Tape reading focuses on analyzing real-time price and volume data to predict short-term market movements using Level 2 quotes and time and sales data. News trading capitalizes on market volatility triggered by breaking news and economic releases, requiring quick interpretation of headlines and sentiment shifts. Explore how mastering both techniques can enhance your trading strategy and decision-making precision.

Why it is important

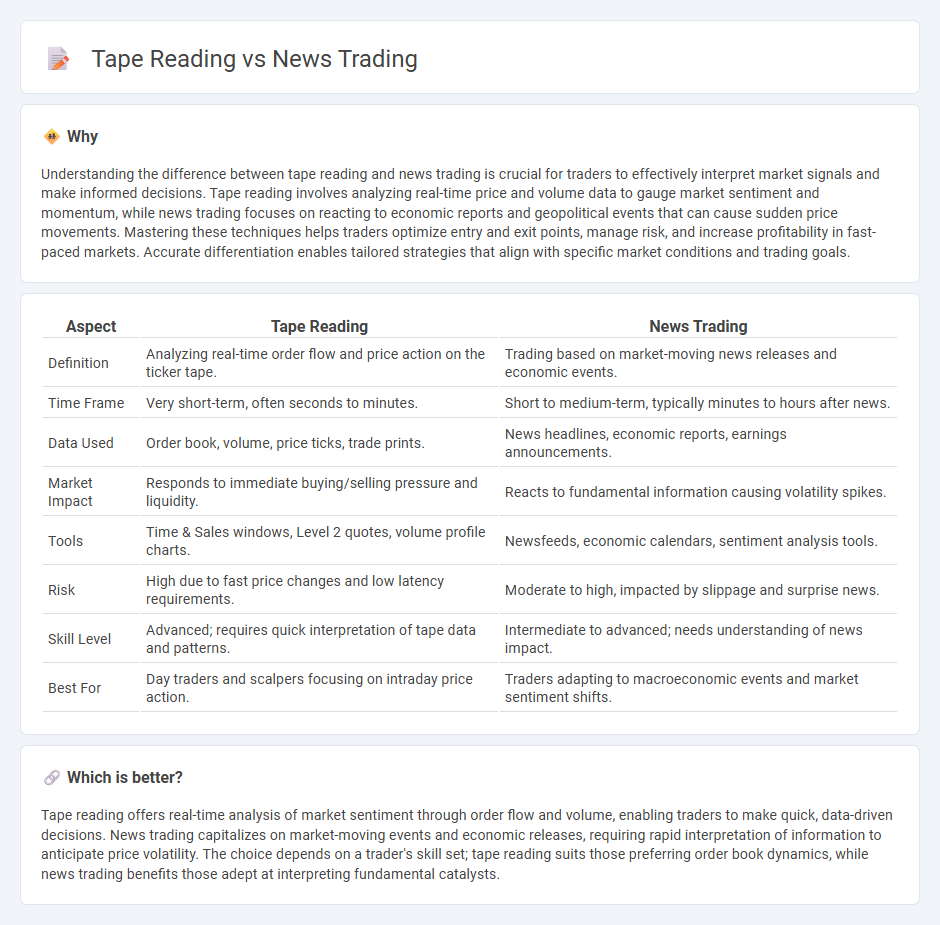

Understanding the difference between tape reading and news trading is crucial for traders to effectively interpret market signals and make informed decisions. Tape reading involves analyzing real-time price and volume data to gauge market sentiment and momentum, while news trading focuses on reacting to economic reports and geopolitical events that can cause sudden price movements. Mastering these techniques helps traders optimize entry and exit points, manage risk, and increase profitability in fast-paced markets. Accurate differentiation enables tailored strategies that align with specific market conditions and trading goals.

Comparison Table

| Aspect | Tape Reading | News Trading |

|---|---|---|

| Definition | Analyzing real-time order flow and price action on the ticker tape. | Trading based on market-moving news releases and economic events. |

| Time Frame | Very short-term, often seconds to minutes. | Short to medium-term, typically minutes to hours after news. |

| Data Used | Order book, volume, price ticks, trade prints. | News headlines, economic reports, earnings announcements. |

| Market Impact | Responds to immediate buying/selling pressure and liquidity. | Reacts to fundamental information causing volatility spikes. |

| Tools | Time & Sales windows, Level 2 quotes, volume profile charts. | Newsfeeds, economic calendars, sentiment analysis tools. |

| Risk | High due to fast price changes and low latency requirements. | Moderate to high, impacted by slippage and surprise news. |

| Skill Level | Advanced; requires quick interpretation of tape data and patterns. | Intermediate to advanced; needs understanding of news impact. |

| Best For | Day traders and scalpers focusing on intraday price action. | Traders adapting to macroeconomic events and market sentiment shifts. |

Which is better?

Tape reading offers real-time analysis of market sentiment through order flow and volume, enabling traders to make quick, data-driven decisions. News trading capitalizes on market-moving events and economic releases, requiring rapid interpretation of information to anticipate price volatility. The choice depends on a trader's skill set; tape reading suits those preferring order book dynamics, while news trading benefits those adept at interpreting fundamental catalysts.

Connection

Tape reading and news trading are interconnected trading techniques that rely on real-time information flow to make informed market decisions. Tape reading involves analyzing the stream of ticker tape data to gauge market sentiment and price momentum, while news trading focuses on interpreting news releases and economic reports to anticipate market reactions. Both methods require swift analysis and execution, as they capitalize on immediate market responses driven by the influx of new information.

Key Terms

**News Trading:**

News trading capitalizes on the immediate market reactions to economic releases, corporate announcements, and geopolitical events, leveraging real-time news feeds for quick decision-making. This strategy demands rapid interpretation of headlines, event impact analysis, and understanding market sentiment shifts to profit from volatility spikes. Explore the techniques and tools essential for mastering news trading to enhance your trading performance.

Economic Releases

News trading leverages rapid analysis of economic releases such as GDP reports, employment data, and inflation rates to capitalize on market volatility immediately following announcements. Tape reading focuses on interpreting real-time order flow and volume changes, providing traders with insights into market sentiment and potential price movements during these economic events. Explore further to understand how these strategies can enhance your trading decisions around key economic releases.

Market Sentiment

News trading capitalizes on real-time economic reports and headline events to gauge market sentiment and predict price movements. Tape reading involves analyzing the time and sales data to understand immediate supply and demand dynamics, offering a granular view of market sentiment shifts. Explore advanced strategies to master market sentiment through both news trading and tape reading techniques.

Source and External Links

News Trading Strategies | How To Trade The News | AvaTrade - News trading is a strategy that seeks to capitalize on market moves triggered by economic news releases, focusing on short-term, event-driven opportunities distinct from traditional technical and fundamental analysis approaches.

Trading the news - Wikipedia - Trading the news involves making timely trades based on economic, corporate, or geopolitical announcements that cause sharp price movements in equities, currencies, or other assets, and can be done manually or through algorithmic event-based trading systems.

News Trader - Overview, Types of News, and Strategies - A news trader makes investment decisions by anticipating and reacting to news events, exploiting market volatility occurring just before or immediately after announcements, often focusing on unexpected or recurring news such as economic reports or geopolitical developments.

dowidth.com

dowidth.com