Delta neutral strategy involves balancing positive and negative delta positions to minimize directional risk and achieve market neutrality, often using options to hedge underlying asset price movements. Iron condor is a popular delta neutral options strategy combining a bull put spread and a bear call spread to generate income within a defined price range while limiting risk. Explore detailed comparisons and practical applications to understand which strategy suits your trading goals best.

Why it is important

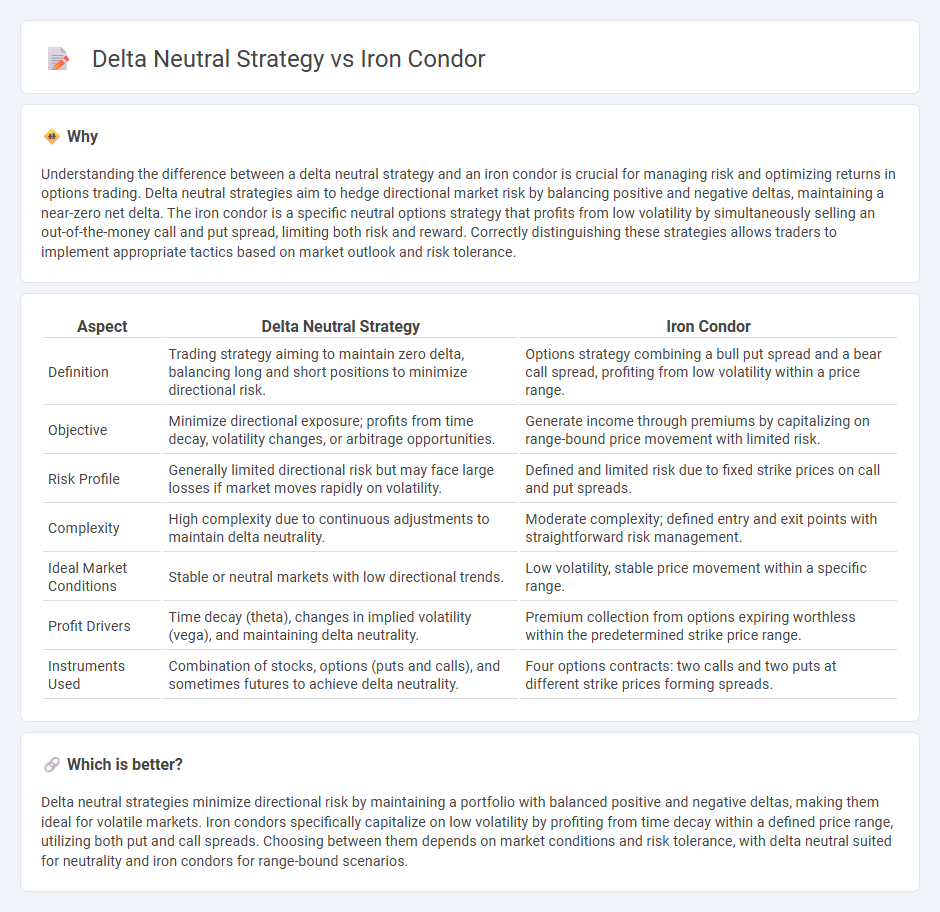

Understanding the difference between a delta neutral strategy and an iron condor is crucial for managing risk and optimizing returns in options trading. Delta neutral strategies aim to hedge directional market risk by balancing positive and negative deltas, maintaining a near-zero net delta. The iron condor is a specific neutral options strategy that profits from low volatility by simultaneously selling an out-of-the-money call and put spread, limiting both risk and reward. Correctly distinguishing these strategies allows traders to implement appropriate tactics based on market outlook and risk tolerance.

Comparison Table

| Aspect | Delta Neutral Strategy | Iron Condor |

|---|---|---|

| Definition | Trading strategy aiming to maintain zero delta, balancing long and short positions to minimize directional risk. | Options strategy combining a bull put spread and a bear call spread, profiting from low volatility within a price range. |

| Objective | Minimize directional exposure; profits from time decay, volatility changes, or arbitrage opportunities. | Generate income through premiums by capitalizing on range-bound price movement with limited risk. |

| Risk Profile | Generally limited directional risk but may face large losses if market moves rapidly on volatility. | Defined and limited risk due to fixed strike prices on call and put spreads. |

| Complexity | High complexity due to continuous adjustments to maintain delta neutrality. | Moderate complexity; defined entry and exit points with straightforward risk management. |

| Ideal Market Conditions | Stable or neutral markets with low directional trends. | Low volatility, stable price movement within a specific range. |

| Profit Drivers | Time decay (theta), changes in implied volatility (vega), and maintaining delta neutrality. | Premium collection from options expiring worthless within the predetermined strike price range. |

| Instruments Used | Combination of stocks, options (puts and calls), and sometimes futures to achieve delta neutrality. | Four options contracts: two calls and two puts at different strike prices forming spreads. |

Which is better?

Delta neutral strategies minimize directional risk by maintaining a portfolio with balanced positive and negative deltas, making them ideal for volatile markets. Iron condors specifically capitalize on low volatility by profiting from time decay within a defined price range, utilizing both put and call spreads. Choosing between them depends on market conditions and risk tolerance, with delta neutral suited for neutrality and iron condors for range-bound scenarios.

Connection

Delta neutral strategy involves balancing positive and negative delta positions to achieve a net delta of zero, minimizing directional risk in trading. The iron condor is a popular delta neutral options strategy utilizing four different strike prices to generate profits from low volatility by selling an out-of-the-money call and put spread simultaneously. Both approaches focus on hedging against price movements while aiming to profit from time decay and stable market conditions.

Key Terms

Option Spreads

Iron condor and delta neutral strategies both utilize option spreads to manage risk and generate consistent income with limited directional exposure. The iron condor employs multiple strike prices in a four-leg spread to capitalize on low volatility and time decay, whereas delta neutral strategies often adjust positions dynamically to maintain a net delta close to zero, hedging against price movements. Explore how option spreads can enhance portfolio stability and income potential through tailored approaches.

Implied Volatility

Iron condor strategies capitalize on high implied volatility by selling out-of-the-money call and put spreads, aiming to profit from volatility contraction and time decay. Delta neutral strategies focus on maintaining a portfolio's delta close to zero, trading options and underlying assets to hedge directional risk while betting on minimal price movement, often sensitive to changes in implied volatility. Explore more about how implied volatility impacts risk management and profitability in these option strategies.

Hedging

Iron condor and delta-neutral strategies both serve as hedging techniques in options trading, aiming to mitigate risk while maintaining limited exposure to market volatility. The iron condor focuses on establishing a range-bound profit by selling both put and call spreads, while a delta-neutral strategy dynamically balances positive and negative deltas to achieve near-zero directional exposure. Explore the nuances of these strategies to enhance your portfolio's risk management and optimize hedging effectiveness.

Source and External Links

Iron Condor Options Trading Strategy - tastylive - An iron condor is a directionally neutral, defined risk options strategy that combines an out-of-the-money short put credit spread and an out-of-the-money short call credit spread, profiting when the stock trades within a range until expiration.

Iron Condors & Butterflies Explained - TradeStation - This strategy involves selling two out-of-the-money credit spreads simultaneously, aiming to keep the underlying asset's price between the short strikes at expiration, with capped maximum loss and profit defined by the spreads' width.

Iron condor - Wikipedia - The iron condor consists of two vertical spreads (put spread and call spread) with the same expiration and four different strikes, designed to profit when the asset price remains outside or inside defined strike ranges depending on the long or short condor position.

dowidth.com

dowidth.com