Grid trading involves placing buy and sell orders at preset intervals around a set price, capitalizing on normal price volatility without predicting market direction. High-frequency trading (HFT) uses sophisticated algorithms and high-speed data networks to execute thousands of trades per second, aiming for minimal profits per trade but large aggregate gains. Explore detailed strategies and risk profiles of grid trading versus high-frequency trading to optimize your trading approach.

Why it is important

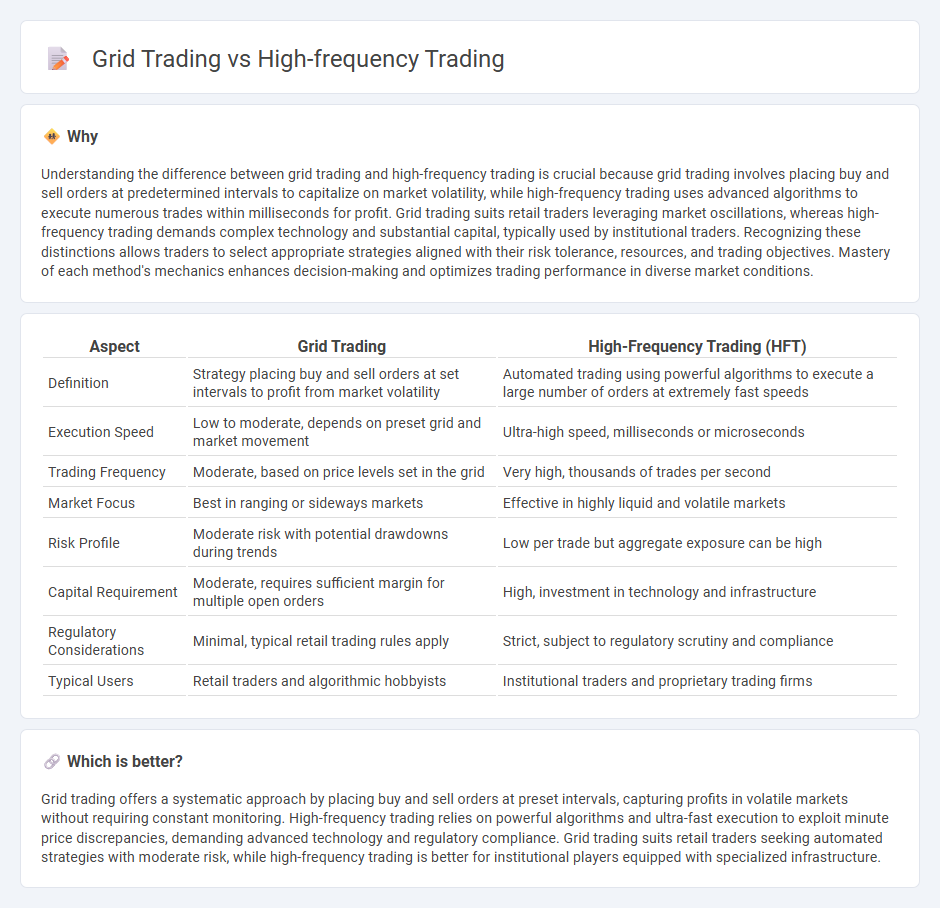

Understanding the difference between grid trading and high-frequency trading is crucial because grid trading involves placing buy and sell orders at predetermined intervals to capitalize on market volatility, while high-frequency trading uses advanced algorithms to execute numerous trades within milliseconds for profit. Grid trading suits retail traders leveraging market oscillations, whereas high-frequency trading demands complex technology and substantial capital, typically used by institutional traders. Recognizing these distinctions allows traders to select appropriate strategies aligned with their risk tolerance, resources, and trading objectives. Mastery of each method's mechanics enhances decision-making and optimizes trading performance in diverse market conditions.

Comparison Table

| Aspect | Grid Trading | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Strategy placing buy and sell orders at set intervals to profit from market volatility | Automated trading using powerful algorithms to execute a large number of orders at extremely fast speeds |

| Execution Speed | Low to moderate, depends on preset grid and market movement | Ultra-high speed, milliseconds or microseconds |

| Trading Frequency | Moderate, based on price levels set in the grid | Very high, thousands of trades per second |

| Market Focus | Best in ranging or sideways markets | Effective in highly liquid and volatile markets |

| Risk Profile | Moderate risk with potential drawdowns during trends | Low per trade but aggregate exposure can be high |

| Capital Requirement | Moderate, requires sufficient margin for multiple open orders | High, investment in technology and infrastructure |

| Regulatory Considerations | Minimal, typical retail trading rules apply | Strict, subject to regulatory scrutiny and compliance |

| Typical Users | Retail traders and algorithmic hobbyists | Institutional traders and proprietary trading firms |

Which is better?

Grid trading offers a systematic approach by placing buy and sell orders at preset intervals, capturing profits in volatile markets without requiring constant monitoring. High-frequency trading relies on powerful algorithms and ultra-fast execution to exploit minute price discrepancies, demanding advanced technology and regulatory compliance. Grid trading suits retail traders seeking automated strategies with moderate risk, while high-frequency trading is better for institutional players equipped with specialized infrastructure.

Connection

Grid trading and high-frequency trading are connected through their reliance on algorithmic strategies to exploit market volatility and price fluctuations. Both approaches utilize automated systems to execute numerous trades rapidly, aiming to capitalize on small price movements and generate consistent profits. The integration of advanced data analysis and fast execution platforms is essential for maximizing the efficiency of grid trading within high-frequency trading environments.

Key Terms

Latency

High-frequency trading (HFT) prioritizes ultra-low latency to execute thousands of trades per second using advanced algorithms and direct market access, capitalizing on minimal price movements. Grid trading, by contrast, operates on a predefined price grid and does not require ultra-low latency, focusing more on strategic placement of buy and sell orders over time. Explore the nuances of latency impact on trading strategies to optimize your trading performance.

Arbitrage

High-frequency trading (HFT) leverages sophisticated algorithms and ultra-low latency to exploit minute arbitrage opportunities across multiple markets within milliseconds. Grid trading employs predefined buy and sell orders at fixed intervals to capitalize on market volatility, but it lacks the speed and precision of HFT in capturing fleeting arbitrage profits. Discover more about how these strategies uniquely harness arbitrage in modern financial markets.

Order Grid

Order Grid in grid trading structures buy and sell orders at predetermined price intervals, capturing profits from market fluctuations without constant monitoring. High-frequency trading (HFT), by contrast, relies on powerful algorithms executing thousands of trades per second to capitalize on minimal price discrepancies. Explore deeper insights to understand how these strategies impact trading efficiency and risk management.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading (HFT) is automated trading using powerful computers and algorithms to execute an enormous number of trades at extremely high speeds, capitalizing on tiny price changes rapidly across multiple markets to generate profits.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT uses specialized computers to achieve ultra-fast trade execution and large transaction volumes, mainly employed by large institutions to profit from small price fluctuations and arbitrage between exchanges, enhancing market liquidity.

High-frequency trading - Wikipedia - HFT involves quantitative algorithmic trading with short holding periods, leveraging speed to perform strategies like market-making and arbitrage, exploiting minor market inefficiencies faster than traditional traders.

dowidth.com

dowidth.com