Liquidity sweep strategies target large orders by executing trades across multiple venues to capture hidden liquidity and minimize market impact, optimizing execution efficiency. Opening auctions establish a single equilibrium price by aggregating buy and sell orders at market open, enhancing price discovery and reducing volatility. Explore these concepts further to refine your trading tactics and improve market outcomes.

Why it is important

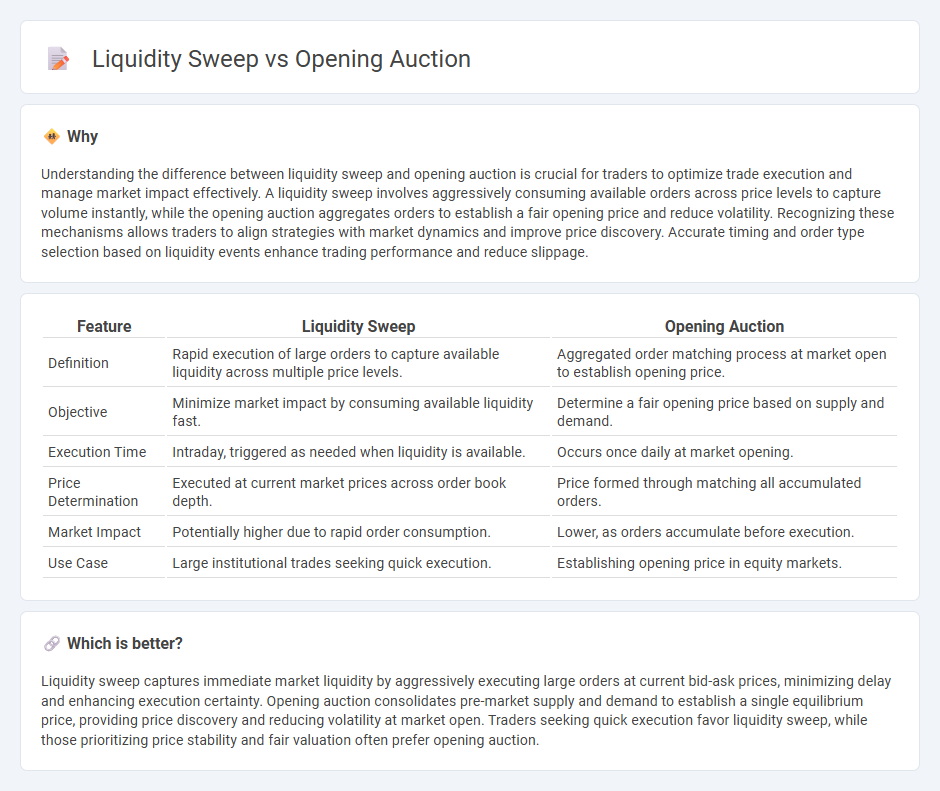

Understanding the difference between liquidity sweep and opening auction is crucial for traders to optimize trade execution and manage market impact effectively. A liquidity sweep involves aggressively consuming available orders across price levels to capture volume instantly, while the opening auction aggregates orders to establish a fair opening price and reduce volatility. Recognizing these mechanisms allows traders to align strategies with market dynamics and improve price discovery. Accurate timing and order type selection based on liquidity events enhance trading performance and reduce slippage.

Comparison Table

| Feature | Liquidity Sweep | Opening Auction |

|---|---|---|

| Definition | Rapid execution of large orders to capture available liquidity across multiple price levels. | Aggregated order matching process at market open to establish opening price. |

| Objective | Minimize market impact by consuming available liquidity fast. | Determine a fair opening price based on supply and demand. |

| Execution Time | Intraday, triggered as needed when liquidity is available. | Occurs once daily at market opening. |

| Price Determination | Executed at current market prices across order book depth. | Price formed through matching all accumulated orders. |

| Market Impact | Potentially higher due to rapid order consumption. | Lower, as orders accumulate before execution. |

| Use Case | Large institutional trades seeking quick execution. | Establishing opening price in equity markets. |

Which is better?

Liquidity sweep captures immediate market liquidity by aggressively executing large orders at current bid-ask prices, minimizing delay and enhancing execution certainty. Opening auction consolidates pre-market supply and demand to establish a single equilibrium price, providing price discovery and reducing volatility at market open. Traders seeking quick execution favor liquidity sweep, while those prioritizing price stability and fair valuation often prefer opening auction.

Connection

Liquidity sweeps occur during the opening auction as large orders are matched against available liquidity to establish the opening price efficiently. The opening auction aggregates buy and sell orders, optimizing liquidity distribution and minimizing price volatility at market open. This connection enhances market stability by ensuring smoother price discovery through concentrated liquidity.

Key Terms

Order Imbalance

The opening auction plays a critical role in determining the initial price by aggregating buy and sell orders to address order imbalances before the market opens, ensuring price discovery and market stability. In contrast, a liquidity sweep aims to exploit temporary order imbalances during regular trading hours by rapidly executing large orders to capture available liquidity across price levels. Explore the dynamics of order imbalances in more detail to enhance your trading strategy.

Market Open

The opening auction sets the initial market price by aggregating buy and sell orders to establish a stable and fair opening price, ensuring balanced liquidity at market open. In contrast, a liquidity sweep aggressively executes large orders to capture available liquidity immediately, often impacting price volatility at the start of trading. Explore the nuances between these mechanisms to optimize trading strategies at market open.

Price Discovery

Opening auctions play a crucial role in price discovery by aggregating buy and sell orders at market open to establish a fair opening price based on supply and demand. Liquidity sweeps, on the other hand, rapidly execute large orders by consuming available liquidity, which can temporarily disrupt price signals but ultimately realign prices with current market conditions. Explore more to understand how these mechanisms impact trading strategies and market efficiency.

Source and External Links

NYSE American Trading Information - The opening auction is a single-price auction matching buy and sell orders at the Indicative Match Price to maximize the tradable volume, starting with order collection early morning and determining the opening price by a system that balances executable volume and price proximity to reference prices.

Cboe Titanium U.S. Equities Auction Process - The Cboe opening auction aims to efficiently maximize executed shares at a single price by selecting prices that minimize imbalance and use tie-breakers, disseminating auction details to market participants before merging auction and continuous books to set the opening price.

NYSE Opening and Closing Auctions Fact Sheet - The NYSE opening auction involves order entry starting at 6:30 a.m. for NYSE-listed securities, disseminates imbalance information up to the 9:30 a.m. official open, and opens securities algorithmically or manually based on price range and crossing interest, ensuring efficient price discovery and liquidity at market open.

dowidth.com

dowidth.com