Pair trading involves simultaneously buying and selling related securities to capitalize on price divergences, minimizing market risk through statistical arbitrage. High-frequency trading (HFT) leverages powerful algorithms and low-latency data to execute thousands of trades per second, profiting from fleeting market inefficiencies. Discover the key differences and strategies behind pair trading and high-frequency trading for smarter investment decisions.

Why it is important

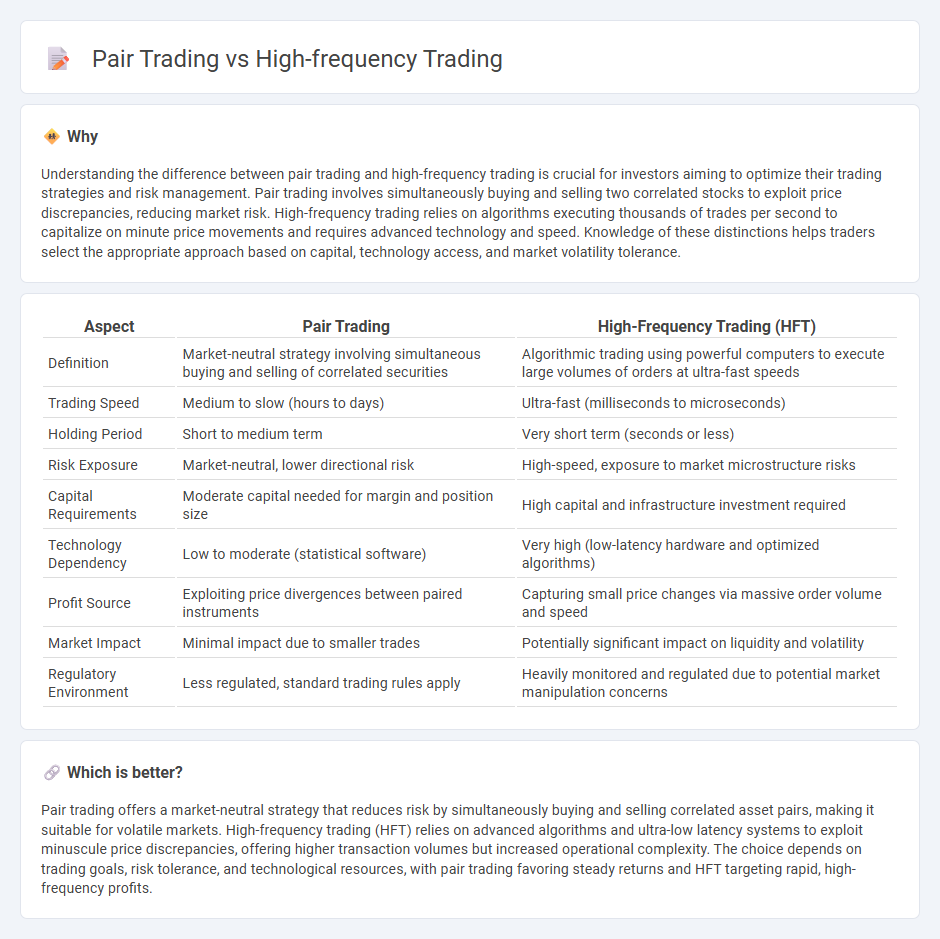

Understanding the difference between pair trading and high-frequency trading is crucial for investors aiming to optimize their trading strategies and risk management. Pair trading involves simultaneously buying and selling two correlated stocks to exploit price discrepancies, reducing market risk. High-frequency trading relies on algorithms executing thousands of trades per second to capitalize on minute price movements and requires advanced technology and speed. Knowledge of these distinctions helps traders select the appropriate approach based on capital, technology access, and market volatility tolerance.

Comparison Table

| Aspect | Pair Trading | High-Frequency Trading (HFT) |

|---|---|---|

| Definition | Market-neutral strategy involving simultaneous buying and selling of correlated securities | Algorithmic trading using powerful computers to execute large volumes of orders at ultra-fast speeds |

| Trading Speed | Medium to slow (hours to days) | Ultra-fast (milliseconds to microseconds) |

| Holding Period | Short to medium term | Very short term (seconds or less) |

| Risk Exposure | Market-neutral, lower directional risk | High-speed, exposure to market microstructure risks |

| Capital Requirements | Moderate capital needed for margin and position size | High capital and infrastructure investment required |

| Technology Dependency | Low to moderate (statistical software) | Very high (low-latency hardware and optimized algorithms) |

| Profit Source | Exploiting price divergences between paired instruments | Capturing small price changes via massive order volume and speed |

| Market Impact | Minimal impact due to smaller trades | Potentially significant impact on liquidity and volatility |

| Regulatory Environment | Less regulated, standard trading rules apply | Heavily monitored and regulated due to potential market manipulation concerns |

Which is better?

Pair trading offers a market-neutral strategy that reduces risk by simultaneously buying and selling correlated asset pairs, making it suitable for volatile markets. High-frequency trading (HFT) relies on advanced algorithms and ultra-low latency systems to exploit minuscule price discrepancies, offering higher transaction volumes but increased operational complexity. The choice depends on trading goals, risk tolerance, and technological resources, with pair trading favoring steady returns and HFT targeting rapid, high-frequency profits.

Connection

Pair trading and high-frequency trading are interconnected through their reliance on statistical arbitrage and algorithmic strategies to exploit price inefficiencies between correlated assets. High-frequency trading enhances pair trading by executing rapid, automated trades that capitalize on short-term divergences in asset pairs before the market adjusts. This synergy enables traders to increase profit potential while minimizing market exposure and risk.

Key Terms

High-Frequency Trading:

High-frequency trading (HFT) leverages advanced algorithms and ultra-low latency technology to execute thousands of trades per second, capitalizing on minor price discrepancies across markets for rapid profits. Unlike pair trading, which relies on statistical relationships between correlated stocks, HFT exploits market microstructure inefficiencies with algorithms that analyze real-time data and order book dynamics to identify fleeting opportunities. Discover the cutting-edge technology and strategies powering the high-stakes world of high-frequency trading.

Latency

High-frequency trading (HFT) relies heavily on ultra-low latency to execute thousands of orders per second and capitalize on minute price discrepancies across multiple markets. Pair trading, a market-neutral strategy, depends less on speed and more on relative price movements between correlated assets to generate returns. Explore the nuanced differences in latency requirements and technology used in these strategies to deepen your understanding.

Market Microstructure

Market microstructure intricately influences high-frequency trading (HFT) by leveraging ultra-fast order execution and order book dynamics to capitalize on transient price inefficiencies. Pair trading relies on statistical arbitrage between correlated asset pairs, where microstructural elements like bid-ask spreads and latency impact trade timing and profitability. Explore deeper insights into how market microstructure nuances differentiate these advanced trading strategies.

Source and External Links

High-Frequency Trading Explained: What Is It and How Do You Get ... - High-frequency trading uses powerful computers and advanced algorithms to execute a vast number of trades at microsecond speeds, profiting from tiny price differences across markets.

High Frequency Trading (HFT) - Definition, Pros and Cons - HFT is algorithmic trading defined by extremely fast execution, very high trade volumes, and ultra-short investment horizons, primarily used by large institutional investors to capitalize on minute market movements.

High-frequency trading - Wikipedia - HFT involves quantitative, computerized trading strategies with short holding periods, focusing on speed and volume to exploit fleeting market opportunities.

dowidth.com

dowidth.com