Modular blockchains trading leverages interoperable layers to enhance scalability and transaction speed, enabling seamless asset exchanges and decentralized finance applications. Prediction markets focus on aggregating collective wisdom to forecast outcomes, using trading mechanisms to incentivize accurate information sharing. Explore how these distinct trading frameworks transform market dynamics and investment strategies.

Why it is important

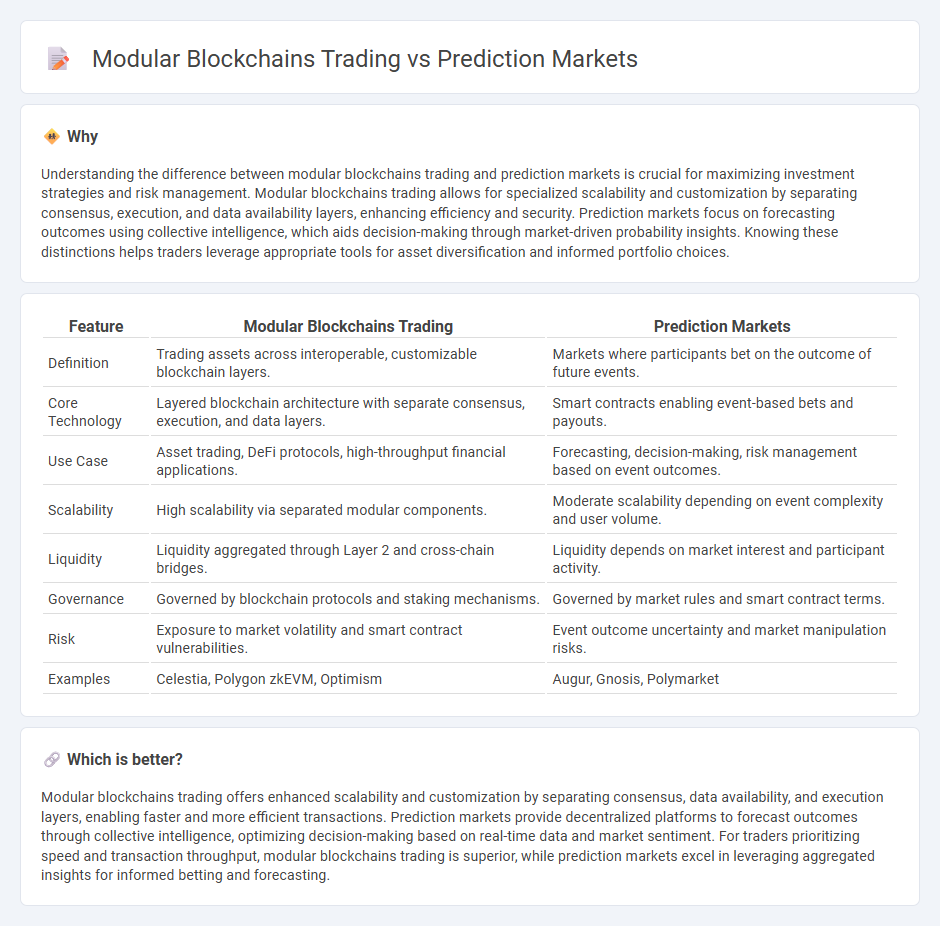

Understanding the difference between modular blockchains trading and prediction markets is crucial for maximizing investment strategies and risk management. Modular blockchains trading allows for specialized scalability and customization by separating consensus, execution, and data availability layers, enhancing efficiency and security. Prediction markets focus on forecasting outcomes using collective intelligence, which aids decision-making through market-driven probability insights. Knowing these distinctions helps traders leverage appropriate tools for asset diversification and informed portfolio choices.

Comparison Table

| Feature | Modular Blockchains Trading | Prediction Markets |

|---|---|---|

| Definition | Trading assets across interoperable, customizable blockchain layers. | Markets where participants bet on the outcome of future events. |

| Core Technology | Layered blockchain architecture with separate consensus, execution, and data layers. | Smart contracts enabling event-based bets and payouts. |

| Use Case | Asset trading, DeFi protocols, high-throughput financial applications. | Forecasting, decision-making, risk management based on event outcomes. |

| Scalability | High scalability via separated modular components. | Moderate scalability depending on event complexity and user volume. |

| Liquidity | Liquidity aggregated through Layer 2 and cross-chain bridges. | Liquidity depends on market interest and participant activity. |

| Governance | Governed by blockchain protocols and staking mechanisms. | Governed by market rules and smart contract terms. |

| Risk | Exposure to market volatility and smart contract vulnerabilities. | Event outcome uncertainty and market manipulation risks. |

| Examples | Celestia, Polygon zkEVM, Optimism | Augur, Gnosis, Polymarket |

Which is better?

Modular blockchains trading offers enhanced scalability and customization by separating consensus, data availability, and execution layers, enabling faster and more efficient transactions. Prediction markets provide decentralized platforms to forecast outcomes through collective intelligence, optimizing decision-making based on real-time data and market sentiment. For traders prioritizing speed and transaction throughput, modular blockchains trading is superior, while prediction markets excel in leveraging aggregated insights for informed betting and forecasting.

Connection

Modular blockchains enhance trading by enabling specialized layers for execution, data availability, and consensus, which streamlines transaction throughput and reduces latency in prediction markets. Prediction markets leverage these modular architectures to securely and transparently aggregate information, facilitating more accurate forecasting of event outcomes. This integration boosts market efficiency by allowing traders to access real-time, reliable data while maintaining scalability and decentralization.

Key Terms

Oracle

Prediction markets rely heavily on Oracles to provide real-world data inputs essential for resolving market outcomes accurately. Modular blockchains enhance Oracle integration by separating consensus, data availability, and execution layers, ensuring more secure and scalable access to external information. Explore how advanced Oracle solutions are transforming trading dynamics in both prediction markets and modular blockchain ecosystems.

Liquidity

Prediction markets rely heavily on liquidity pools to enable seamless trading and accurate price discovery, ensuring traders can easily enter and exit positions. Modular blockchains improve liquidity by separating consensus, data availability, and execution layers, allowing for scalable and efficient transaction processing without congesting the network. Explore the nuances of how liquidity dynamics differ between these two frameworks for optimized trading strategies.

Interoperability

Prediction markets leverage interoperable protocols to aggregate diverse data sources efficiently, enhancing market accuracy and liquidity. Modular blockchains enable scalability and customization by separating consensus, execution, and data availability layers, facilitating seamless cross-chain interactions. Explore the evolving landscape of interoperability between prediction markets and modular blockchain trading for deeper insights.

Source and External Links

Prediction market - Kalshi - A prediction market is a trading platform where participants buy and sell contracts based on the projected outcomes of specific events, such as politics, pop culture, or economics, with prices reflecting collective estimated probabilities.

Prediction market - Wikipedia - Prediction markets are open markets where people trade contracts on event outcomes, with market prices representing the crowd's probability estimates and used to aggregate beliefs about unknown future events.

A Primer on Prediction Markets - Wharton WIFPR - Prediction markets facilitate event-based bets with real-time analytics and automated market-making, enabling high liquidity and providing opportunities for traders to hedge against specific risks in various events, including political and financial outcomes.

dowidth.com

dowidth.com