Stop hunting targets traders' stop-loss orders by pushing prices to trigger them, creating artificial volatility for strategic gain. Liquidity grabs focus on absorbing available market liquidity to execute larger trades without causing significant price shifts. Explore these trading tactics to better understand market dynamics and improve your strategy.

Why it is important

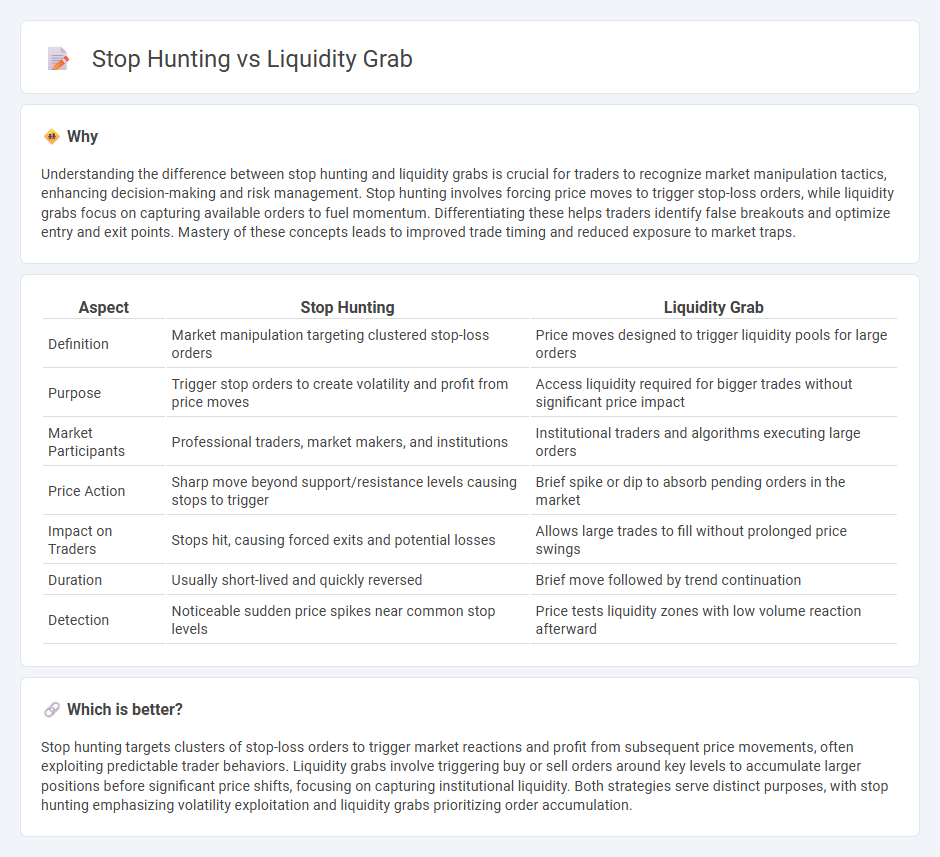

Understanding the difference between stop hunting and liquidity grabs is crucial for traders to recognize market manipulation tactics, enhancing decision-making and risk management. Stop hunting involves forcing price moves to trigger stop-loss orders, while liquidity grabs focus on capturing available orders to fuel momentum. Differentiating these helps traders identify false breakouts and optimize entry and exit points. Mastery of these concepts leads to improved trade timing and reduced exposure to market traps.

Comparison Table

| Aspect | Stop Hunting | Liquidity Grab |

|---|---|---|

| Definition | Market manipulation targeting clustered stop-loss orders | Price moves designed to trigger liquidity pools for large orders |

| Purpose | Trigger stop orders to create volatility and profit from price moves | Access liquidity required for bigger trades without significant price impact |

| Market Participants | Professional traders, market makers, and institutions | Institutional traders and algorithms executing large orders |

| Price Action | Sharp move beyond support/resistance levels causing stops to trigger | Brief spike or dip to absorb pending orders in the market |

| Impact on Traders | Stops hit, causing forced exits and potential losses | Allows large trades to fill without prolonged price swings |

| Duration | Usually short-lived and quickly reversed | Brief move followed by trend continuation |

| Detection | Noticeable sudden price spikes near common stop levels | Price tests liquidity zones with low volume reaction afterward |

Which is better?

Stop hunting targets clusters of stop-loss orders to trigger market reactions and profit from subsequent price movements, often exploiting predictable trader behaviors. Liquidity grabs involve triggering buy or sell orders around key levels to accumulate larger positions before significant price shifts, focusing on capturing institutional liquidity. Both strategies serve distinct purposes, with stop hunting emphasizing volatility exploitation and liquidity grabs prioritizing order accumulation.

Connection

Stop hunting and liquidity grabs are interconnected trading strategies where market participants target stop-loss orders to trigger price movements, creating liquidity opportunities. Traders exploit these zones of accumulated stops to induce sharp price reversals or breakouts, capturing the resulting liquidity for profit. Understanding these dynamics aids in anticipating market manipulation and improving risk management during volatile trading sessions.

Key Terms

Order Book

Liquidity grab targets clustered stop orders in the order book to trigger rapid price movements, allowing larger players to absorb liquidity at advantageous levels. Stop hunting exploits predictable stop-loss zones identified in the order book to induce forced exits from positions and manipulate market direction. Explore deeper insights into order book dynamics to differentiate and capitalize on these trading tactics.

Stop-Loss Orders

Stop-loss orders are key targets in both liquidity grabs and stop hunting strategies, as traders' automatic sell or buy actions create rapid price movements. Liquidity grabs involve triggering stop-loss levels to access deeper market liquidity, while stop hunting aims to push prices beyond these points to force liquidations and manipulate market direction. Explore how understanding stop-loss dynamics can enhance your trading tactics and risk management.

Market Manipulation

Liquidity grab and stop hunting are prevalent market manipulation tactics where large traders trigger stop-loss orders to exploit price movements. Liquidity grabs involve targeting clustered stop orders to create false price breakouts, allowing manipulators to fill positions at favorable prices. Explore detailed strategies and safeguards against these deceptive practices to enhance your trading resilience.

Source and External Links

Liquidity Grab in Trading - A liquidity grab is a sharp price move triggered when a cluster of stop-loss or entry/exit orders is hit, creating an opportunity for traders to profit from this sudden market liquidity absorption, often at psychological price levels or beyond prior swing highs/lows.

Liquidity Grabs: A Crucial Concept in the Investment World - Liquidity grabs occur when large orders absorb available liquidity at key price levels, often causing sudden price spikes; savvy traders use strategies like "fade the move" or placing limit orders at key levels to profit as prices revert after the grab.

The Liquidity Grab Trading Strategy - Mind Math Money - Smart money pushes prices to liquidity zones to trigger stop-losses and pool orders, then exploits this imbalance by entering trades on the candle close after the grab, using tight stop-losses and aiming for favorable risk-reward ratios.

dowidth.com

dowidth.com