Social sentiment analysis trading leverages real-time data from social media platforms, news, and online forums to capture market emotions and crowd behavior, enabling traders to anticipate short-term price movements. In contrast, fundamental analysis trading evaluates a company's financial health, macroeconomic indicators, and industry trends to determine its intrinsic value for long-term investment decisions. Discover how these distinct trading approaches can enhance your market strategy and improve your trading outcomes.

Why it is important

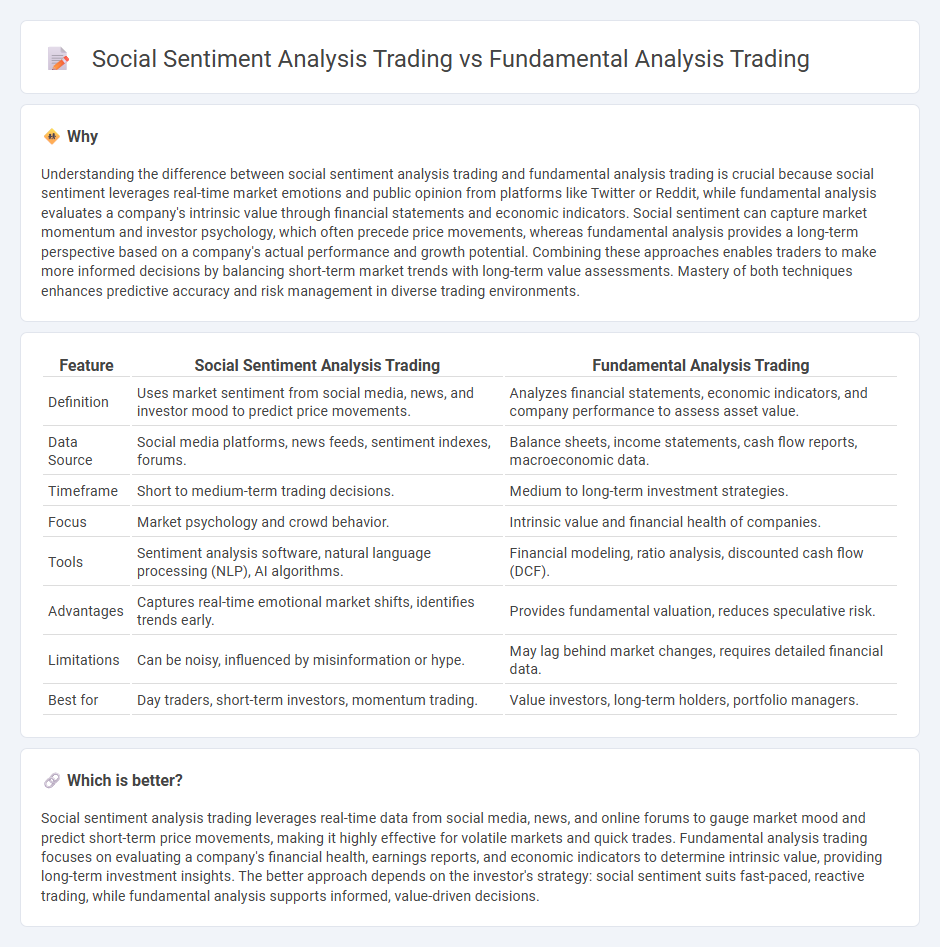

Understanding the difference between social sentiment analysis trading and fundamental analysis trading is crucial because social sentiment leverages real-time market emotions and public opinion from platforms like Twitter or Reddit, while fundamental analysis evaluates a company's intrinsic value through financial statements and economic indicators. Social sentiment can capture market momentum and investor psychology, which often precede price movements, whereas fundamental analysis provides a long-term perspective based on a company's actual performance and growth potential. Combining these approaches enables traders to make more informed decisions by balancing short-term market trends with long-term value assessments. Mastery of both techniques enhances predictive accuracy and risk management in diverse trading environments.

Comparison Table

| Feature | Social Sentiment Analysis Trading | Fundamental Analysis Trading |

|---|---|---|

| Definition | Uses market sentiment from social media, news, and investor mood to predict price movements. | Analyzes financial statements, economic indicators, and company performance to assess asset value. |

| Data Source | Social media platforms, news feeds, sentiment indexes, forums. | Balance sheets, income statements, cash flow reports, macroeconomic data. |

| Timeframe | Short to medium-term trading decisions. | Medium to long-term investment strategies. |

| Focus | Market psychology and crowd behavior. | Intrinsic value and financial health of companies. |

| Tools | Sentiment analysis software, natural language processing (NLP), AI algorithms. | Financial modeling, ratio analysis, discounted cash flow (DCF). |

| Advantages | Captures real-time emotional market shifts, identifies trends early. | Provides fundamental valuation, reduces speculative risk. |

| Limitations | Can be noisy, influenced by misinformation or hype. | May lag behind market changes, requires detailed financial data. |

| Best for | Day traders, short-term investors, momentum trading. | Value investors, long-term holders, portfolio managers. |

Which is better?

Social sentiment analysis trading leverages real-time data from social media, news, and online forums to gauge market mood and predict short-term price movements, making it highly effective for volatile markets and quick trades. Fundamental analysis trading focuses on evaluating a company's financial health, earnings reports, and economic indicators to determine intrinsic value, providing long-term investment insights. The better approach depends on the investor's strategy: social sentiment suits fast-paced, reactive trading, while fundamental analysis supports informed, value-driven decisions.

Connection

Social sentiment analysis trading leverages real-time data from social media platforms to gauge market mood, which can influence asset price movements. Fundamental analysis trading focuses on evaluating a company's financial health, economic indicators, and intrinsic value to inform investment decisions. Integrating social sentiment insights with fundamental analysis allows traders to capture both quantitative financial metrics and qualitative market perceptions, enhancing predictive accuracy and risk management.

Key Terms

Earnings Reports

Earnings reports serve as crucial data points in fundamental analysis trading, providing insights into a company's financial health and future performance projections. Social sentiment analysis trading leverages real-time public sentiment and market psychology drawn from social media platforms to gauge investor mood and potential stock movement around earnings announcements. Explore in-depth comparisons and strategies to effectively blend these approaches in your trading decisions.

Economic Indicators

Fundamental analysis trading relies on evaluating key economic indicators such as GDP growth, unemployment rates, and inflation to predict asset price movements based on financial health and macroeconomic conditions. Social sentiment analysis trading assesses market sentiment by analyzing data from social media platforms, news sources, and public opinion, capturing real-time investor emotions and reactions. Explore more to understand how combining these approaches can enhance trading strategies.

Analyst Ratings

Fundamental analysis trading relies on in-depth evaluation of a company's financial health, earnings, and industry position, often incorporating analyst ratings to gauge stock potential accurately. Social sentiment analysis trading, on the other hand, interprets real-time market mood and consumer opinions from social media, using analyst ratings as a supplement to validate sentiment trends. Discover how combining these approaches with analyst ratings can enhance your trading decisions.

Source and External Links

What is Fundamental Analysis & How to Use it in Trading? / Axi - Fundamental analysis is a technique used by traders to assess whether an asset is overvalued or undervalued by examining economic, financial, social, and political factors affecting its intrinsic value, applicable across various assets like forex, stocks, and commodities.

Beginners Guide to Fundamental Analysis | Learn to Trade - Oanda - Fundamental analysis involves assessing an asset's strength through macroeconomic data or instrument-specific factors using top-down or bottom-up approaches, with key drivers including trade balance and interest rates which influence currency demand.

What is fundamental analysis? How to assess value in trading | Saxo - Fundamental analysis focuses on evaluating the core qualities and intrinsic value of an asset, independent of market sentiment and price movements, contrasting with technical analysis which is based on market trends and sentiment.

dowidth.com

dowidth.com