Social sentiment analysis trading leverages real-time data from social media platforms, news sources, and forums to gauge market mood and predict stock movements. Momentum trading focuses on capitalizing on existing price trends by buying assets showing upward momentum and selling those in decline. Explore the unique advantages and strategies of both approaches to enhance your trading decisions.

Why it is important

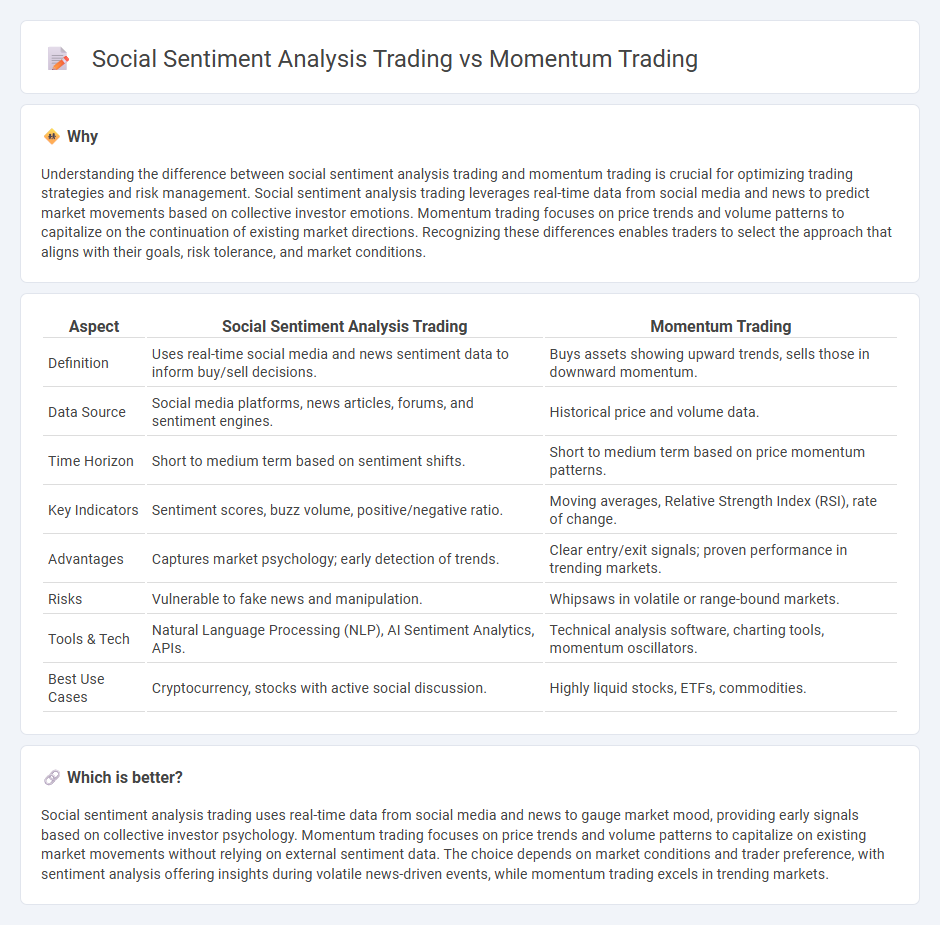

Understanding the difference between social sentiment analysis trading and momentum trading is crucial for optimizing trading strategies and risk management. Social sentiment analysis trading leverages real-time data from social media and news to predict market movements based on collective investor emotions. Momentum trading focuses on price trends and volume patterns to capitalize on the continuation of existing market directions. Recognizing these differences enables traders to select the approach that aligns with their goals, risk tolerance, and market conditions.

Comparison Table

| Aspect | Social Sentiment Analysis Trading | Momentum Trading |

|---|---|---|

| Definition | Uses real-time social media and news sentiment data to inform buy/sell decisions. | Buys assets showing upward trends, sells those in downward momentum. |

| Data Source | Social media platforms, news articles, forums, and sentiment engines. | Historical price and volume data. |

| Time Horizon | Short to medium term based on sentiment shifts. | Short to medium term based on price momentum patterns. |

| Key Indicators | Sentiment scores, buzz volume, positive/negative ratio. | Moving averages, Relative Strength Index (RSI), rate of change. |

| Advantages | Captures market psychology; early detection of trends. | Clear entry/exit signals; proven performance in trending markets. |

| Risks | Vulnerable to fake news and manipulation. | Whipsaws in volatile or range-bound markets. |

| Tools & Tech | Natural Language Processing (NLP), AI Sentiment Analytics, APIs. | Technical analysis software, charting tools, momentum oscillators. |

| Best Use Cases | Cryptocurrency, stocks with active social discussion. | Highly liquid stocks, ETFs, commodities. |

Which is better?

Social sentiment analysis trading uses real-time data from social media and news to gauge market mood, providing early signals based on collective investor psychology. Momentum trading focuses on price trends and volume patterns to capitalize on existing market movements without relying on external sentiment data. The choice depends on market conditions and trader preference, with sentiment analysis offering insights during volatile news-driven events, while momentum trading excels in trending markets.

Connection

Social sentiment analysis trading leverages real-time data from social media platforms to gauge market emotions and predict price movements. Momentum trading capitalizes on these trends by buying assets showing upward price momentum driven by prevailing positive sentiment. Integrating social sentiment insights enhances momentum trading strategies by identifying early shifts in investor behavior, improving trade timing and profitability.

Key Terms

**Momentum trading:**

Momentum trading capitalizes on the continuation of existing market trends by buying assets showing upward price movement and selling those with downward momentum to capture profits during strong trends. This strategy relies heavily on technical indicators such as moving averages, Relative Strength Index (RSI), and volume analysis to identify potential entry and exit points. Explore the nuances of momentum trading to enhance your market timing and investment returns.

Trend

Momentum trading capitalizes on price trends and volume patterns to identify assets showing strong upward or downward movement. Social sentiment analysis trading leverages data from social media platforms to gauge public emotions and opinions, influencing market trends before they are evident in price charts. Explore how combining these strategies can enhance your trend detection and trading decisions.

Volume

Momentum trading leverages volume spikes to identify and capitalize on price trends driven by increased buying or selling activity. Social sentiment analysis trading interprets volume surges influenced by collective investor emotions and online discussions on platforms like Twitter and Reddit. Explore how integrating volume data with sentiment analysis can enhance trading strategies.

Source and External Links

Momentum Trading: Types, Strategies and More - Part I - Momentum trading involves buying or selling assets based on recent price trends and mainly includes two types: time-series momentum, which looks at an asset's own past performance, and cross-sectional momentum, which compares assets relative to each other for trading decisions.

Momentum Trading: Types, Strategies, and More - QuantInsti Blog - Momentum trading strategies capitalize on price trends, with time-series momentum focusing on historical performance of individual assets, while cross-sectional momentum ranks assets against peers to identify strong performers for buying or shorting.

Momentum Trading for Beginners (What They Don't Teach You) - This video explains momentum trading as buying assets showing strong price moves and provides practical guidance on using indicators like RSI and MACD, momentum candle patterns, and risk management to trade breakout trends successfully.

dowidth.com

dowidth.com