Gamma scalping involves actively managing an options position to capitalize on price fluctuations by adjusting the hedge ratio, aiming to profit from changes in an asset's volatility. Straddle strategy consists of buying a call and put option at the same strike price, targeting significant price movement in either direction without predicting market direction. Explore detailed comparisons and strategic applications to optimize your trading approach.

Why it is important

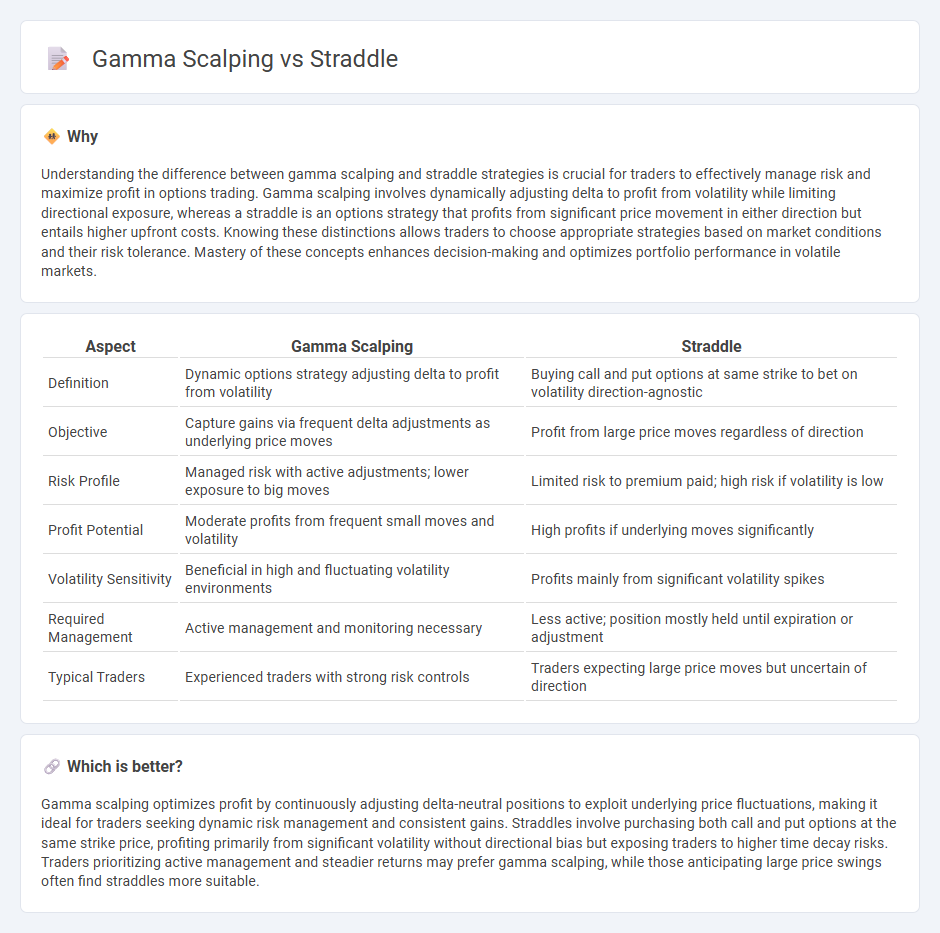

Understanding the difference between gamma scalping and straddle strategies is crucial for traders to effectively manage risk and maximize profit in options trading. Gamma scalping involves dynamically adjusting delta to profit from volatility while limiting directional exposure, whereas a straddle is an options strategy that profits from significant price movement in either direction but entails higher upfront costs. Knowing these distinctions allows traders to choose appropriate strategies based on market conditions and their risk tolerance. Mastery of these concepts enhances decision-making and optimizes portfolio performance in volatile markets.

Comparison Table

| Aspect | Gamma Scalping | Straddle |

|---|---|---|

| Definition | Dynamic options strategy adjusting delta to profit from volatility | Buying call and put options at same strike to bet on volatility direction-agnostic |

| Objective | Capture gains via frequent delta adjustments as underlying price moves | Profit from large price moves regardless of direction |

| Risk Profile | Managed risk with active adjustments; lower exposure to big moves | Limited risk to premium paid; high risk if volatility is low |

| Profit Potential | Moderate profits from frequent small moves and volatility | High profits if underlying moves significantly |

| Volatility Sensitivity | Beneficial in high and fluctuating volatility environments | Profits mainly from significant volatility spikes |

| Required Management | Active management and monitoring necessary | Less active; position mostly held until expiration or adjustment |

| Typical Traders | Experienced traders with strong risk controls | Traders expecting large price moves but uncertain of direction |

Which is better?

Gamma scalping optimizes profit by continuously adjusting delta-neutral positions to exploit underlying price fluctuations, making it ideal for traders seeking dynamic risk management and consistent gains. Straddles involve purchasing both call and put options at the same strike price, profiting primarily from significant volatility without directional bias but exposing traders to higher time decay risks. Traders prioritizing active management and steadier returns may prefer gamma scalping, while those anticipating large price swings often find straddles more suitable.

Connection

Gamma scalping is a dynamic trading strategy that involves continuously adjusting a delta-neutral options position to profit from changes in the underlying asset's price volatility. A straddle, which consists of simultaneously buying a call and a put option at the same strike price and expiration date, serves as a foundational position for gamma scalping due to its high gamma exposure. By leveraging the gamma of a straddle, traders can execute gamma scalping to capture profits from price fluctuations while managing delta risk effectively.

Key Terms

Options Premium

Straddle and gamma scalping strategies both aim to capitalize on options premium but differ fundamentally in approach; straddles involve purchasing both call and put options to profit from volatility spikes, while gamma scalping continuously adjusts the delta position to hedge and capture premium decay. The effectiveness of each strategy depends on market conditions, implied volatility, and rapid price movements, with straddles benefiting from large, sudden moves and gamma scalping thriving in fluctuating markets with high gamma exposure. Explore detailed tactics and risk considerations to optimize your options premium management.

Implied Volatility

Straddle strategies capitalize on expected increases in implied volatility by purchasing both call and put options to profit from significant price movements regardless of direction. Gamma scalping involves dynamically adjusting positions to manage the gamma exposure of an options portfolio, benefiting from changes in implied volatility and underlying asset price fluctuations. Explore the nuances of implied volatility's impact on these options strategies to enhance your trading approach.

Delta Neutral

Straddle and gamma scalping strategies both target delta neutral positions but differ in risk management and profit generation. Straddle involves purchasing both call and put options to capitalize on volatility without directional bias, while gamma scalping actively adjusts the delta hedge to profit from underlying price movements. Explore the distinct techniques and applications of these strategies to enhance your options trading approach.

Source and External Links

Straddle - Definition, How to Create It, Examples - A straddle strategy involves simultaneously buying and selling a call option and a put option on the same underlying asset, with the same strike price and expiration date, typically used when a trader expects high price volatility but is unsure of the direction.

Straddle - A straddle in finance is an options strategy that involves buying or selling both a call and a put option with the same strike price and expiration date, allowing a trader to profit from significant price movements in either direction.

Long Straddle Options Strategy - A long straddle consists of buying one call and one put option at the same strike and expiration to profit from substantial moves in the stock price, regardless of direction, with the maximum loss limited to the initial cost.

dowidth.com

dowidth.com