Synthetic positions replicate the payoff of holding long stock by combining options contracts, specifically a long call and a short put at the same strike price. This strategy allows traders to gain exposure with potentially lower capital outlay and different risk profiles compared to outright purchasing shares. Explore further to understand how synthetic positions can optimize your trading tactics.

Why it is important

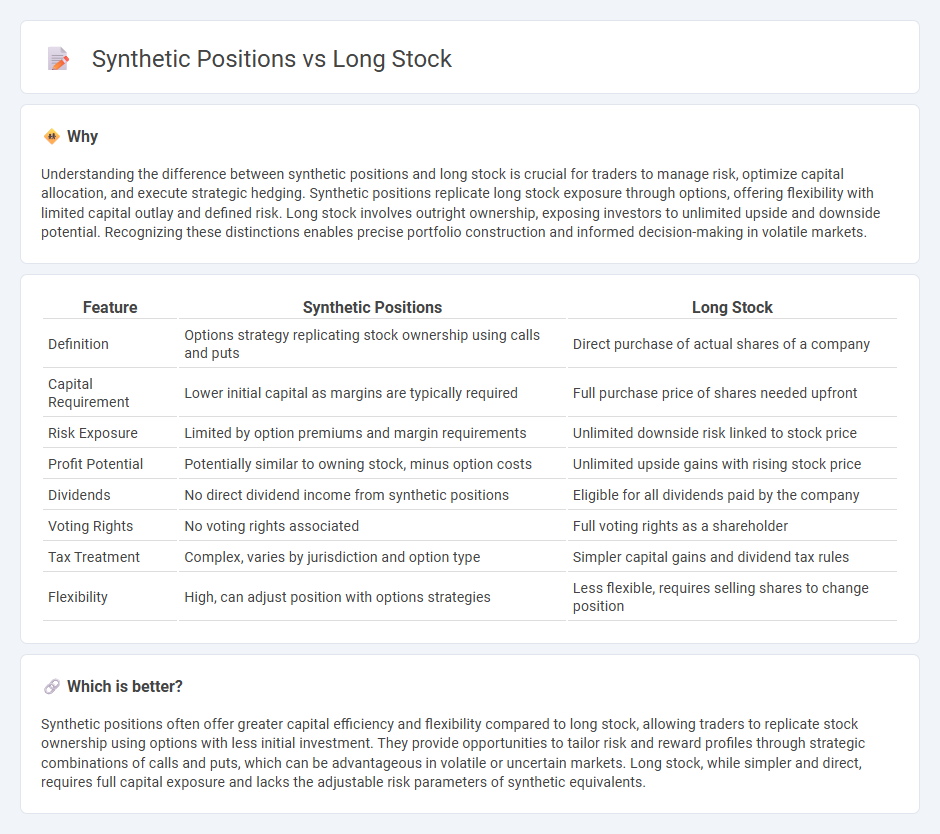

Understanding the difference between synthetic positions and long stock is crucial for traders to manage risk, optimize capital allocation, and execute strategic hedging. Synthetic positions replicate long stock exposure through options, offering flexibility with limited capital outlay and defined risk. Long stock involves outright ownership, exposing investors to unlimited upside and downside potential. Recognizing these distinctions enables precise portfolio construction and informed decision-making in volatile markets.

Comparison Table

| Feature | Synthetic Positions | Long Stock |

|---|---|---|

| Definition | Options strategy replicating stock ownership using calls and puts | Direct purchase of actual shares of a company |

| Capital Requirement | Lower initial capital as margins are typically required | Full purchase price of shares needed upfront |

| Risk Exposure | Limited by option premiums and margin requirements | Unlimited downside risk linked to stock price |

| Profit Potential | Potentially similar to owning stock, minus option costs | Unlimited upside gains with rising stock price |

| Dividends | No direct dividend income from synthetic positions | Eligible for all dividends paid by the company |

| Voting Rights | No voting rights associated | Full voting rights as a shareholder |

| Tax Treatment | Complex, varies by jurisdiction and option type | Simpler capital gains and dividend tax rules |

| Flexibility | High, can adjust position with options strategies | Less flexible, requires selling shares to change position |

Which is better?

Synthetic positions often offer greater capital efficiency and flexibility compared to long stock, allowing traders to replicate stock ownership using options with less initial investment. They provide opportunities to tailor risk and reward profiles through strategic combinations of calls and puts, which can be advantageous in volatile or uncertain markets. Long stock, while simpler and direct, requires full capital exposure and lacks the adjustable risk parameters of synthetic equivalents.

Connection

Synthetic positions replicate long stock exposure using options, creating similar profit and loss profiles without owning the underlying asset directly. By combining call and put options with the same strike price and expiration, traders achieve a strategy that mimics being long on stock, managing risk and capital more efficiently. This technique enhances portfolio flexibility, allowing participation in stock price movements while optimizing leverage and margin requirements.

Key Terms

Underlying Asset

Long stock positions involve owning the actual shares of the underlying asset, granting full ownership rights, dividends, and voting privileges. Synthetic positions replicate the payoff of owning the stock using options or derivatives without holding the actual shares, enabling strategic leverage and risk management. Explore how underlying asset dynamics influence both strategies for optimized investment decisions.

Derivative Contracts

Long stock positions involve directly owning shares of a company, providing voting rights and potential dividends. Synthetic positions replicate these exposures using derivative contracts such as options and futures, allowing traders to achieve similar risk-reward profiles with potentially lower capital requirements and enhanced flexibility. Explore the advantages and strategic uses of derivative contracts to better understand synthetic stock positions.

Delta

Long stock positions exhibit a Delta of +1, meaning the position gains one point for every one-point increase in the underlying asset. Synthetic positions, composed of options such as long calls and short puts, can replicate this Delta, providing similar directional exposure with potentially lower capital requirements. Explore more about how Delta influences risk and payoff profiles in long stock versus synthetic strategies.

Source and External Links

Long Stock - The Options Industry Council - Long stock means acquiring shares expecting prices to rise, with unlimited gains possible and losses limited to the purchase price, reflecting a bullish outlook.

What Is A Long Stock? - PersonalFinanceLab - Being long a stock means owning shares of a company, implying a claim on its assets and earnings, and benefiting from price increases.

Long Position Vs. Short Position: What's The Difference In Stock ... - Being long a stock means owning it to profit from a rise in price, opposite of being short which profits from a decline.

dowidth.com

dowidth.com