Altcoin sniping involves rapid, high-frequency trades aiming to capitalize on newly launched tokens' initial price spikes, while swing trading focuses on capturing medium-term trends over days or weeks. Both strategies require distinct risk management and market analysis techniques to maximize profitability in the volatile cryptocurrency market. Explore deeper insights to discover which method fits your trading style best.

Why it is important

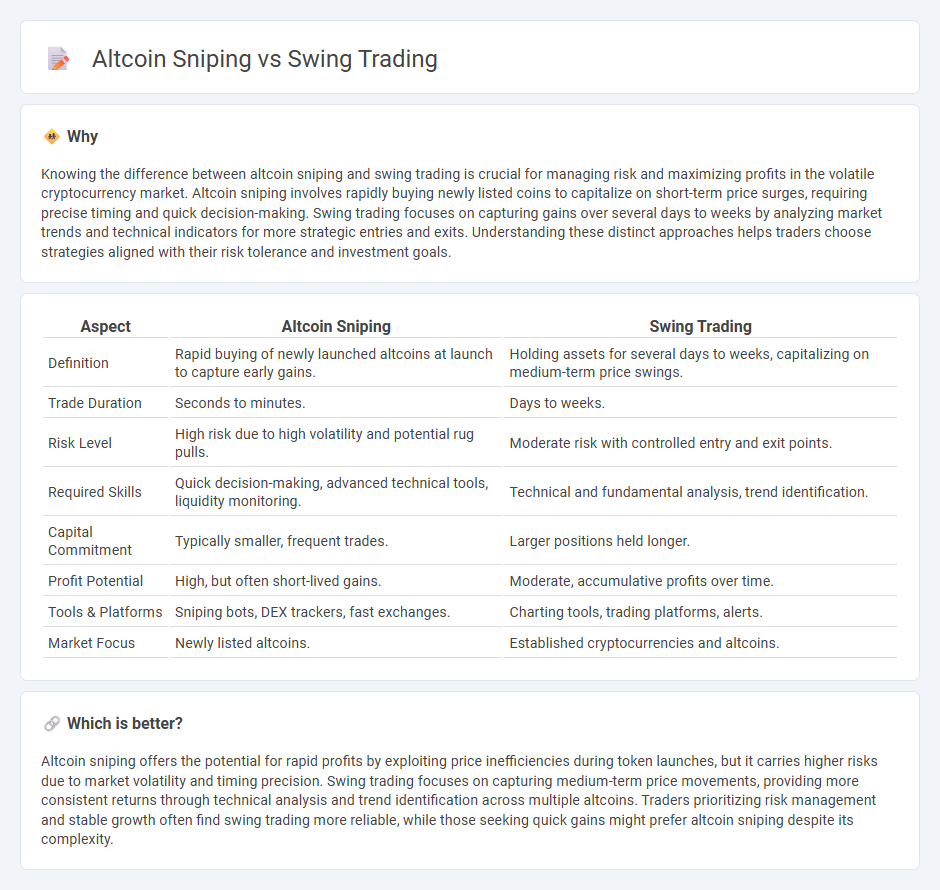

Knowing the difference between altcoin sniping and swing trading is crucial for managing risk and maximizing profits in the volatile cryptocurrency market. Altcoin sniping involves rapidly buying newly listed coins to capitalize on short-term price surges, requiring precise timing and quick decision-making. Swing trading focuses on capturing gains over several days to weeks by analyzing market trends and technical indicators for more strategic entries and exits. Understanding these distinct approaches helps traders choose strategies aligned with their risk tolerance and investment goals.

Comparison Table

| Aspect | Altcoin Sniping | Swing Trading |

|---|---|---|

| Definition | Rapid buying of newly launched altcoins at launch to capture early gains. | Holding assets for several days to weeks, capitalizing on medium-term price swings. |

| Trade Duration | Seconds to minutes. | Days to weeks. |

| Risk Level | High risk due to high volatility and potential rug pulls. | Moderate risk with controlled entry and exit points. |

| Required Skills | Quick decision-making, advanced technical tools, liquidity monitoring. | Technical and fundamental analysis, trend identification. |

| Capital Commitment | Typically smaller, frequent trades. | Larger positions held longer. |

| Profit Potential | High, but often short-lived gains. | Moderate, accumulative profits over time. |

| Tools & Platforms | Sniping bots, DEX trackers, fast exchanges. | Charting tools, trading platforms, alerts. |

| Market Focus | Newly listed altcoins. | Established cryptocurrencies and altcoins. |

Which is better?

Altcoin sniping offers the potential for rapid profits by exploiting price inefficiencies during token launches, but it carries higher risks due to market volatility and timing precision. Swing trading focuses on capturing medium-term price movements, providing more consistent returns through technical analysis and trend identification across multiple altcoins. Traders prioritizing risk management and stable growth often find swing trading more reliable, while those seeking quick gains might prefer altcoin sniping despite its complexity.

Connection

Altcoin sniping and swing trading both capitalize on market volatility but differ in execution speed and time horizon; sniping aims for rapid entry and exit during initial coin offerings or sudden price spikes while swing trading holds positions over days or weeks to profit from expected price swings. Both strategies require technical analysis, real-time market data, and risk management to maximize returns in altcoin markets. Integrating sniping tactics within swing trading frameworks can enhance portfolio diversification and exploit short-term momentum within longer trading cycles.

Key Terms

Swing Trading:

Swing trading captures medium-term price movements by holding altcoins over several days to weeks, capitalizing on market trends and volatility without constant monitoring. This strategy relies on technical analysis and key indicators such as moving averages and RSI to identify entry and exit points, reducing risk compared to rapid, high-frequency trades typical in altcoin sniping. Explore detailed strategies and tools to optimize swing trading outcomes in the volatile cryptocurrency market.

Technical Analysis

Swing trading relies on technical analysis tools such as moving averages, MACD, and RSI to identify medium-term price trends and execute trades lasting days to weeks in altcoin markets. Altcoin sniping focuses on ultra-short-term technical signals, leveraging order book depth, volume spikes, and rapid price momentum to capture quick profits on newly listed or volatile tokens. Explore detailed strategies and toolsets for mastering technical analysis in both swing trading and altcoin sniping to maximize crypto gains.

Holding Period

Swing trading involves holding altcoins for several days to weeks to capitalize on medium-term price trends, while altcoin sniping targets rapid, short-term gains by quickly buying newly launched tokens within seconds or minutes of listing. The holding period differs significantly, with swing traders relying on technical analysis and market momentum whereas snipers depend on speed and automated tools to exploit price volatility immediately after launch. Explore deeper insights to optimize your altcoin strategies for both holding periods.

Source and External Links

Swing trading - Swing trading is a speculative strategy where assets are held for days to profit from price swings, using technical or fundamental analysis and trading systems to decide entry and exit points.

Swing trading: Strategies and insights for successful trading - Swing trading profits from short-term price changes, involving buying on dips and shorting on rises, and is positioned between day trading and trend trading in terms of holding periods.

Swing Trading Stocks: Strategies and Indicators - Swing traders often trade with the broader trend, using indicators like support and resistance levels to identify entries, exits, and trade sizing, with techniques including bounces and breakouts on price charts.

dowidth.com

dowidth.com