Smart Money Concepts revolve around tracking institutional investors' movements to predict market trends, emphasizing volume analysis and order flow dynamics. Liquidity Grabs focus on sudden price spikes designed to trigger stop-loss orders, providing opportunities to exploit market inefficiencies. Explore deeper into how these strategies interplay to enhance your trading accuracy.

Why it is important

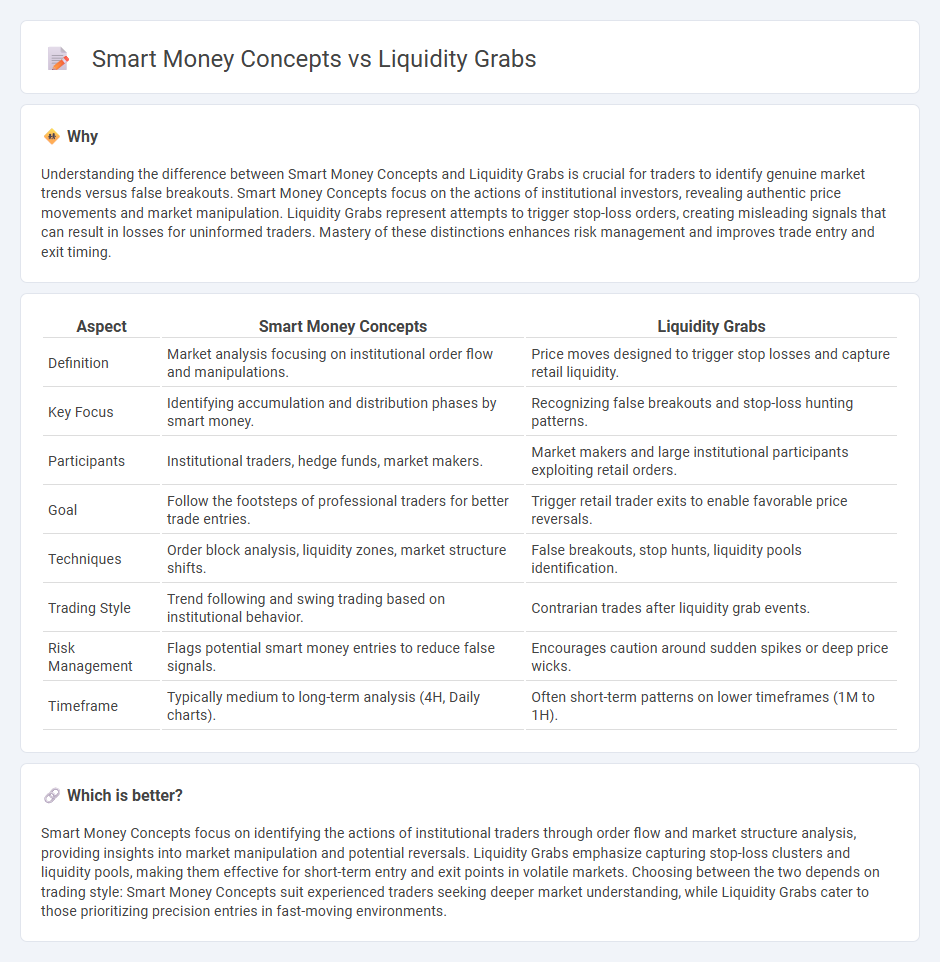

Understanding the difference between Smart Money Concepts and Liquidity Grabs is crucial for traders to identify genuine market trends versus false breakouts. Smart Money Concepts focus on the actions of institutional investors, revealing authentic price movements and market manipulation. Liquidity Grabs represent attempts to trigger stop-loss orders, creating misleading signals that can result in losses for uninformed traders. Mastery of these distinctions enhances risk management and improves trade entry and exit timing.

Comparison Table

| Aspect | Smart Money Concepts | Liquidity Grabs |

|---|---|---|

| Definition | Market analysis focusing on institutional order flow and manipulations. | Price moves designed to trigger stop losses and capture retail liquidity. |

| Key Focus | Identifying accumulation and distribution phases by smart money. | Recognizing false breakouts and stop-loss hunting patterns. |

| Participants | Institutional traders, hedge funds, market makers. | Market makers and large institutional participants exploiting retail orders. |

| Goal | Follow the footsteps of professional traders for better trade entries. | Trigger retail trader exits to enable favorable price reversals. |

| Techniques | Order block analysis, liquidity zones, market structure shifts. | False breakouts, stop hunts, liquidity pools identification. |

| Trading Style | Trend following and swing trading based on institutional behavior. | Contrarian trades after liquidity grab events. |

| Risk Management | Flags potential smart money entries to reduce false signals. | Encourages caution around sudden spikes or deep price wicks. |

| Timeframe | Typically medium to long-term analysis (4H, Daily charts). | Often short-term patterns on lower timeframes (1M to 1H). |

Which is better?

Smart Money Concepts focus on identifying the actions of institutional traders through order flow and market structure analysis, providing insights into market manipulation and potential reversals. Liquidity Grabs emphasize capturing stop-loss clusters and liquidity pools, making them effective for short-term entry and exit points in volatile markets. Choosing between the two depends on trading style: Smart Money Concepts suit experienced traders seeking deeper market understanding, while Liquidity Grabs cater to those prioritizing precision entries in fast-moving environments.

Connection

Smart money concepts identify institutional trading patterns by analyzing market liquidity zones where large financial players operate. Liquidity grabs occur when price temporarily moves beyond support or resistance levels, triggering stop-loss orders and attracting market participants, which smart money exploits to enter or exit positions. Understanding this connection helps traders align with professional strategies, enhancing trade timing and risk management.

Key Terms

Stop Loss Hunt

Liquidity grabs occur when market makers deliberately push prices to trigger clustered stop-loss orders, creating artificial volatility and liquidity pools to capitalize on retail traders' positions. Smart money concepts emphasize these stop loss hunts as strategic moves by institutional players to accumulate positions at favorable prices before driving the trend in their desired direction. Explore how understanding stop loss hunts within liquidity grabs and smart money tactics can enhance your trading edge and risk management strategies.

Order Blocks

Order blocks represent significant price zones where institutional traders accumulate or distribute positions, often preceding major market moves. Liquidity grabs occur when price temporarily breaches these order blocks to trigger stop-loss orders, allowing smart money to enter the market at optimal levels. Explore the mechanics of order blocks and their role in smart money strategies for deeper trading insights.

Liquidity Pools

Liquidity pools represent centralized or decentralized reserves where assets are aggregated to facilitate trading and capital efficiency in financial markets. Unlike smart money strategies, which focus on informed investment decisions and market trends, liquidity grabs exploit large orders within these pools to trigger stop-losses and create rapid price movements. Explore how understanding liquidity pools enhances trading strategies and risk management.

Source and External Links

The Liquidity Grab Trading Strategy - Mind Math Money - A liquidity grab is when large market players ("smart money") push prices into liquidity zones to trigger stop-loss orders and collect liquidity, enabling them to enter or exit positions advantageously, often signaled by candlestick wicks beyond key support or resistance levels followed by a quick reversal.

Liquidity Grab in Trading [PDF] | HowToTrade - Liquidity grabs occur when price swiftly moves through areas with clustered stop-loss or entry orders around psychological price levels and swing highs/lows, triggering these orders and creating sharp price distortions that informed traders exploit for potential profit.

Liquidity Grabs Explained - Flux Charts - Liquidity grabs involve sweeping buy or sell liquidity at key market levels, causing many stop losses to trigger rapidly and often indicating potential market reversals, with bullish grabs suggesting upward trends and bearish grabs downward trends.

dowidth.com

dowidth.com