Risk reversal involves simultaneously buying a call option and selling a put option to hedge or speculate on price movements with limited upfront cost, while debit spreads require purchasing one option and selling another at a different strike price within the same expiration, limiting risk and reward potential. Both strategies are essential tools in options trading for managing directional exposure and volatility. Explore detailed comparisons to understand how risk reversals and debit spreads fit various trading objectives.

Why it is important

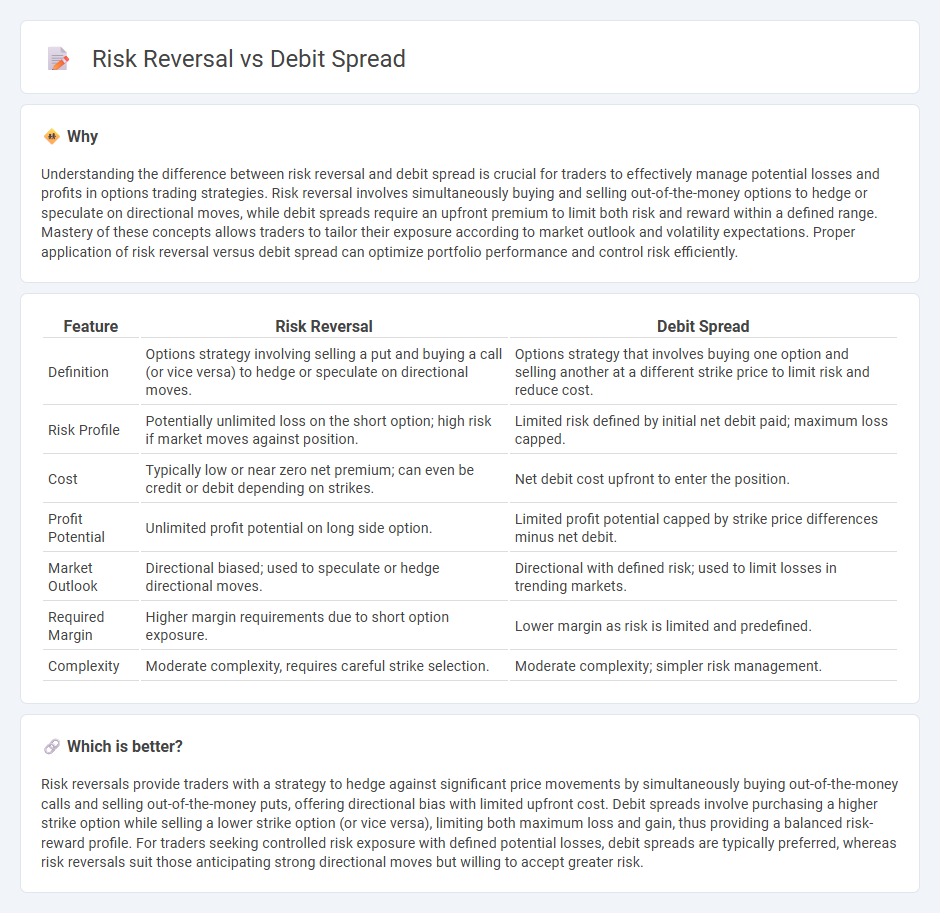

Understanding the difference between risk reversal and debit spread is crucial for traders to effectively manage potential losses and profits in options trading strategies. Risk reversal involves simultaneously buying and selling out-of-the-money options to hedge or speculate on directional moves, while debit spreads require an upfront premium to limit both risk and reward within a defined range. Mastery of these concepts allows traders to tailor their exposure according to market outlook and volatility expectations. Proper application of risk reversal versus debit spread can optimize portfolio performance and control risk efficiently.

Comparison Table

| Feature | Risk Reversal | Debit Spread |

|---|---|---|

| Definition | Options strategy involving selling a put and buying a call (or vice versa) to hedge or speculate on directional moves. | Options strategy that involves buying one option and selling another at a different strike price to limit risk and reduce cost. |

| Risk Profile | Potentially unlimited loss on the short option; high risk if market moves against position. | Limited risk defined by initial net debit paid; maximum loss capped. |

| Cost | Typically low or near zero net premium; can even be credit or debit depending on strikes. | Net debit cost upfront to enter the position. |

| Profit Potential | Unlimited profit potential on long side option. | Limited profit potential capped by strike price differences minus net debit. |

| Market Outlook | Directional biased; used to speculate or hedge directional moves. | Directional with defined risk; used to limit losses in trending markets. |

| Required Margin | Higher margin requirements due to short option exposure. | Lower margin as risk is limited and predefined. |

| Complexity | Moderate complexity, requires careful strike selection. | Moderate complexity; simpler risk management. |

Which is better?

Risk reversals provide traders with a strategy to hedge against significant price movements by simultaneously buying out-of-the-money calls and selling out-of-the-money puts, offering directional bias with limited upfront cost. Debit spreads involve purchasing a higher strike option while selling a lower strike option (or vice versa), limiting both maximum loss and gain, thus providing a balanced risk-reward profile. For traders seeking controlled risk exposure with defined potential losses, debit spreads are typically preferred, whereas risk reversals suit those anticipating strong directional moves but willing to accept greater risk.

Connection

Risk reversals and debit spreads are both options trading strategies used to manage risk and speculate on market direction, involving simultaneous buying and selling of call and put options. A risk reversal involves buying an out-of-the-money call and selling an out-of-the-money put (or vice versa), effectively creating a synthetic long or short position with limited capital. Debit spreads, on the other hand, involve buying and selling options at different strike prices within the same expiration, limiting both potential loss and gain, often complementing risk reversal structures for tailored risk exposure.

Key Terms

Net Premium

A debit spread involves paying a net premium to enter a position, which limits risk by defining maximum loss upfront, while a risk reversal typically generates a net credit or minimal net premium depending on option strikes, reflecting a directional bias without fixed maximum loss. Net premium management in debit spreads ensures controlled costs and risk, contrasting with risk reversals where traders accept variable risk for potential higher returns. Explore detailed comparisons to understand how net premium impacts strategy selection and risk management.

Directional Bias

A debit spread involves purchasing a higher-premium option and selling a lower-premium option, creating a net cost position that profits from a specific directional move with limited risk and reward. A risk reversal combines buying an out-of-the-money call and selling an out-of-the-money put (or vice versa), expressing a stronger directional bias with potentially unlimited profit but higher risk exposure. Explore more to understand how these strategies align with your market outlook and risk tolerance.

Risk Profile

A debit spread involves purchasing one option and selling another at a different strike price, limiting both potential loss and gain while establishing a defined risk profile. A risk reversal consists of buying an out-of-the-money call and selling an out-of-the-money put (or vice versa), creating an asymmetric risk profile with unlimited profit potential but significant downside risk. Explore these strategies in detail to understand their suitability for your trading objectives and risk tolerance.

Source and External Links

Debit spread - Wikipedia - A debit spread is an options strategy where an investor buys an option with a higher premium and sells one with a lower premium, expecting the spread to widen; it has defined maximum gain and loss based on the difference in strike prices and net premium paid.

Debit Spread Strategy: Enhance Your Options Trading Potential - A debit spread involves buying and selling options of the same type with different strike prices, where the maximum profit occurs when the underlying price moves beyond the sold option's strike, and maximum loss is the net premium paid.

Debit Spread Explained: Definition, Example, vs. Credit ... - tastylive - Debit spreads require a net premium payment to initiate and include strategies like bull call and bear put spreads, constructed by buying higher-premium options and simultaneously selling lower-premium options to partly offset costs and limit risk.

dowidth.com

dowidth.com