High frequency trading leverages powerful algorithms and ultra-low latency connections to execute thousands of trades within milliseconds, capitalizing on minute price discrepancies across markets. Order flow trading focuses on analyzing the real-time stream of buy and sell orders to predict short-term price movements and market direction. Discover the nuanced differences and strategies behind these cutting-edge trading techniques.

Why it is important

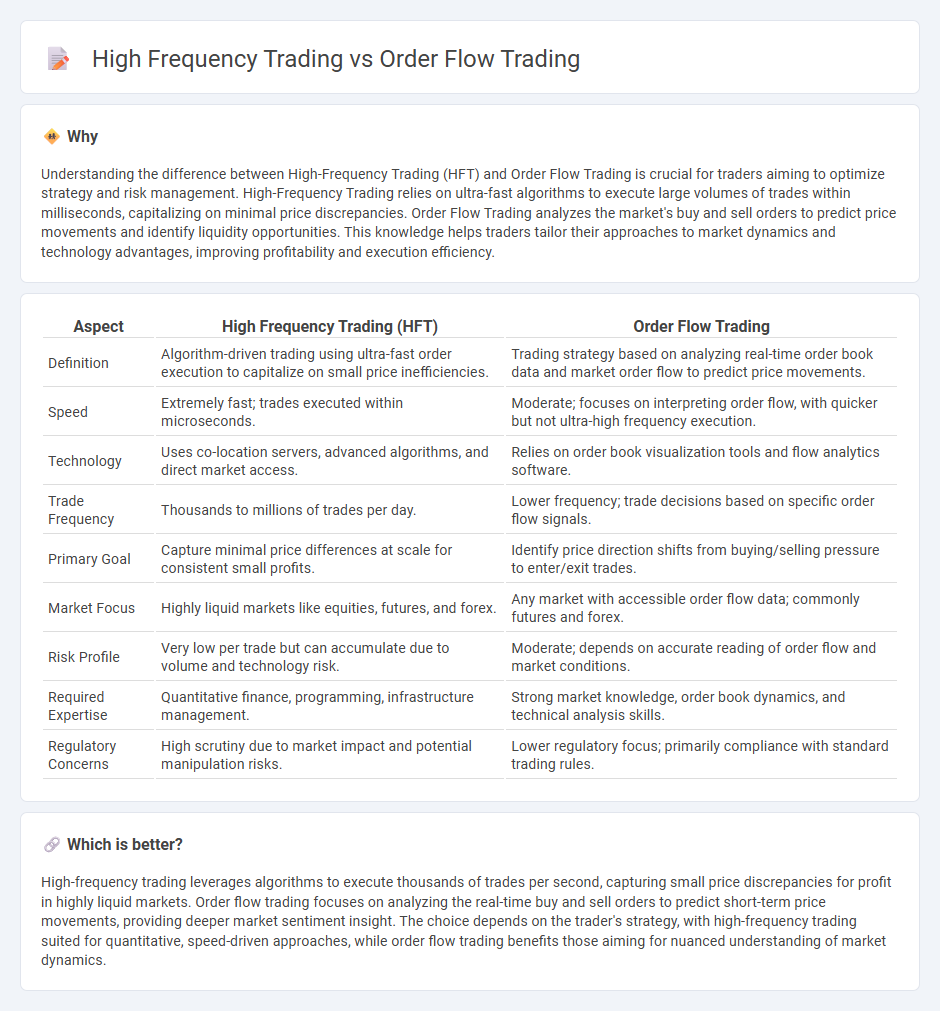

Understanding the difference between High-Frequency Trading (HFT) and Order Flow Trading is crucial for traders aiming to optimize strategy and risk management. High-Frequency Trading relies on ultra-fast algorithms to execute large volumes of trades within milliseconds, capitalizing on minimal price discrepancies. Order Flow Trading analyzes the market's buy and sell orders to predict price movements and identify liquidity opportunities. This knowledge helps traders tailor their approaches to market dynamics and technology advantages, improving profitability and execution efficiency.

Comparison Table

| Aspect | High Frequency Trading (HFT) | Order Flow Trading |

|---|---|---|

| Definition | Algorithm-driven trading using ultra-fast order execution to capitalize on small price inefficiencies. | Trading strategy based on analyzing real-time order book data and market order flow to predict price movements. |

| Speed | Extremely fast; trades executed within microseconds. | Moderate; focuses on interpreting order flow, with quicker but not ultra-high frequency execution. |

| Technology | Uses co-location servers, advanced algorithms, and direct market access. | Relies on order book visualization tools and flow analytics software. |

| Trade Frequency | Thousands to millions of trades per day. | Lower frequency; trade decisions based on specific order flow signals. |

| Primary Goal | Capture minimal price differences at scale for consistent small profits. | Identify price direction shifts from buying/selling pressure to enter/exit trades. |

| Market Focus | Highly liquid markets like equities, futures, and forex. | Any market with accessible order flow data; commonly futures and forex. |

| Risk Profile | Very low per trade but can accumulate due to volume and technology risk. | Moderate; depends on accurate reading of order flow and market conditions. |

| Required Expertise | Quantitative finance, programming, infrastructure management. | Strong market knowledge, order book dynamics, and technical analysis skills. |

| Regulatory Concerns | High scrutiny due to market impact and potential manipulation risks. | Lower regulatory focus; primarily compliance with standard trading rules. |

Which is better?

High-frequency trading leverages algorithms to execute thousands of trades per second, capturing small price discrepancies for profit in highly liquid markets. Order flow trading focuses on analyzing the real-time buy and sell orders to predict short-term price movements, providing deeper market sentiment insight. The choice depends on the trader's strategy, with high-frequency trading suited for quantitative, speed-driven approaches, while order flow trading benefits those aiming for nuanced understanding of market dynamics.

Connection

High frequency trading (HFT) leverages advanced algorithms and ultra-low latency data to execute a large number of trades within milliseconds, capitalizing on minute price discrepancies in the market. Order flow trading analyzes the real-time buy and sell orders to predict short-term price movements, providing valuable insights into market sentiment and liquidity. The connection lies in HFT using order flow information to anticipate market microstructure changes, enabling faster and more informed trading decisions.

Key Terms

**Order Flow Trading:**

Order Flow Trading analyzes real-time market orders, focusing on the buying and selling pressure within the order book to predict short-term price movements. It relies on interpreting trade volume, bid-ask spreads, and market depth to identify liquidity imbalances and potential reversals. Discover how mastering order flow trading can enhance your market insights and trading strategies.

Liquidity

Order flow trading analyzes real-time market transactions to interpret liquidity and anticipate price movements based on the intentions of large traders. High frequency trading (HFT) exploits speed and sophisticated algorithms to provide liquidity through rapid order placements and cancellations, often profiting from minimal price discrepancies. Explore the distinct liquidity roles and strategies of order flow trading and high frequency trading for deeper insights.

Market Depth

Order flow trading analyzes real-time market depth data to identify supply and demand imbalances by examining the order book's bid and ask volumes, enabling traders to anticipate price movements with precision. High frequency trading leverages sophisticated algorithms and ultra-low latency connections to rapidly execute large volumes of trades within milliseconds, capitalizing on fleeting arbitrage opportunities across market depth levels. Explore the nuances of market depth and trading strategies to enhance your understanding of these advanced trading techniques.

Source and External Links

Technical Analysis vs. Order Flow: Techniques and Tools for Traders - Order flow trading involves analyzing the real-time flow of buy and sell orders, including their size and aggressiveness, to predict price movements by reading the order book and analyzing volume clusters and pivot points for support and resistance zones.

Lesson 1 - The Basics of Order Flow - Jigsaw Trading - Order flow trading is based on observing how market orders hit limit orders, causing those limit orders to be hit or pulled, which drives price movements and reflects buying or selling pressure in the market.

Order Flow Trading & Volumetric Bars | NinjaTrader - Order flow trading uses tools like volumetric bars, volume profiles, VWAP, and cumulative delta to visualize buying and selling pressure and confirm trends by tracking executed order activity and volume distribution at price levels.

dowidth.com

dowidth.com