledge empowers traders to optimize their capital allocation, control over trades, and growth potential while mitigating risks. Choosing the appropriate model directly impacts trading success, financial responsibility, and long-term career development.

Comparison Table

| Feature | Funded Account Programs | Managed Accounts |

|---|---|---|

| Ownership | Trader operates own account funded by firm | Account owned by client, managed by professional trader |

| Capital Requirement | Trader must pass evaluation/testing to access firm capital | Client provides capital, no evaluation needed |

| Profit Sharing | TYPICALLY 70-80% profits to trader | Fees or percentage of profits to manager (usually 20-50%) |

| Risk Management | Strict drawdown limits and rules by funding firm | Risk depends on manager's strategy and client agreement |

| Control | Trader controls all trading decisions | Trader manager controls trades; client has limited control |

| Fees | Usually evaluation fees upfront; no management fees | Management and performance fees charged |

| Ideal For | Skilled traders seeking firm capital without personal risk | Investors wanting professional trading without direct involvement |

Which is better?

Funded account programs offer traders the advantage of trading with company capital while retaining a significant portion of profits, providing risk mitigation and growth opportunities without personal financial exposure. Managed accounts involve professional traders managing client funds, ideal for investors seeking hands-off exposure to markets but often include higher fees and less direct control. Evaluating factors like risk tolerance, profit sharing, and desired involvement helps determine the optimal choice between funded accounts and managed account programs.

Connection

Funded account programs provide traders with capital to execute trades without risking their own money, while managed accounts involve professional portfolio managers trading on behalf of clients using their funds. Both models rely on risk management strategies and performance-based profit sharing, creating alignment between trader incentives and account growth. The connection lies in capital allocation efficiency and expertise, enabling scalable trading operations that benefit individual traders and investors alike.

Key Terms

Account Ownership

Managed accounts provide clients with direct ownership of their investment portfolios, offering transparency and control over asset allocation and performance. Funded account programs typically involve third-party capital management where the investor may have limited direct ownership, with the fund manager making trading decisions on behalf of the investor. Explore the fundamental differences in account ownership by diving deeper into managed accounts and funded account programs.

Capital Allocation

Managed accounts allow investors to maintain ownership of assets while professional managers execute strategies, ensuring transparent capital allocation aligned with individual risk tolerances. Funded account programs provide traders with allocated capital from proprietary firms, removing personal financial risk but requiring profit sharing based on performance metrics. Explore detailed comparisons to identify the optimal capital allocation strategy tailored to your investment goals.

Profit Sharing

Profit sharing in managed accounts typically involves a percentage of the actual gains distributed between the investor and the account manager, aligning their interests closely. Funded account programs often require traders to reach specific profit targets before sharing profits, with predefined split ratios depending on the program's rules. Explore detailed comparisons to optimize your investment strategy and maximize returns.

Source and External Links

What Is a Managed Account? (Advantages and Disadvantages) - A managed account is an investment portfolio overseen by a financial expert who autonomously manages assets like financial instruments and property titles on behalf of clients to meet investment goals, typically involving fees and minimum investment requirements.

Managed account - Wikipedia - Managed accounts are fee-based investment products primarily for high-net-worth individuals, offering professional management, customization, tax efficiencies, increased transparency, liquidity, and control, with evolving formats like SMAs, MSAs, and UMAs.

Managed Account - Overview, Pros and Cons - A managed account consists of individual stocks or bonds handled by a professional investment manager who exercises discretionary authority tailored to the owner's specific investment goals, risk tolerance, and asset size.

dowidth.com

dowidth.com