Tape reading involves analyzing real-time price and volume data to make trading decisions, relying heavily on human intuition and pattern recognition. Algorithmic trading uses computer programs to execute pre-defined trading strategies based on quantitative models and historical data. Explore detailed comparisons to understand which approach aligns best with your trading goals and risk tolerance.

Why it is important

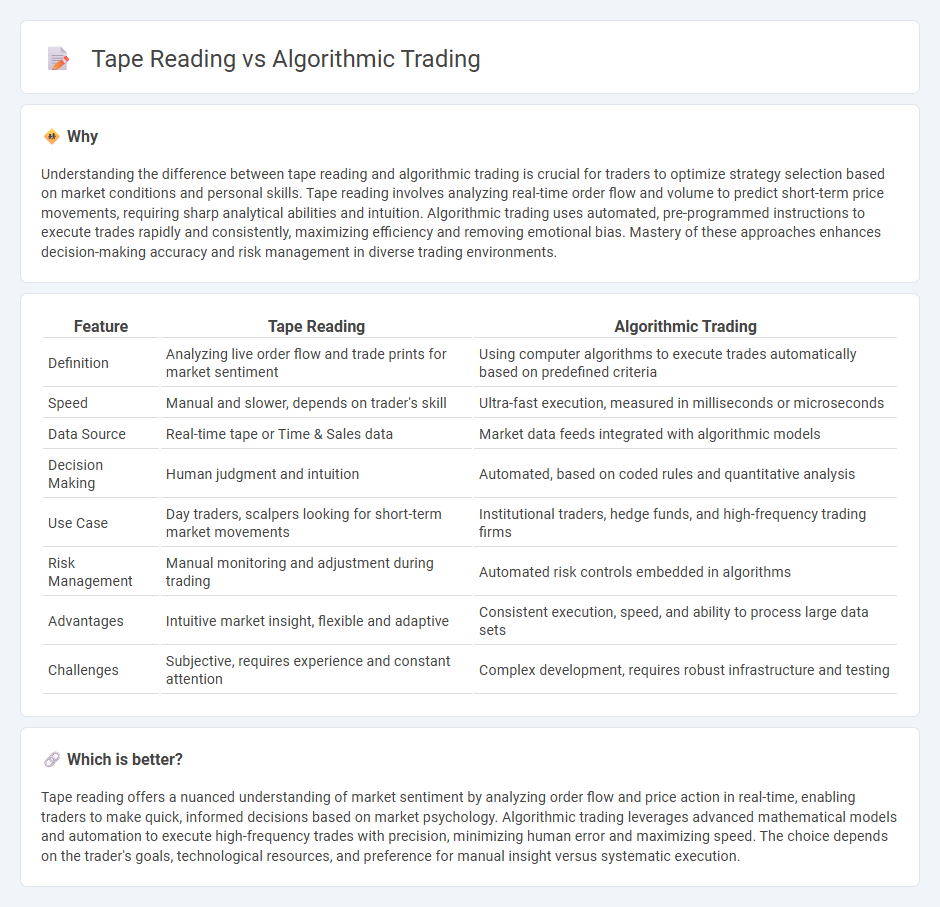

Understanding the difference between tape reading and algorithmic trading is crucial for traders to optimize strategy selection based on market conditions and personal skills. Tape reading involves analyzing real-time order flow and volume to predict short-term price movements, requiring sharp analytical abilities and intuition. Algorithmic trading uses automated, pre-programmed instructions to execute trades rapidly and consistently, maximizing efficiency and removing emotional bias. Mastery of these approaches enhances decision-making accuracy and risk management in diverse trading environments.

Comparison Table

| Feature | Tape Reading | Algorithmic Trading |

|---|---|---|

| Definition | Analyzing live order flow and trade prints for market sentiment | Using computer algorithms to execute trades automatically based on predefined criteria |

| Speed | Manual and slower, depends on trader's skill | Ultra-fast execution, measured in milliseconds or microseconds |

| Data Source | Real-time tape or Time & Sales data | Market data feeds integrated with algorithmic models |

| Decision Making | Human judgment and intuition | Automated, based on coded rules and quantitative analysis |

| Use Case | Day traders, scalpers looking for short-term market movements | Institutional traders, hedge funds, and high-frequency trading firms |

| Risk Management | Manual monitoring and adjustment during trading | Automated risk controls embedded in algorithms |

| Advantages | Intuitive market insight, flexible and adaptive | Consistent execution, speed, and ability to process large data sets |

| Challenges | Subjective, requires experience and constant attention | Complex development, requires robust infrastructure and testing |

Which is better?

Tape reading offers a nuanced understanding of market sentiment by analyzing order flow and price action in real-time, enabling traders to make quick, informed decisions based on market psychology. Algorithmic trading leverages advanced mathematical models and automation to execute high-frequency trades with precision, minimizing human error and maximizing speed. The choice depends on the trader's goals, technological resources, and preference for manual insight versus systematic execution.

Connection

Tape reading, which involves analyzing real-time price and volume data to anticipate market moves, serves as a foundational technique for developing algorithmic trading strategies. Algorithmic trading leverages automated systems to execute trades based on patterns identified through tape reading, enhancing speed and precision in high-frequency trading environments. This integration significantly improves market analysis accuracy and trade execution efficiency by combining human insight with machine processing power.

Key Terms

**Algorithmic Trading:**

Algorithmic trading utilizes advanced mathematical models and automated systems to execute high-frequency trades with precision, minimizing human error and maximizing speed. It processes vast amounts of market data in real-time to identify trading opportunities based on predefined criteria such as price patterns, volume, and market trends. Explore how algorithmic trading transforms decision-making and efficiency in modern financial markets.

Backtesting

Backtesting in algorithmic trading involves using historical price data to simulate and evaluate the performance of trading strategies, ensuring they adapt to various market conditions and optimize risk management. Tape reading relies more on interpreting real-time order flow and market depth rather than systematic backtesting, making it less quantifiable but highly responsive to immediate market dynamics. Explore how integrating both methods can enhance decision-making and improve trading efficacy.

Execution algorithms

Execution algorithms in algorithmic trading use pre-programmed instructions to automate order placement, optimize trade timing, and minimize market impact by analyzing real-time data and market conditions. Tape reading relies on the interpretation of order flow and price movements from the time and sales tape to make discretionary decisions. Explore the nuances of execution algorithms to understand their advantages and practical applications.

Source and External Links

What is Algorithmic Trading and How Do You Get Started? - IG - Algorithmic trading uses computer programs to execute trades based on predefined rules like price movements, including strategies based on price action, technical analysis, or a combination, often used for high-frequency trading.

Algorithmic Trading - Definition, Example, Pros, Cons - Algorithmic trading involves writing code with preset rules for buying and selling securities automatically, such as moving average strategies, to execute trades efficiently and reduce market impact.

Algorithmic trading - Wikipedia - Algorithmic trading relies on pre-programmed trading instructions and increasingly incorporates advanced machine learning techniques like deep reinforcement learning and directional change algorithms to adapt to volatile market conditions dynamically.

dowidth.com

dowidth.com