Social copy trading allows investors to replicate the strategies of experienced traders in real-time, providing a hands-off approach to the markets. Arbitrage trading exploits price differences across various exchanges to secure risk-free profits, relying on speed and precision. Explore these trading methods further to find the strategy that suits your investment goals.

Why it is important

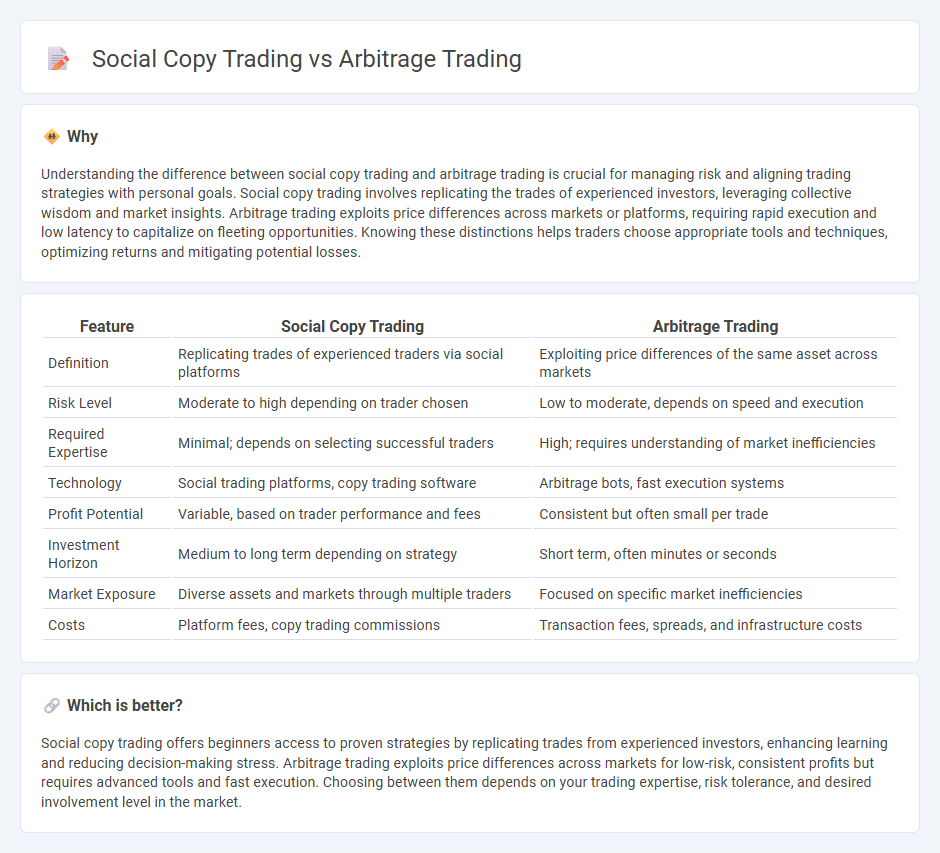

Understanding the difference between social copy trading and arbitrage trading is crucial for managing risk and aligning trading strategies with personal goals. Social copy trading involves replicating the trades of experienced investors, leveraging collective wisdom and market insights. Arbitrage trading exploits price differences across markets or platforms, requiring rapid execution and low latency to capitalize on fleeting opportunities. Knowing these distinctions helps traders choose appropriate tools and techniques, optimizing returns and mitigating potential losses.

Comparison Table

| Feature | Social Copy Trading | Arbitrage Trading |

|---|---|---|

| Definition | Replicating trades of experienced traders via social platforms | Exploiting price differences of the same asset across markets |

| Risk Level | Moderate to high depending on trader chosen | Low to moderate, depends on speed and execution |

| Required Expertise | Minimal; depends on selecting successful traders | High; requires understanding of market inefficiencies |

| Technology | Social trading platforms, copy trading software | Arbitrage bots, fast execution systems |

| Profit Potential | Variable, based on trader performance and fees | Consistent but often small per trade |

| Investment Horizon | Medium to long term depending on strategy | Short term, often minutes or seconds |

| Market Exposure | Diverse assets and markets through multiple traders | Focused on specific market inefficiencies |

| Costs | Platform fees, copy trading commissions | Transaction fees, spreads, and infrastructure costs |

Which is better?

Social copy trading offers beginners access to proven strategies by replicating trades from experienced investors, enhancing learning and reducing decision-making stress. Arbitrage trading exploits price differences across markets for low-risk, consistent profits but requires advanced tools and fast execution. Choosing between them depends on your trading expertise, risk tolerance, and desired involvement level in the market.

Connection

Social copy trading and arbitrage trading are connected through automated decision-making and rapid execution processes that allow traders to replicate arbitrage strategies shared by expert investors in real-time. Copy trading platforms facilitate the seamless imitation of arbitrage opportunities across different markets by synchronizing trades instantly, maximizing profit potential from price discrepancies. The integration of these methods enhances market efficiency and provides retail traders access to sophisticated arbitrage tactics without requiring deep technical expertise.

Key Terms

**Arbitrage Trading:**

Arbitrage trading exploits price discrepancies of the same asset across different markets, enabling traders to purchase low in one exchange and sell high in another, capitalizing on market inefficiencies. This strategy requires fast execution, sophisticated algorithms, and low-latency platforms to minimize risk and maximize profits. Explore the nuances of arbitrage trading to enhance your market strategies and achieve consistent returns.

Price Discrepancy

Arbitrage trading exploits price discrepancies across different markets or exchanges to generate risk-free profits by simultaneously buying low and selling high. Social copy trading involves replicating the trades of experienced investors without directly analyzing price differences, relying on their market insights instead. Explore the nuances between these strategies to optimize your trading approach and maximize returns.

Market Efficiency

Arbitrage trading exploits price discrepancies across markets to enhance market efficiency by rapidly correcting mispricings, while social copy trading relies on mimicking successful traders, which may not always contribute to true price discovery. Arbitrage ensures liquidity and tighter spreads, directly impacting market dynamics, whereas copy trading primarily benefits individual portfolios through collective wisdom without necessarily improving overall market function. Explore deeper insights on how these strategies shape market efficiency and your trading approach.

Source and External Links

What Is Arbitrage in Investing? (Risks, Types and Examples) - Indeed - Arbitrage trading involves simultaneously buying an asset in one market where the price is lower and selling it in another market where the price is higher, profiting from the price difference before the discrepancy disappears, typically within seconds.

Arbitrage - Wikipedia - Arbitrage is the practice of exploiting price differences of the same asset or similar assets across markets by executing matched trades simultaneously to avoid market risk, commonly done in electronic financial markets.

What is Crypto Arbitrage Trading & How Do Traders Use It? | MoonPay - Crypto arbitrage trading capitalizes on price inefficiencies across different crypto exchanges by buying cryptocurrency at a lower price on one platform and selling it at a higher price on another, exploiting the market fragmentation and volatility unique to cryptocurrencies.

dowidth.com

dowidth.com