Flash loans offer instant, uncollateralized borrowing predominantly used in decentralized finance (DeFi) for arbitrage, collateral swapping, and liquidation strategies. High-frequency trading (HFT) relies on sophisticated algorithms and ultra-low latency networks to execute large volumes of orders at extremely high speeds within traditional financial markets. Explore the nuances and strategic advantages of flash loans versus high-frequency trading to enhance your trading expertise.

Why it is important

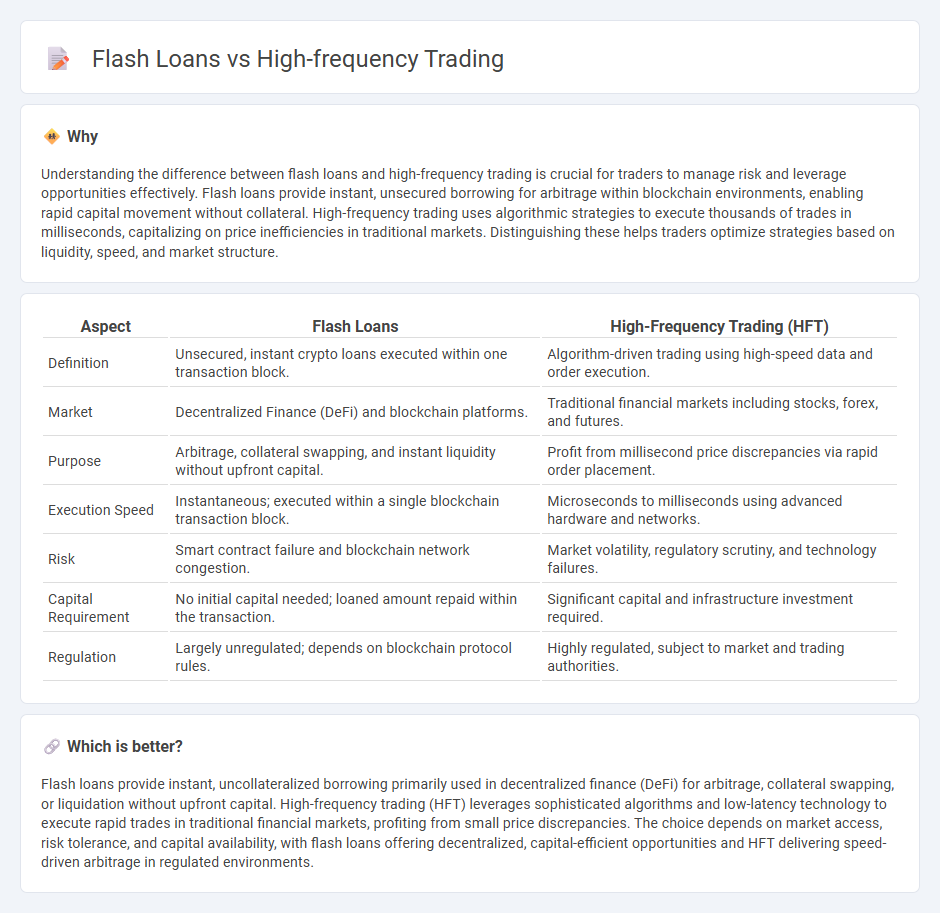

Understanding the difference between flash loans and high-frequency trading is crucial for traders to manage risk and leverage opportunities effectively. Flash loans provide instant, unsecured borrowing for arbitrage within blockchain environments, enabling rapid capital movement without collateral. High-frequency trading uses algorithmic strategies to execute thousands of trades in milliseconds, capitalizing on price inefficiencies in traditional markets. Distinguishing these helps traders optimize strategies based on liquidity, speed, and market structure.

Comparison Table

| Aspect | Flash Loans | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Unsecured, instant crypto loans executed within one transaction block. | Algorithm-driven trading using high-speed data and order execution. |

| Market | Decentralized Finance (DeFi) and blockchain platforms. | Traditional financial markets including stocks, forex, and futures. |

| Purpose | Arbitrage, collateral swapping, and instant liquidity without upfront capital. | Profit from millisecond price discrepancies via rapid order placement. |

| Execution Speed | Instantaneous; executed within a single blockchain transaction block. | Microseconds to milliseconds using advanced hardware and networks. |

| Risk | Smart contract failure and blockchain network congestion. | Market volatility, regulatory scrutiny, and technology failures. |

| Capital Requirement | No initial capital needed; loaned amount repaid within the transaction. | Significant capital and infrastructure investment required. |

| Regulation | Largely unregulated; depends on blockchain protocol rules. | Highly regulated, subject to market and trading authorities. |

Which is better?

Flash loans provide instant, uncollateralized borrowing primarily used in decentralized finance (DeFi) for arbitrage, collateral swapping, or liquidation without upfront capital. High-frequency trading (HFT) leverages sophisticated algorithms and low-latency technology to execute rapid trades in traditional financial markets, profiting from small price discrepancies. The choice depends on market access, risk tolerance, and capital availability, with flash loans offering decentralized, capital-efficient opportunities and HFT delivering speed-driven arbitrage in regulated environments.

Connection

Flash loans enable instant, unsecured borrowing of large cryptocurrency amounts, facilitating rapid buy and sell actions typical in high-frequency trading (HFT). HFT algorithms leverage these loans to exploit minute price discrepancies across decentralized exchanges, executing thousands of trades per second with minimal capital at risk. This synergy accelerates liquidity provision and arbitrage opportunities, intensifying market efficiency and volatility in crypto trading ecosystems.

Key Terms

**High-Frequency Trading:**

High-frequency trading (HFT) leverages sophisticated algorithms and high-speed data networks to execute thousands of trades within milliseconds, capitalizing on minor price discrepancies across markets. This strategy relies heavily on co-location services and low-latency connections to gain an edge, often influencing market liquidity and volatility. Explore how HFT reshapes modern finance and its implications for market participants.

Latency

High-frequency trading (HFT) leverages ultra-low latency networks and co-location near exchanges to execute thousands of trades within microseconds, capitalizing on minute market fluctuations. Flash loans, inherent to decentralized finance (DeFi), operate on blockchain networks where transaction speeds are limited by block confirmation times, resulting in higher latency compared to HFT but enabling instant, uncollateralized borrowing within a single transaction. Explore detailed latency implications and strategies in both HFT and flash loan ecosystems to understand their competitive advantages.

Algorithmic Trading

Algorithmic trading employs sophisticated algorithms to execute high-frequency trades by rapidly analyzing market data and placing orders within milliseconds, capturing tiny price discrepancies across multiple exchanges. Flash loans utilize smart contracts to borrow large sums of cryptocurrency instantly without collateral, exploiting arbitrage opportunities or executing complex financial strategies in decentralized finance (DeFi). Explore the intricacies of algorithmic trading and flash loans to understand their impact on modern financial markets.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do ... - High-frequency trading is automated trading using powerful computers and advanced algorithms to execute vast numbers of trades at speeds measured in microseconds or milliseconds, aiming to profit from tiny price discrepancies across markets.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is an algorithmic trading method characterized by extremely high-speed trade execution and large transaction volumes, primarily used by institutional investors to capitalize on small price fluctuations and arbitrage opportunities.

High-frequency trading - HFT involves quantitative, algorithm-driven trading strategies with very short portfolio holding periods, emphasizing speed in executing trades to exploit tiny market inefficiencies through strategies like market-making and arbitrage.

dowidth.com

dowidth.com