Paper trading platforms offer a risk-free way for traders to practice buying and selling financial instruments using real market data without risking actual capital. Simulated trading environments often replicate market conditions with advanced features such as order execution delays and varying liquidity to enhance realism. Explore the differences between these tools to find the best fit for honing your trading skills.

Why it is important

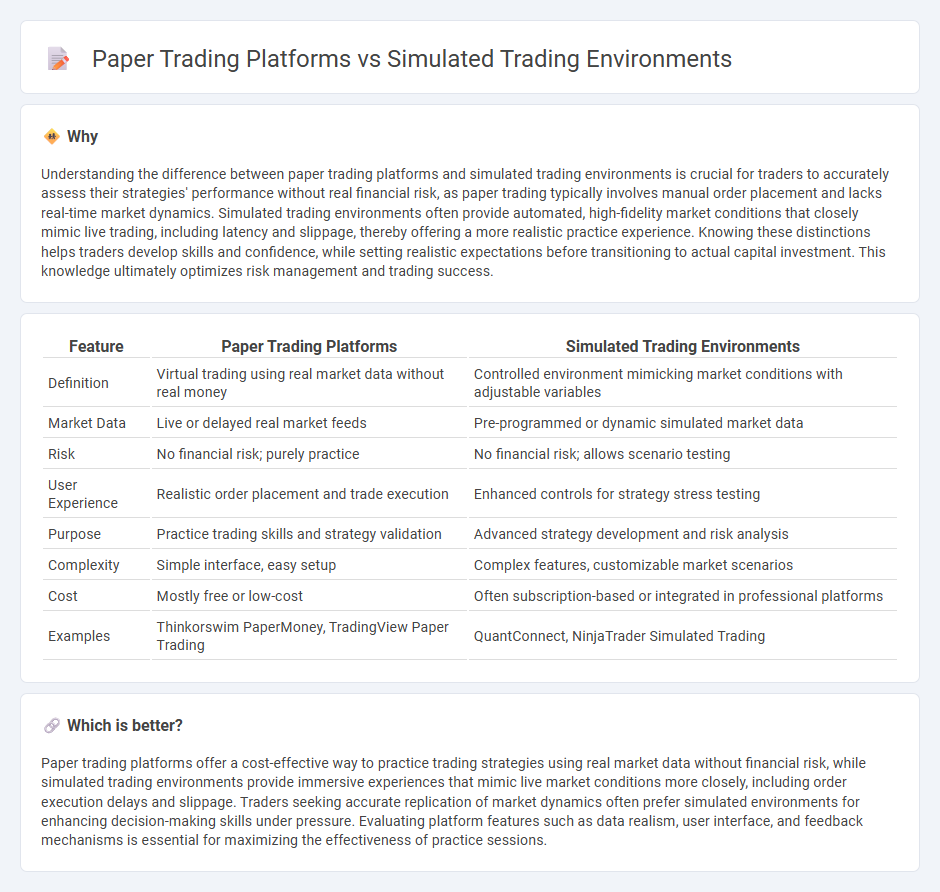

Understanding the difference between paper trading platforms and simulated trading environments is crucial for traders to accurately assess their strategies' performance without real financial risk, as paper trading typically involves manual order placement and lacks real-time market dynamics. Simulated trading environments often provide automated, high-fidelity market conditions that closely mimic live trading, including latency and slippage, thereby offering a more realistic practice experience. Knowing these distinctions helps traders develop skills and confidence, while setting realistic expectations before transitioning to actual capital investment. This knowledge ultimately optimizes risk management and trading success.

Comparison Table

| Feature | Paper Trading Platforms | Simulated Trading Environments |

|---|---|---|

| Definition | Virtual trading using real market data without real money | Controlled environment mimicking market conditions with adjustable variables |

| Market Data | Live or delayed real market feeds | Pre-programmed or dynamic simulated market data |

| Risk | No financial risk; purely practice | No financial risk; allows scenario testing |

| User Experience | Realistic order placement and trade execution | Enhanced controls for strategy stress testing |

| Purpose | Practice trading skills and strategy validation | Advanced strategy development and risk analysis |

| Complexity | Simple interface, easy setup | Complex features, customizable market scenarios |

| Cost | Mostly free or low-cost | Often subscription-based or integrated in professional platforms |

| Examples | Thinkorswim PaperMoney, TradingView Paper Trading | QuantConnect, NinjaTrader Simulated Trading |

Which is better?

Paper trading platforms offer a cost-effective way to practice trading strategies using real market data without financial risk, while simulated trading environments provide immersive experiences that mimic live market conditions more closely, including order execution delays and slippage. Traders seeking accurate replication of market dynamics often prefer simulated environments for enhancing decision-making skills under pressure. Evaluating platform features such as data realism, user interface, and feedback mechanisms is essential for maximizing the effectiveness of practice sessions.

Connection

Paper trading platforms and simulated trading environments both provide risk-free settings for traders to practice strategies using virtual money, replicating real market conditions. These platforms enable users to test orders, analyze market movements, and refine techniques without financial loss, fostering skill development. Integration between them enhances realism by incorporating live data feeds and complex algorithmic scenarios, optimizing learning outcomes.

Key Terms

Real-time Data

Simulated trading environments offer real-time market data that closely mimics live trading conditions, enabling traders to practice strategies with accurate price movements and order executions. Paper trading platforms often rely on delayed or static data, limiting their effectiveness in capturing the dynamic fluctuations and liquidity challenges of actual markets. Explore the nuances of real-time data integration to enhance your trading practice and decision-making accuracy.

Order Execution

Simulated trading environments offer realistic order execution by mimicking real market conditions, including order types, slippage, and latency, providing traders with accurate feedback on trade performance. Paper trading platforms typically execute orders instantly without market impact factors, which may lead to an unrealistic understanding of execution risks and order fills. Explore the differences in order execution to choose the best tool for refining your trading strategies.

Risk-free Practice

Simulated trading environments provide a comprehensive and interactive experience that mimics real market conditions with real-time data, offering traders the ability to test strategies without risking actual capital. Paper trading platforms typically involve manually recording trades on a paper or spreadsheet, which lacks the dynamic feedback and complexity found in simulated environments. Explore detailed comparisons to understand which risk-free practice method fits your trading goals best.

Source and External Links

Test Your Strategies With Our Trading Simulator - TradeStation offers a simulated trading environment with real-time data for stocks, options, and futures, allowing traders to develop, back-test, and forward-test strategies using their EasyLanguage programming and advanced tools like OptionStation Pro and RadarScreen.

Free Simulated Futures Trading - Tradovate provides unlimited simulated trades with real-time market data and market replay capabilities, enabling users to practice strategy, order, and risk management without risking real money.

Free Futures Trading Simulator - NinjaTrader offers a risk-free futures trading simulator with live streaming data, unlimited simulated trading with funded accounts, a backtesting engine, and market replay to validate and refine trading strategies before live trading.

dowidth.com

dowidth.com