Funding rate arbitrage exploits differences in perpetual futures funding rates across exchanges to generate risk-free profits by simultaneously holding long and short positions. Convergence trading focuses on capitalizing on price discrepancies between related assets or markets, anticipating their values will align over time. Explore these strategies in depth to understand their mechanisms and potential returns.

Why it is important

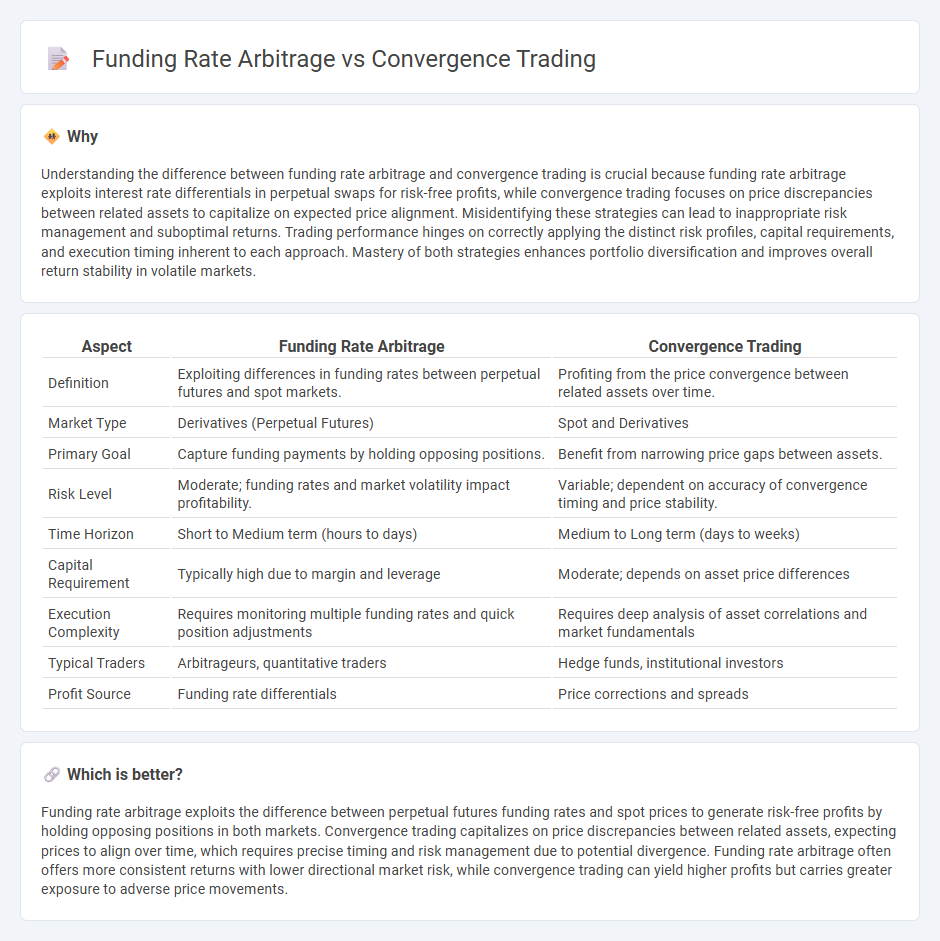

Understanding the difference between funding rate arbitrage and convergence trading is crucial because funding rate arbitrage exploits interest rate differentials in perpetual swaps for risk-free profits, while convergence trading focuses on price discrepancies between related assets to capitalize on expected price alignment. Misidentifying these strategies can lead to inappropriate risk management and suboptimal returns. Trading performance hinges on correctly applying the distinct risk profiles, capital requirements, and execution timing inherent to each approach. Mastery of both strategies enhances portfolio diversification and improves overall return stability in volatile markets.

Comparison Table

| Aspect | Funding Rate Arbitrage | Convergence Trading |

|---|---|---|

| Definition | Exploiting differences in funding rates between perpetual futures and spot markets. | Profiting from the price convergence between related assets over time. |

| Market Type | Derivatives (Perpetual Futures) | Spot and Derivatives |

| Primary Goal | Capture funding payments by holding opposing positions. | Benefit from narrowing price gaps between assets. |

| Risk Level | Moderate; funding rates and market volatility impact profitability. | Variable; dependent on accuracy of convergence timing and price stability. |

| Time Horizon | Short to Medium term (hours to days) | Medium to Long term (days to weeks) |

| Capital Requirement | Typically high due to margin and leverage | Moderate; depends on asset price differences |

| Execution Complexity | Requires monitoring multiple funding rates and quick position adjustments | Requires deep analysis of asset correlations and market fundamentals |

| Typical Traders | Arbitrageurs, quantitative traders | Hedge funds, institutional investors |

| Profit Source | Funding rate differentials | Price corrections and spreads |

Which is better?

Funding rate arbitrage exploits the difference between perpetual futures funding rates and spot prices to generate risk-free profits by holding opposing positions in both markets. Convergence trading capitalizes on price discrepancies between related assets, expecting prices to align over time, which requires precise timing and risk management due to potential divergence. Funding rate arbitrage often offers more consistent returns with lower directional market risk, while convergence trading can yield higher profits but carries greater exposure to adverse price movements.

Connection

Funding rate arbitrage exploits the interest rate differentials between perpetual futures and spot markets, profiting from rate discrepancies. Convergence trading focuses on capitalizing on the price gap between related assets, anticipating their prices to align over time. Both strategies rely on the principle that temporary divergences between derivative and underlying asset prices or rates will revert, enabling traders to earn profits from market inefficiencies.

Key Terms

**Convergence Trading:**

Convergence trading exploits price discrepancies between related assets, anticipating that prices will align over time, often seen in pairs trading or futures contracts nearing expiration. This strategy relies on statistical relationships and mean reversion to capture profits from temporary market inefficiencies. Discover how convergence trading tactics compare to funding rate arbitrage for optimized portfolio strategies.

Price Discrepancy

Convergence trading exploits price discrepancies between spot prices and futures contracts by anticipating their alignment over time, effectively profiting from the narrowing spread. Funding rate arbitrage leverages the periodic payments made between long and short positions in perpetual futures markets, targeting profit from funding rate differentials instead of direct price convergence. Explore deeper insights into how price discrepancies influence these trading strategies and identify optimal opportunities.

Mean Reversion

Convergence trading exploits price discrepancies between related assets, anticipating that prices will revert to their historical mean, while funding rate arbitrage capitalizes on differences in perpetual futures funding rates to earn risk-free profits. Both strategies rely on mean reversion principles but target different market signals: price convergence in spot-futures pairs versus funding rate imbalances in derivatives markets. Explore detailed mechanisms and risk profiles of each to enhance your trading strategy.

Source and External Links

What Does Convergence Trade Mean? - PAXFOREX - Convergence trading is the strategy of buying securities with a future delivery date at a lower price and selling similar securities at a higher price, aiming to profit from the prices converging over time; this method often involves high leverage and small mispricing detected mainly by computer programs.

What is Convergence trade - Capital.com - Convergence trade involves buying a security with a future delivery date for a low price and selling a similar one for a higher price, expecting their prices to come closer, which differs from pure arbitrage that involves identical instruments, and it carries risks mainly because it relies on the assumption that prices will converge.

Convergence trade - Wikipedia - Convergence trade is a trading strategy that involves simultaneously buying one asset forward and selling a similar asset forward at a higher price, betting that their prices will equalize at delivery, with this strategy sometimes loosely called arbitrage but actually involving similar (not identical) assets.

dowidth.com

dowidth.com