Degen trading involves high-risk, short-term trades based on market momentum and speculative trends, often leveraging volatile assets like cryptocurrencies or meme stocks. Fundamental analysis trading focuses on evaluating an asset's intrinsic value through financial statements, economic indicators, and industry conditions to make informed investment decisions. Explore the key differences and strategies behind degen trading and fundamental analysis to enhance your trading approach.

Why it is important

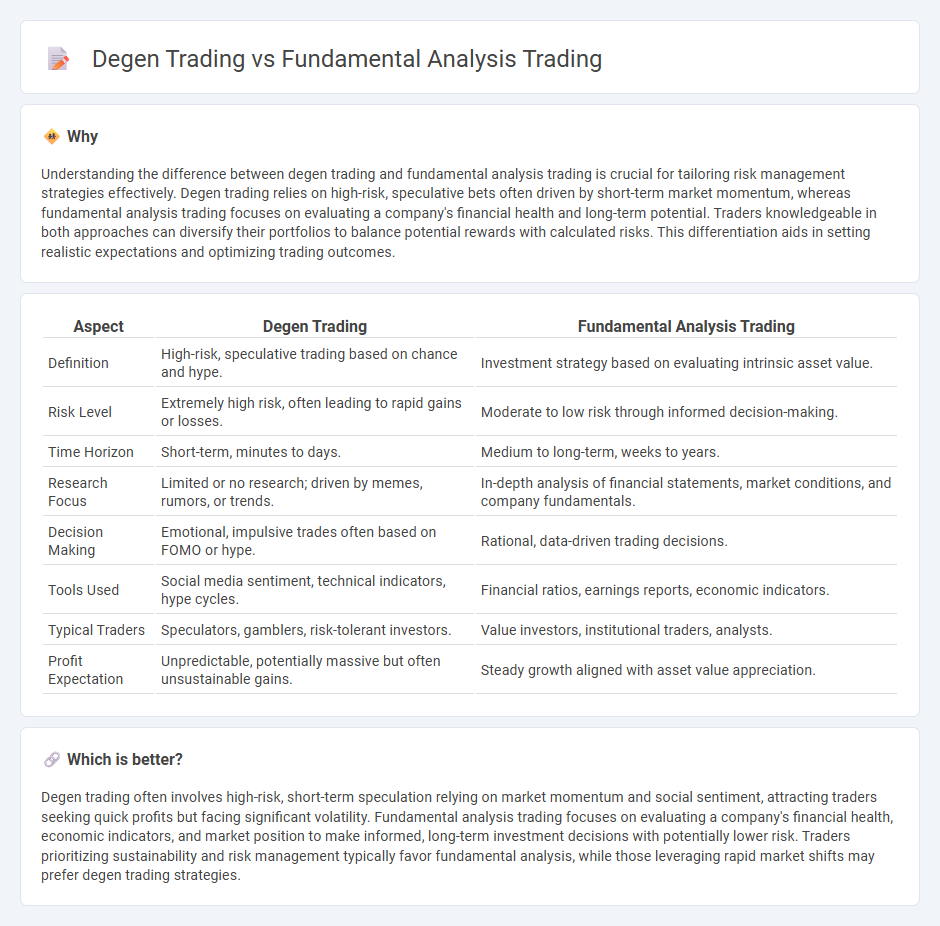

Understanding the difference between degen trading and fundamental analysis trading is crucial for tailoring risk management strategies effectively. Degen trading relies on high-risk, speculative bets often driven by short-term market momentum, whereas fundamental analysis trading focuses on evaluating a company's financial health and long-term potential. Traders knowledgeable in both approaches can diversify their portfolios to balance potential rewards with calculated risks. This differentiation aids in setting realistic expectations and optimizing trading outcomes.

Comparison Table

| Aspect | Degen Trading | Fundamental Analysis Trading |

|---|---|---|

| Definition | High-risk, speculative trading based on chance and hype. | Investment strategy based on evaluating intrinsic asset value. |

| Risk Level | Extremely high risk, often leading to rapid gains or losses. | Moderate to low risk through informed decision-making. |

| Time Horizon | Short-term, minutes to days. | Medium to long-term, weeks to years. |

| Research Focus | Limited or no research; driven by memes, rumors, or trends. | In-depth analysis of financial statements, market conditions, and company fundamentals. |

| Decision Making | Emotional, impulsive trades often based on FOMO or hype. | Rational, data-driven trading decisions. |

| Tools Used | Social media sentiment, technical indicators, hype cycles. | Financial ratios, earnings reports, economic indicators. |

| Typical Traders | Speculators, gamblers, risk-tolerant investors. | Value investors, institutional traders, analysts. |

| Profit Expectation | Unpredictable, potentially massive but often unsustainable gains. | Steady growth aligned with asset value appreciation. |

Which is better?

Degen trading often involves high-risk, short-term speculation relying on market momentum and social sentiment, attracting traders seeking quick profits but facing significant volatility. Fundamental analysis trading focuses on evaluating a company's financial health, economic indicators, and market position to make informed, long-term investment decisions with potentially lower risk. Traders prioritizing sustainability and risk management typically favor fundamental analysis, while those leveraging rapid market shifts may prefer degen trading strategies.

Connection

Degen trading relies on high-risk, speculative decisions often driven by short-term market trends, while fundamental analysis trading focuses on evaluating intrinsic asset value through economic indicators and company performance. Both approaches intersect as degen traders may utilize fundamental analysis insights to identify undervalued assets with potential for rapid gains. This fusion enhances decision-making by combining speculative momentum with deeper market understanding to optimize trading strategies.

Key Terms

Fundamental Analysis Trading:

Fundamental analysis trading involves evaluating a company's financial statements, industry position, and economic factors to determine its intrinsic value and make informed investment decisions. This method prioritizes long-term growth potential and risk management by focusing on earnings reports, revenue trends, and macroeconomic indicators. Explore more to understand how fundamental analysis can enhance your trading strategy and portfolio performance.

Earnings Reports

Fundamental analysis trading centers on evaluating earnings reports to assess a company's financial health, profitability, and growth potential, providing data-driven insights for informed investment decisions. In contrast, degen trading often relies on speculative, high-risk strategies with less emphasis on detailed earnings analysis, favoring short-term market trends and volatility. Explore more to understand how earnings reports impact different trading styles and optimize your strategy.

Intrinsic Value

Fundamental analysis trading emphasizes evaluating a security's intrinsic value by examining financial statements, industry trends, and economic indicators to identify undervalued assets for long-term gains. Degen trading, on the other hand, relies on high-risk speculative moves without thorough valuation, often driven by market hype and quick momentum. Explore comprehensive insights on how intrinsic value shapes these distinct trading strategies.

Source and External Links

What is Fundamental Analysis and How Does it Work? - Fundamental analysis examines external economic factors like central bank interest rates, GDP, and employment data that affect the value of stocks, commodities, or currencies to forecast market direction and value changes.

Beginners Guide to Fundamental Analysis | Learn to Trade - Fundamental analysis assesses an asset's strength by analyzing macroeconomic factors (top-down) or the instrument itself (bottom-up), focusing on forces driving supply and demand, such as interest rates and trade balance.

Fundamental Analysis - This method aims to determine the intrinsic value of an asset through economic, industry, and company analysis, enabling investors to identify mispriced securities and trade based on correcting market valuations over time.

dowidth.com

dowidth.com