Delta-neutral strategies minimize exposure to directional market movements by offsetting long and short positions, reducing risk during volatile trading conditions. Trend-following strategies capitalize on sustained price movements, aiming to profit from market momentum in bullish or bearish trends. Explore these approaches to enhance your trading tactics and manage risk effectively.

Why it is important

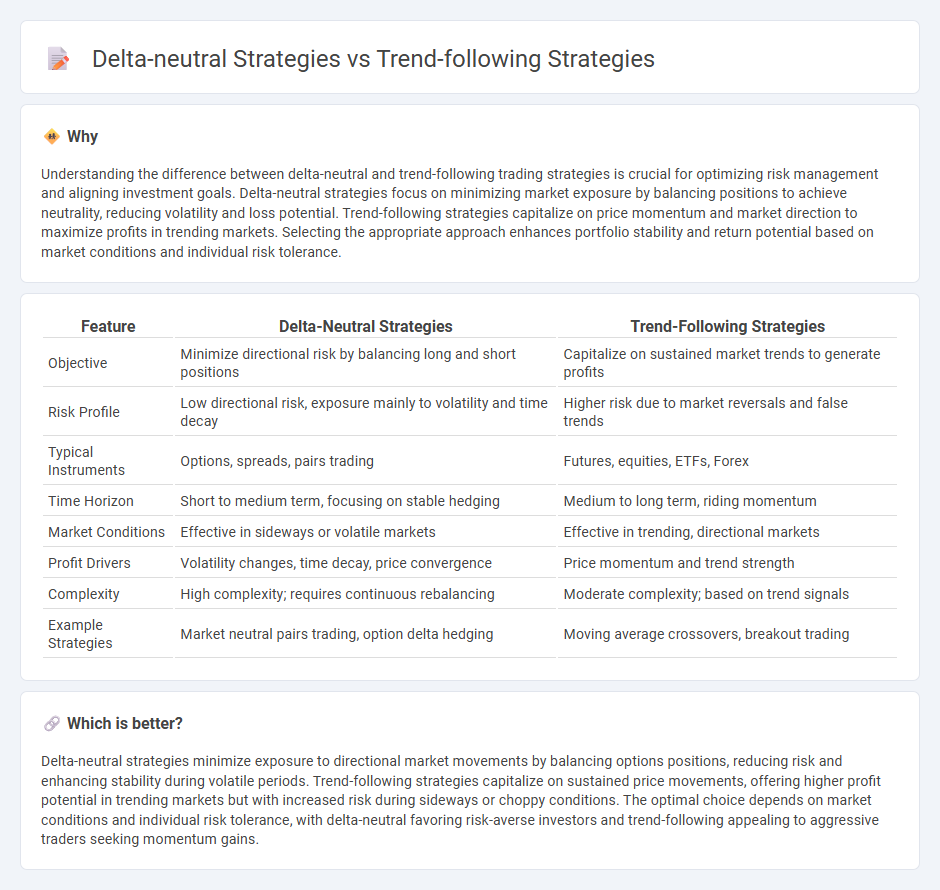

Understanding the difference between delta-neutral and trend-following trading strategies is crucial for optimizing risk management and aligning investment goals. Delta-neutral strategies focus on minimizing market exposure by balancing positions to achieve neutrality, reducing volatility and loss potential. Trend-following strategies capitalize on price momentum and market direction to maximize profits in trending markets. Selecting the appropriate approach enhances portfolio stability and return potential based on market conditions and individual risk tolerance.

Comparison Table

| Feature | Delta-Neutral Strategies | Trend-Following Strategies |

|---|---|---|

| Objective | Minimize directional risk by balancing long and short positions | Capitalize on sustained market trends to generate profits |

| Risk Profile | Low directional risk, exposure mainly to volatility and time decay | Higher risk due to market reversals and false trends |

| Typical Instruments | Options, spreads, pairs trading | Futures, equities, ETFs, Forex |

| Time Horizon | Short to medium term, focusing on stable hedging | Medium to long term, riding momentum |

| Market Conditions | Effective in sideways or volatile markets | Effective in trending, directional markets |

| Profit Drivers | Volatility changes, time decay, price convergence | Price momentum and trend strength |

| Complexity | High complexity; requires continuous rebalancing | Moderate complexity; based on trend signals |

| Example Strategies | Market neutral pairs trading, option delta hedging | Moving average crossovers, breakout trading |

Which is better?

Delta-neutral strategies minimize exposure to directional market movements by balancing options positions, reducing risk and enhancing stability during volatile periods. Trend-following strategies capitalize on sustained price movements, offering higher profit potential in trending markets but with increased risk during sideways or choppy conditions. The optimal choice depends on market conditions and individual risk tolerance, with delta-neutral favoring risk-averse investors and trend-following appealing to aggressive traders seeking momentum gains.

Connection

Delta-neutral strategies and trend-following strategies intersect through their shared goal of optimizing risk-adjusted returns in dynamic markets. Delta-neutral approaches minimize directional exposure by balancing long and short positions, which complements trend-following methods that capitalize on sustained market movements. Integrating these strategies enhances portfolio diversification by managing volatility while exploiting identifiable price trends.

Key Terms

**Trend-Following Strategies:**

Trend-following strategies capitalize on sustained asset price movements by identifying and trading in the direction of established market trends, often using technical indicators like moving averages and breakout signals to trigger entry and exit points. These strategies excel in trending markets where momentum drives price action, enabling traders to capture significant profits during prolonged price swings. Explore more to understand how trend-following can optimize portfolio performance in dynamic market conditions.

Moving Average

Trend-following strategies based on moving averages exploit price momentum by buying when the asset price crosses above the moving average and selling when it crosses below, capturing sustained market trends. Delta-neutral strategies use moving averages to identify mean-reversion opportunities, dynamically hedging positions to maintain a neutral exposure to price movements while profiting from small oscillations around the moving average. Explore further insights on optimizing moving average parameters for enhanced performance in both approaches.

Breakout

Trend-following strategies capitalize on sustained price movements by entering positions during breakouts, aiming to profit as the trend continues. Delta-neutral strategies, particularly in options trading, seek to balance positive and negative deltas around breakout points to minimize directional risk while capturing volatility-driven gains. Explore deeper insights into how breakout mechanisms influence the risk-reward profiles of both strategies for optimized trading performance.

Source and External Links

Trend Following Trading Strategies and Systems (Backtest Results) - Trend-following strategies aim to profit from existing market trends by using technical analysis tools to enter trades in the trend direction and exit upon signs of reversal, incorporating risk management, diversification, and systematic rules, with several specific strategies such as ATR Channel Breakout and Moving Average crossovers demonstrated with backtest results.

Trend-following strategies | Python - Trend-following, also called momentum strategies, bet that prices will continue in their current direction and commonly use indicators like moving averages to generate signals, with a popular example being the moving average crossover strategy where a short-term average crossing above a long-term average signals a buy.

Trend Following Strategies: A Practical Guide - Trend following strategies show consistent effectiveness across asset classes and markets by capturing time-series momentum, offering diversification and crisis alpha benefits, with success requiring careful alignment of trend time scales with asset returns, disciplined risk management, and an acceptance of drawdowns.

dowidth.com

dowidth.com