Funded account programs provide traders with allocated capital to trade on behalf of proprietary firms, minimizing personal financial risk compared to retail brokerage accounts where traders use their own funds. These programs often offer performance-based scaling, allowing successful traders to access increased capital and profit shares. Discover how funded account programs can accelerate trading careers beyond traditional retail brokerage limitations.

Why it is important

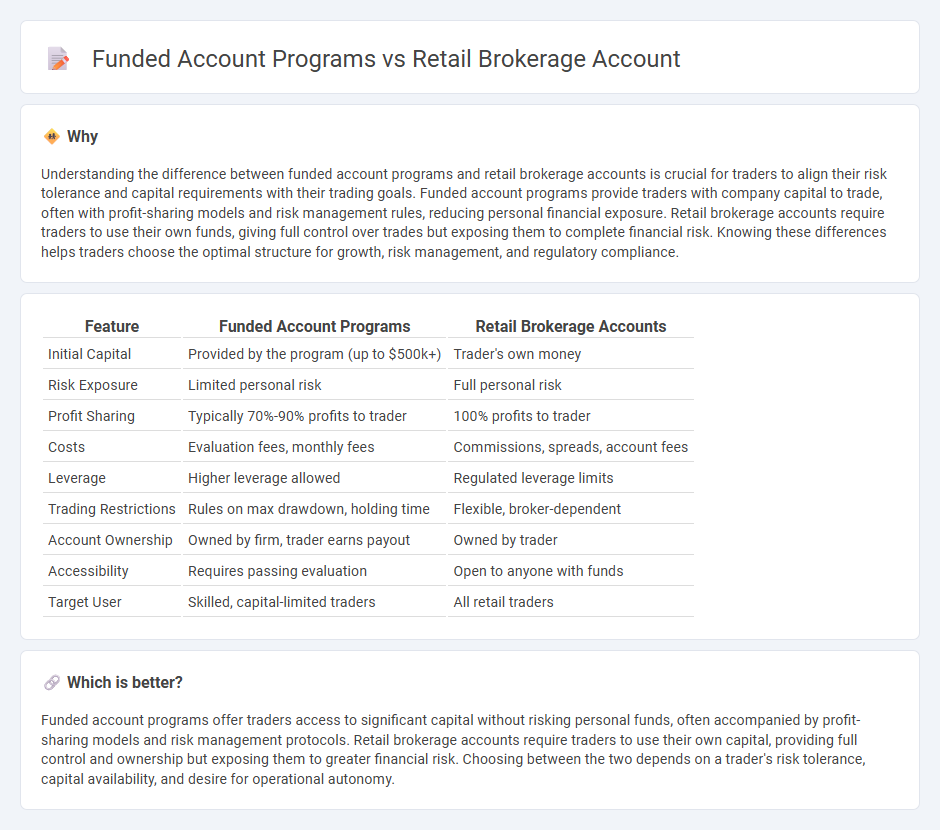

Understanding the difference between funded account programs and retail brokerage accounts is crucial for traders to align their risk tolerance and capital requirements with their trading goals. Funded account programs provide traders with company capital to trade, often with profit-sharing models and risk management rules, reducing personal financial exposure. Retail brokerage accounts require traders to use their own funds, giving full control over trades but exposing them to complete financial risk. Knowing these differences helps traders choose the optimal structure for growth, risk management, and regulatory compliance.

Comparison Table

| Feature | Funded Account Programs | Retail Brokerage Accounts |

|---|---|---|

| Initial Capital | Provided by the program (up to $500k+) | Trader's own money |

| Risk Exposure | Limited personal risk | Full personal risk |

| Profit Sharing | Typically 70%-90% profits to trader | 100% profits to trader |

| Costs | Evaluation fees, monthly fees | Commissions, spreads, account fees |

| Leverage | Higher leverage allowed | Regulated leverage limits |

| Trading Restrictions | Rules on max drawdown, holding time | Flexible, broker-dependent |

| Account Ownership | Owned by firm, trader earns payout | Owned by trader |

| Accessibility | Requires passing evaluation | Open to anyone with funds |

| Target User | Skilled, capital-limited traders | All retail traders |

Which is better?

Funded account programs offer traders access to significant capital without risking personal funds, often accompanied by profit-sharing models and risk management protocols. Retail brokerage accounts require traders to use their own capital, providing full control and ownership but exposing them to greater financial risk. Choosing between the two depends on a trader's risk tolerance, capital availability, and desire for operational autonomy.

Connection

Funded account programs provide traders with capital to execute trades without risking personal funds, while retail brokerage accounts act as the platform through which these trades are conducted. Traders leverage retail brokerage accounts to access markets, execute strategies, and monitor performance, linking the capital from funded accounts directly to market participation. This connection enhances trading opportunities by combining professional capital backing with the retail brokerage infrastructure.

Key Terms

Capital Requirements

Retail brokerage accounts typically require minimal capital, often allowing individuals to start trading with as little as $500 to $2,000, which enhances accessibility for new investors. Funded account programs, in contrast, mandate a higher capital commitment, frequently ranging from $10,000 to $50,000 or more, to enable traders to access significant leverage and pursue larger market positions. Explore the nuances of these capital requirements and how they impact trading potential and risk management.

Profit Split

Retail brokerage accounts offer traders direct market access with profits fully retained by the individual, whereas funded account programs provide traders with capital from proprietary firms in exchange for a profit split, often ranging from 50% to 80%. Profit splits in funded accounts incentivize performance while minimizing personal capital risk, creating a shared interest between traders and firms. Explore detailed comparisons and strategies for maximizing gains through profit splits in funded trading programs.

Leverage

Retail brokerage accounts typically offer limited leverage, often capped at 2:1 for equities and up to 50:1 for forex in certain jurisdictions, adhering to regulatory standards set by bodies like the SEC and CFTC. Funded account programs provide traders with significantly higher leverage, sometimes exceeding 100:1, by utilizing capital allocated by proprietary trading firms, allowing for greater exposure without increased personal risk. Explore more to understand how leverage differences impact trading strategies and capital requirements.

Source and External Links

Brokerage Accounts - FINRA - A retail brokerage account allows investors to buy and sell a variety of investments, with options for cash accounts (pay in full) or margin accounts (borrow money from the brokerage), each having specific risks and rules.

What Is a Brokerage Account? Where and How to Open One - NerdWallet - A brokerage account is used to purchase and sell investments like stocks and bonds; opening one requires personal identification, no fee usually applies, and you can fund it by linking a bank account to start investing.

Brokerage Accounts: What They Are, Benefits, & Services - TIAA - Brokerage accounts let you invest in a broad range of assets with no contribution limits or withdrawal restrictions but typically are not tax-advantaged and require you to manage your own portfolio.

dowidth.com

dowidth.com