Volume profile reading reveals price levels where significant trading activity occurred, highlighting key support and resistance zones through volume concentration. Market structure analysis focuses on identifying trends, swing highs and lows, and price patterns to determine market direction and potential reversals. Explore deeper insights into how combining volume profile with market structure enhances trading precision.

Why it is important

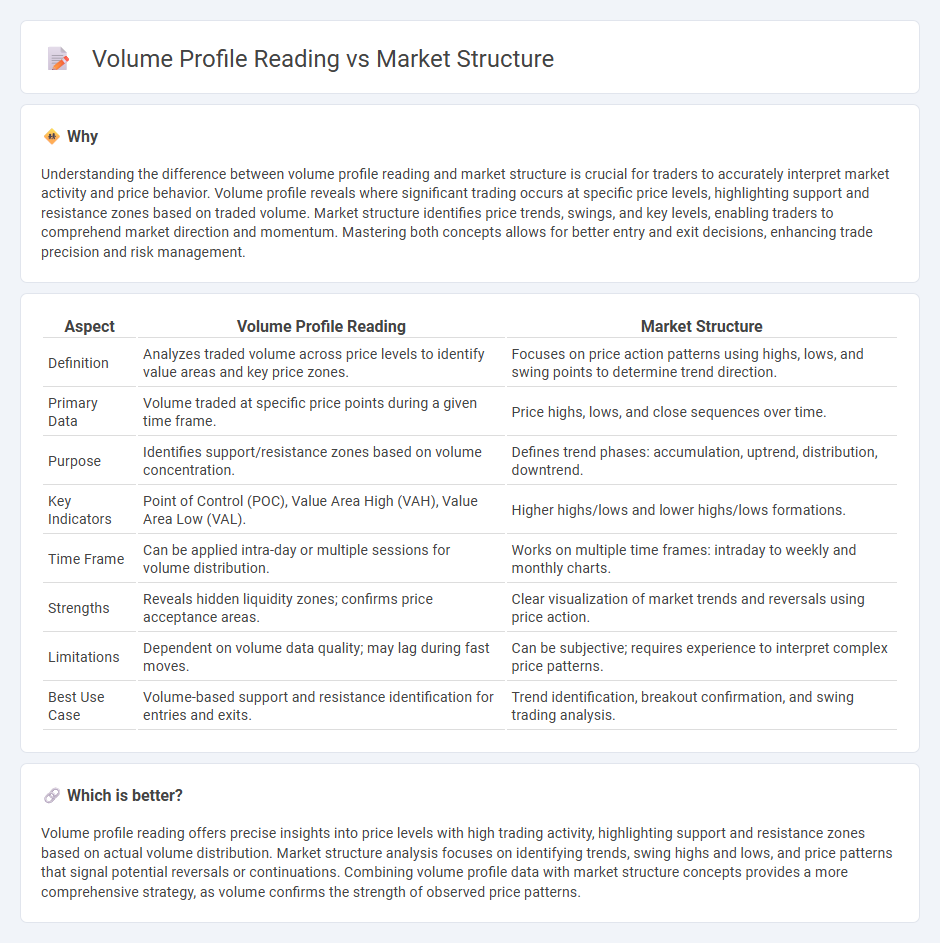

Understanding the difference between volume profile reading and market structure is crucial for traders to accurately interpret market activity and price behavior. Volume profile reveals where significant trading occurs at specific price levels, highlighting support and resistance zones based on traded volume. Market structure identifies price trends, swings, and key levels, enabling traders to comprehend market direction and momentum. Mastering both concepts allows for better entry and exit decisions, enhancing trade precision and risk management.

Comparison Table

| Aspect | Volume Profile Reading | Market Structure |

|---|---|---|

| Definition | Analyzes traded volume across price levels to identify value areas and key price zones. | Focuses on price action patterns using highs, lows, and swing points to determine trend direction. |

| Primary Data | Volume traded at specific price points during a given time frame. | Price highs, lows, and close sequences over time. |

| Purpose | Identifies support/resistance zones based on volume concentration. | Defines trend phases: accumulation, uptrend, distribution, downtrend. |

| Key Indicators | Point of Control (POC), Value Area High (VAH), Value Area Low (VAL). | Higher highs/lows and lower highs/lows formations. |

| Time Frame | Can be applied intra-day or multiple sessions for volume distribution. | Works on multiple time frames: intraday to weekly and monthly charts. |

| Strengths | Reveals hidden liquidity zones; confirms price acceptance areas. | Clear visualization of market trends and reversals using price action. |

| Limitations | Dependent on volume data quality; may lag during fast moves. | Can be subjective; requires experience to interpret complex price patterns. |

| Best Use Case | Volume-based support and resistance identification for entries and exits. | Trend identification, breakout confirmation, and swing trading analysis. |

Which is better?

Volume profile reading offers precise insights into price levels with high trading activity, highlighting support and resistance zones based on actual volume distribution. Market structure analysis focuses on identifying trends, swing highs and lows, and price patterns that signal potential reversals or continuations. Combining volume profile data with market structure concepts provides a more comprehensive strategy, as volume confirms the strength of observed price patterns.

Connection

Volume profile reading reveals the distribution of traded volume at various price levels, highlighting key support and resistance zones. Market structure, defined by swing highs and lows, aligns with these volume clusters to confirm breakout or reversal points. By analyzing how volume accumulates around structural levels, traders can anticipate potential price movements and validate trend strength.

Key Terms

**Market Structure:**

Market structure analysis focuses on identifying key support and resistance levels, trend direction, and price action patterns to understand the overall market behavior. It emphasizes swing highs and lows, breakouts, and consolidation zones to anticipate potential reversals or continuations. Explore more to master market structure techniques for better trading decisions.

Swing Highs/Lows

Market structure analysis identifies key Swing Highs and Lows to determine trend direction and potential reversal points, using price action and order flow as primary indicators. Volume profile reading complements this by mapping traded volume at specific price levels, highlighting areas of support and resistance around these Swing points. Explore how integrating market structure with volume profile reading enhances your trading precision and decision-making effective strategies.

Trends (Uptrend/Downtrend)

Market structure analysis identifies key support and resistance levels that define trend direction, distinguishing between higher highs and higher lows in an uptrend or lower highs and lower lows in a downtrend. Volume profile reading complements this by revealing trader activity and liquidity concentration at specific price levels, highlighting points of accumulation or distribution during trend formation. Explore how integrating these techniques can enhance your ability to forecast and capitalize on trending market movements.

Source and External Links

Market Structure: Definition, 4 Types and Examples - Market structure classifies businesses based on the degree of competition, ease of entry, and product differentiation, with four main types: perfect competition, monopolistic competition, oligopoly, and monopoly, affecting pricing and innovation.

Market structures | EBSCO Research Starters - Market structure describes economic environments where firms compete and set prices; four main types include perfect competition, monopolistic competition, monopoly, and oligopoly, each with distinct characteristics regarding number of firms, product type, and pricing power.

Market Structure - Overview, Definition, Features, and Types - In economics, market structure differentiates industries by competition level, number of buyers and sellers, product differentiation, and entry barriers, identifying four types: perfect competition, monopoly, oligopoly, and monopolistic competition.

dowidth.com

dowidth.com