Statistical arbitrage exploits pricing inefficiencies using quantitative models and high-frequency trading strategies across numerous securities to generate consistent returns. Index arbitrage focuses on exploiting price differences between index futures and the underlying stocks, leveraging real-time market data to achieve risk-free profit opportunities. Explore the key differences and strategies behind these arbitrage techniques to enhance your trading knowledge.

Why it is important

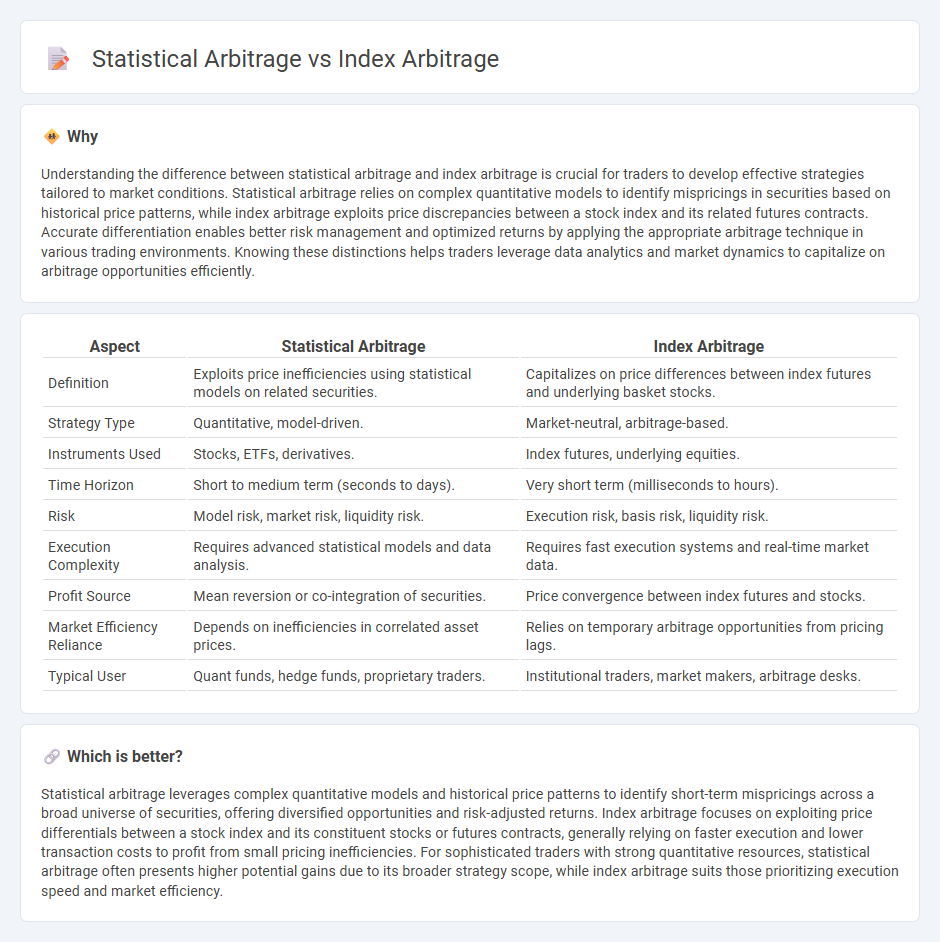

Understanding the difference between statistical arbitrage and index arbitrage is crucial for traders to develop effective strategies tailored to market conditions. Statistical arbitrage relies on complex quantitative models to identify mispricings in securities based on historical price patterns, while index arbitrage exploits price discrepancies between a stock index and its related futures contracts. Accurate differentiation enables better risk management and optimized returns by applying the appropriate arbitrage technique in various trading environments. Knowing these distinctions helps traders leverage data analytics and market dynamics to capitalize on arbitrage opportunities efficiently.

Comparison Table

| Aspect | Statistical Arbitrage | Index Arbitrage |

|---|---|---|

| Definition | Exploits price inefficiencies using statistical models on related securities. | Capitalizes on price differences between index futures and underlying basket stocks. |

| Strategy Type | Quantitative, model-driven. | Market-neutral, arbitrage-based. |

| Instruments Used | Stocks, ETFs, derivatives. | Index futures, underlying equities. |

| Time Horizon | Short to medium term (seconds to days). | Very short term (milliseconds to hours). |

| Risk | Model risk, market risk, liquidity risk. | Execution risk, basis risk, liquidity risk. |

| Execution Complexity | Requires advanced statistical models and data analysis. | Requires fast execution systems and real-time market data. |

| Profit Source | Mean reversion or co-integration of securities. | Price convergence between index futures and stocks. |

| Market Efficiency Reliance | Depends on inefficiencies in correlated asset prices. | Relies on temporary arbitrage opportunities from pricing lags. |

| Typical User | Quant funds, hedge funds, proprietary traders. | Institutional traders, market makers, arbitrage desks. |

Which is better?

Statistical arbitrage leverages complex quantitative models and historical price patterns to identify short-term mispricings across a broad universe of securities, offering diversified opportunities and risk-adjusted returns. Index arbitrage focuses on exploiting price differentials between a stock index and its constituent stocks or futures contracts, generally relying on faster execution and lower transaction costs to profit from small pricing inefficiencies. For sophisticated traders with strong quantitative resources, statistical arbitrage often presents higher potential gains due to its broader strategy scope, while index arbitrage suits those prioritizing execution speed and market efficiency.

Connection

Statistical arbitrage leverages quantitative models to exploit pricing inefficiencies among related securities, often using historical data correlations, while index arbitrage focuses on discrepancies between the prices of index futures and their underlying basket of stocks. Both strategies rely on identifying mispricings and executing trades rapidly to capture riskless or low-risk profits. The connection lies in their use of arbitrage principles applied to price relationships, with statistical arbitrage emphasizing statistical methods and index arbitrage emphasizing the relationship between futures and the cash market.

Key Terms

**Index Arbitrage:**

Index arbitrage exploits price discrepancies between a stock index and its futures contract, capitalizing on the convergence before expiration for profit. This strategy relies heavily on rapid execution and sophisticated algorithms to monitor and trade large baskets of stocks against index futures efficiently. Explore the mechanics and risk factors of index arbitrage to enhance your trading strategy.

Basket Trading

Basket trading in index arbitrage involves simultaneous buying and selling of an index's component stocks to exploit price discrepancies between the index futures and the underlying basket. Statistical arbitrage employs quantitative models to identify mispricings and typically trades large baskets of correlated stocks based on historical price patterns rather than purely market index spreads. Explore deeper insights into basket trading strategies to optimize your arbitrage approach effectively.

Futures-Spot Spread

Index arbitrage exploits price discrepancies between index futures and their underlying spot markets to capture riskless profits, often involving simultaneous buying and selling of futures contracts and index components. Statistical arbitrage uses quantitative models to identify short-term mean-reverting patterns or mispricings in futures-spot spreads across multiple securities, applying advanced statistical techniques to maximize returns. Explore further to understand the detailed mechanics and risk management strategies behind futures-spot spread arbitrage models.

Source and External Links

Index Arbitrage - Quantra by QuantInsti - Index arbitrage is a strategy exploiting price discrepancies between a stock index and its futures contract by taking opposite positions to profit from convergence of prices.

Index arbitrage - Wikipedia - This method exploits divergences between the market price of index-tracking products (like futures or ETFs) and the prices of underlying index components, aiming to buy undervalued and sell overvalued instruments simultaneously.

What is Stock Index Arbitrage? Definition and Examples - Groww - Index arbitrage involves buying the index or its stocks and simultaneously selling the associated futures contract when pricing differences exceed a threshold, accounting for carrying costs and fair value calculations.

dowidth.com

dowidth.com