Prop firm challenges provide traders with real capital to manage after passing evaluation phases designed to test risk management and profitability skills, whereas trading simulators offer a risk-free environment to practice strategies using virtual funds. The key distinction lies in real financial stakes and psychological pressure, which prop firm challenges simulate beyond theoretical practice offered by simulators. Explore the nuances between live trading challenges and simulated environments to optimize your trading journey.

Why it is important

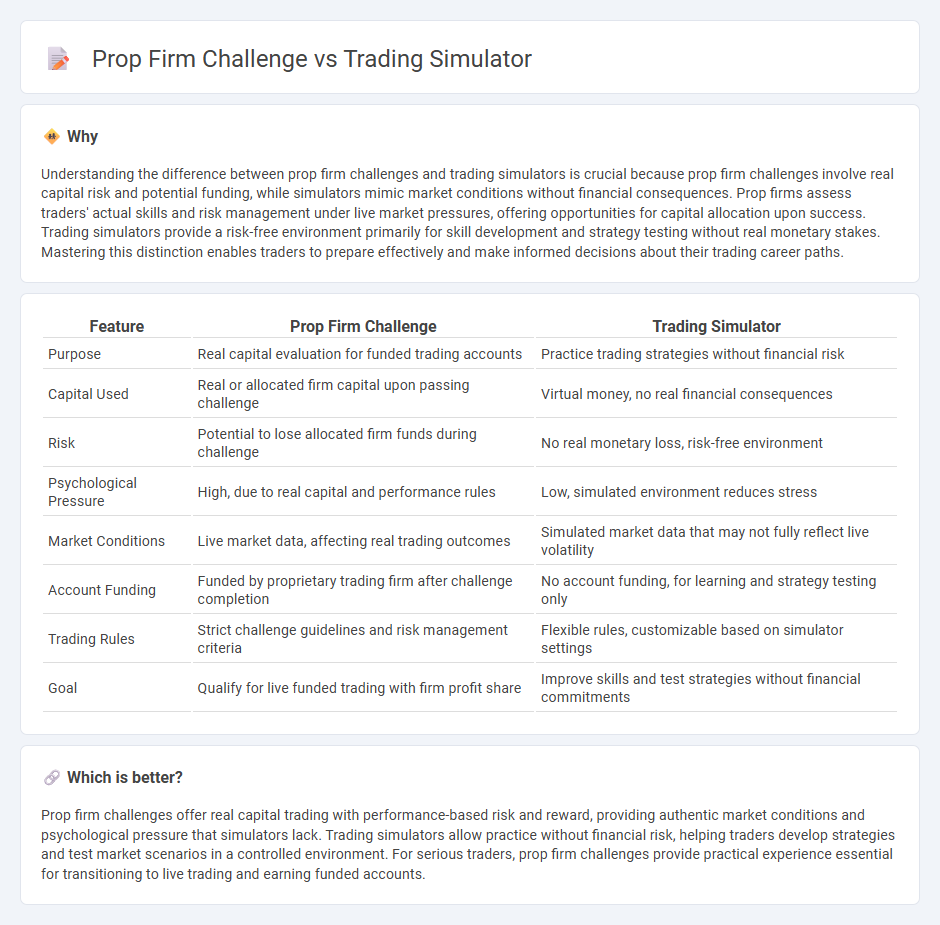

Understanding the difference between prop firm challenges and trading simulators is crucial because prop firm challenges involve real capital risk and potential funding, while simulators mimic market conditions without financial consequences. Prop firms assess traders' actual skills and risk management under live market pressures, offering opportunities for capital allocation upon success. Trading simulators provide a risk-free environment primarily for skill development and strategy testing without real monetary stakes. Mastering this distinction enables traders to prepare effectively and make informed decisions about their trading career paths.

Comparison Table

| Feature | Prop Firm Challenge | Trading Simulator |

|---|---|---|

| Purpose | Real capital evaluation for funded trading accounts | Practice trading strategies without financial risk |

| Capital Used | Real or allocated firm capital upon passing challenge | Virtual money, no real financial consequences |

| Risk | Potential to lose allocated firm funds during challenge | No real monetary loss, risk-free environment |

| Psychological Pressure | High, due to real capital and performance rules | Low, simulated environment reduces stress |

| Market Conditions | Live market data, affecting real trading outcomes | Simulated market data that may not fully reflect live volatility |

| Account Funding | Funded by proprietary trading firm after challenge completion | No account funding, for learning and strategy testing only |

| Trading Rules | Strict challenge guidelines and risk management criteria | Flexible rules, customizable based on simulator settings |

| Goal | Qualify for live funded trading with firm profit share | Improve skills and test strategies without financial commitments |

Which is better?

Prop firm challenges offer real capital trading with performance-based risk and reward, providing authentic market conditions and psychological pressure that simulators lack. Trading simulators allow practice without financial risk, helping traders develop strategies and test market scenarios in a controlled environment. For serious traders, prop firm challenges provide practical experience essential for transitioning to live trading and earning funded accounts.

Connection

Prop firm challenges provide traders with a structured evaluation environment to demonstrate their skills, often requiring simulated trading performance to qualify. Trading simulators offer realistic market conditions for practice without financial risk, enabling participants to refine strategies before entering prop firm evaluations. This connection ensures traders gain experience and confidence, aligning simulated outcomes with the rigorous standards of prop firm challenges.

Key Terms

Virtual Capital

Virtual Capital trading simulators offer risk-free environments for traders to hone strategies using real market data without financial exposure. Prop firm challenges require traders to demonstrate consistent profitability under specific risk management criteria to gain funded accounts. Explore how Virtual Capital's innovative tools and challenge structures can accelerate your path to professional trading success.

Real Money Evaluation

Trading simulators offer risk-free environments to practice strategies without financial consequences, but they lack the emotional pressure of real money stakes found in prop firm challenges. Prop firm challenges require traders to demonstrate consistent profitability under strict risk management rules while trading actual capital, providing valuable real-world experience and potential funding. Explore how each approach impacts trading psychology and skill development to decide which suits your career goals best.

Risk Management

Risk management is more rigorous in prop firm challenges, requiring strict adherence to drawdown limits and position sizing rules to protect capital. Trading simulators offer a controlled environment to practice strategies without real financial consequences but often lack the psychological pressure of live trading. Explore detailed strategies to master risk management in both scenarios for optimal trading success.

Source and External Links

Day Trading Simulator - Trade Stocks, Futures & Crypto - A session-based replay simulator offering synchronized multi-symbol and multi-timeframe views, allowing users to practice stocks, futures, and crypto trading with real historical data across all major US markets.

Free Futures Trading Simulator | NinjaTrader - Provides a risk-free futures trading simulation with live streaming market data, unlimited simulated trading for funded accounts, and a high-performance backtesting engine to validate strategies using historical data.

Trading Simulator: Alpha Chart on App Store - Mobile app that lets users practice stock trading using real-time charts and historical data 24/7, with instant strategy validation, interactive learning, and competitive leaderboards.

dowidth.com

dowidth.com